Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Please try to both questions i will give you upvot

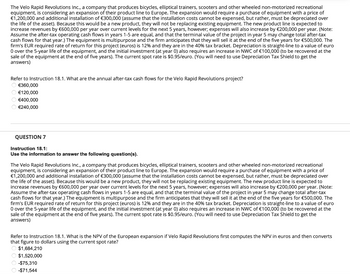

Transcribed Image Text:The Velo Rapid Revolutions Inc., a company that produces bicycles, elliptical trainers, scooters and other wheeled non-motorized recreational

equipment, is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of

€1,200,000 and additional installation of €300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated over

the life of the asset). Because this would be a a new product, they will not be replacing existing equipment. The new product line is expected to

increase revenues by €600,000 per year over current levels for the next 5 years, however; expenses will also increase by €200,000 per year. (Note:

Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax

cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for €500,000. The

firm's EUR required rate of return for this project (euros) is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro

O over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of €100,000 (to be recovered at the

sale of the equipment at the end of five years). The current spot rate is $0.95/euro. (You will need to use Depreciation Tax Shield to get the

answers)

Refer to Instruction 18.1. What are the annual after-tax cash flows for the Velo Rapid Revolutions project?

€360,000

Ⓒ €120,000

€400,000

€240,000

QUESTION 7

Instruction 18.1:

Use the information to answer the following question(s).

The Velo Rapid Revolutions Inc., a company that produces bicycles, elliptical trainers, scooters and other wheeled non-motorized recreational

equipment, is considering an expansion of their product line to Europe. The expansion would require a purchase of equipment with a price of

€1,200,000 and additional installation of €300,000 (assume that the installation costs cannot be expensed, but rather, must be depreciated

the life of the asset). Because this would be a new product, they will not be replacing existing equipment. The new product line is expected to

increase revenues by €600,000 per year over current levels for the next 5 years, however; expenses will also increase by €200,000 per year. (Note:

Assume the after-tax operating cash flows in years 1-5 are equal, and that the terminal value of the project in year 5 may change total after-tax

cash flows for that year.) The equipment is multipurpose and the firm anticipates that they will sell it at the end of the five years for €500,000. The

firm's EUR required rate of return for this project (euros) is 12% and they are in the 40% tax bracket. Depreciation is straight-line to a value of euro

O over the 5-year life of the equipment, and the initial investment (at year 0) also requires an increase in NWC of €100,000 (to be recovered at the

sale of the equipment at the end of five years). The current spot rate is $0.95/euro. (You will need to use Depreciation Tax Shield to get the

answers)

over

Refer to Instruction 18.1. What is the NPV of the European expansion if Velo Rapid Revolutions first computes the NPV in euros and then converts

that figure to dollars using the current spot rate?

$1,684,210

$1,520,000

-$75,310

-$71,544

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- can you explain why the answer for the third part is option number 2 from the selection of answersarrow_forwardI need to know how to find FIFOarrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education