ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

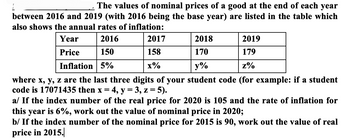

Transcribed Image Text:The values of nominal prices of a good at the end of each year

between 2016 and 2019 (with 2016 being the base year) are listed in the table which

also shows the annual rates of inflation:

2016

150

Inflation 5%

Year

Price

2017

158

x%

2019

179

z%

2018

170

y%

where x, y, z are the last three digits of your student code (for example: if a student

code is 17071435 then x = 4, y = 3, z = 5).

a/ If the index number of the real price for 2020 is 105 and the rate of inflation for

this year is 6%, work out the value of nominal price in 2020;

b/ If the index number of the nominal price for 2015 is 90, work out the value of real

price in 2015.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The average rate of inflation in the United States in the last 100 years is approximately 3.26%. In the last year the rate has jumped to 8.5%. Determine the present worth of a future sum of $10,000 in 10 years. Also, determine the present worth of $10,000 10 years ago. Assume time starts when inflation changes from 3.26% to 8.5%. Also assume the 8.5% rate of inflation continues infinitely. Please correct solution and fasterarrow_forwardThe following table shows a person's nominal and real wages for three years, as well as the price level (price index) for each year, using the first year as the base year. Fill in the blanks in the table. Then calculate the annual inflation rate for each year (not including the base year). Instructions: Round your answers to 2 decimal places. Nominal Wage ($) Real Wage ($) Inflation Rate (%) Year Price Level 1 7.00 140 5.00 2. 9.00 7.00 150.00 3 11 160.00 7.50arrow_forwardIn 2000, the value of the Consumer Price Index was 171.20 and the price of gasoline (per gallon) was $1.56. Six years later in 2006, the value of the Consumer Price Index was 200.43 and the price of gasoline (per gallon) was $2.56. What was the specific inflation rate for gasoline during this period?arrow_forward

- The nominal interest rate is 3% in the economy. Shawn is deciding to give loan to his friend at this rate. The prevailing inflation rate is 2.5% Should Shawn give loan to his friend or not?arrow_forwardIf the nominal interest rate on a loan was 10 percent and the real interest rate was 8 percent, then the inflation rate during that time must have been: 9% 2% 1.25% 18%arrow_forwardAn engineer's salary was $40,000 in 2004. The same engineer's salary in 2011 is $75,000. If the company's salary policy dictates that a yearly raise in salaries reflect the cost of Jiving increase due to inflation, what is the average inflation rate for the period 2004-2012?arrow_forward

- The consumer price index (CPI) of a country was approximately 200 at the beginning of year 2010. If inflation continued at an average rate of 2.5%, what would the index be at the beginning of year 2021?arrow_forwardAn economist has predicted 2% inflation during the next 10 years. How much will an item that presently sells for $100 cost in 10 years?arrow_forwardThe cost of first-class postage has risen by about 5% per year over the past 30 years. The U.S. Postal Service introduced a one-time forever stamp in 2008 that cost 41 cents for first-class postage (one ounce or less), and it will be valid as first-class postage regardless of all future price increases. Let’s say you decided to purchase 1,000 of these stamps for this one-time special rate. Assume 5% inflation and your personalMARR is 10% per year (im). Did you make a sound economical decision?arrow_forward

- Question 7 The price of a product was $0.88 in the year 2008 and $1.28 in the year 2018. What is the average annual inflation rate for this product? 3.82 % 3.68% 3.42 % 3.98 % Question 8 If the CPI for January 2008 is 208.837 and the CPI for December 2018 is 255.539, what is the average annual inflation rate (per year) from Jan 2008 to Dec 2018? (Hint: Calculate monthly inflation rate and then use annual effective interest rate) O 1.65 % ☐ 1.75% O 1.95 % O 1.85 %arrow_forwardIf the Consumer Price Index was 107 in one year and 104 in the following year, then the rate of inflation was approximatelyarrow_forwardVll definitely upvote.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education