Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

part a and b

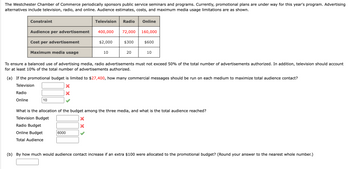

Transcribed Image Text:The Westchester Chamber of Commerce periodically sponsors public service seminars and programs. Currently, promotional plans are under way for this year's program. Advertising

alternatives include television, radio, and online. Audience estimates, costs, and maximum media usage limitations are as shown.

Constraint

Audience per advertisement

Radio

Online

Cost per advertisement

Maximum media usage

10

Television Radio Online

400,000 72,000 160,000

Ra Budget

Online Budget

Total Audience

$2,000

6000

10

$300

To ensure a balanced use of advertising media, radio advertisements must not exceed 50% of the total number of advertisements authorized. In addition, television should account

for at least 10% of the total number of advertisements authorized.

20

(a) If the promotional budget is limited to $27,400, how many commercial messages should be run on each medium to maximize total audience contact?

Television

X

X

$600

10

What is the allocation of the budget among the three media, and what is the total audience reached?

Television Budget

X

(b) By how much would audience contact increase if an extra $100 were allocated to the promotional budget? (Round your answer to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Similar questions

- 22arrow_forward8*. Consider a market with an incumbent firm. Another firm with the same marginal cost would like to enter the market. Which of the following statements is CORRECT? (a) Entry is blocked if the incumbent has to change her behavior to prevent entry. X(b) Entry is accommodated if the incumbent modifies his production in order to take into account the production of the rival firm. (c) Entry is accommodated if the fixed entry costs are sufficiently high, to prevent entry. (d) Entry is deterred if the incumbent firm does not face a credible entry threat. Thus, no firm will find profitable to enter even if the incumbent produces the monopoly quantity.arrow_forwardPls help ASAPon both plsarrow_forward

- 16arrow_forwardWhat is the definition of gross income from farming for purposes of determining eligibility to use the estimated tax rule applicable to farmers and fishermen? (A) Gross farming income from Schedule F, Form 4835, and Schedule E, and ordinary gains from farming assets on Form 4797, Part II. (B) Gross income from Schedule F and Form 4835, and gains from the sale of livestock used for draft, breeding, or dairy purposes. (C) Gross income from Schedule F and Form 4835, and gains from the sale of livestock and other assets used in the production of farm income. (D) Gross farming income from Schedule F, Form 4835, and Schedule E, Parts II and III, and gains from the sale of livestock used for draft, breeding, sporting, or dairy purposes reported on Form 4797.arrow_forward7arrow_forward

- A cattle producer purchased an insurance contract form the USDA Risk Management Agency. The contract pays a fixed dollar amount if and only if the rainfall in the 10 by 10 miles grid surrounding the producer’s land falls below 90 percent of the historical average rainfall. According to the lecture, this is a type of _____ insurance A cattle producer purchased an insurance contract form the USDA Risk Management Agency. The contract pays a fixed dollar amount if and only if the rainfall in the 10 by 10 miles grid surrounding the producer’s land falls below 90 percent of the historical average rainfall. According to the lecture, this is a type of _____ insurance weather pure parametric aggregate loss index parametric indexarrow_forwardPls help ASAParrow_forwardwrite summary of code section 183 and explain the rules and regulations regarding the code. and provide examplesarrow_forward

- Loan interest income ► S.15(1)(i) 。 sums, not otherwise chargeable to tax under this Part (i.e. not chargeable under s.14), received by or accrued to a financial institution by way of interest which arises through or from the carrying on by the financial institution of its business in Hong Kong, notwithstanding that the moneys in respect of which the interest is received or accrues are made available outside Hong Kong 。 Contrast to s.14: arising in or derived from HK What does "arises through or from" mean? Loan interest income is deemed taxable even though the loan is made available outside Hong Kong? 74arrow_forwardPls help ASAParrow_forward15. The annual increase diene cash duander value of a life insurance policy: a. Is taxed when the individual dies and the heirs collect the insurance proceeds. b. Must be included in gross income each year under the original issue discount rules. c. Reduces the deduction for life insurance expense. d. Is not included in gross in ych y sach year because of the substantial restrictions on gaining access to the policy's value.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.