ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

5) The value of government spending in billions of dollars is

- A) 200.

- B) 600.

- C) 800.

- D) 1,000

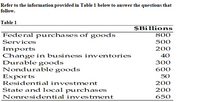

Transcribed Image Text:Refer to the information provided in Table 1 below to answer the questions that

follow.

Table 1

$Billions

800

Federal purchases of goods

Services

500

Imports

Change in business inventories

Durable goods

Nondurable goods

Exports

Residential investment

200

40

300

600

50

200

State and local purchases

Nonresidential investment

200

650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6 an increase in federal income tax rates is an example of fiscal policy that affects GDP indirectly True or False?arrow_forwardDo you agree or disagree with this statement: “It is in the best interest ofoureconomy forCongress and the President to run a balanced budget each year.” Explain your answer.arrow_forward2. How should different types of spending be shared between different levels of government?arrow_forward

- Explain the straightforward path on how a bill becomes a law in our state.arrow_forwardCreate a framework of procedure governing the planning and implementation of budgetary policies. Explain uour framework createdarrow_forwardWhat is the difference among discretionary, nondiscretionary, and entitlementspending in the public budget?arrow_forward

- 40. The most efficient tax system has a broad tax base and a low tax rate. A) True B) False 41. Making the income tax more progressive by adding more tax brackets potentially can result in A) stronger economic growth B) a more "equitable" tax C) no effect on equity or economic growth D) slower economic growth 42. The Atlanta city council decides to double taxes on small business in the downtown area to raise more tax revenue to fund more social programs. From an economic growth perspective, why is this a misguided economic policy? A) it is not a bad policy; doubling taxes will automatically double tax revenue B) excessive taxes on business can result in reduced jobs, incomes and business creation because business simply moves to a new government jurisdiction. C) it is not a bad policy; raising taxes will double tax revenue, raise income levels, and encourage business creation. D) excessive taxes will provide more social benefits, so business will tolerate unusually high taxes and stay…arrow_forwardH10. One solution sometimes proposed to address the growing spending challenges faced by Social Security and Medicare is to increase wage taxes paid by employers and employees. What are some potential downfalls associated with this solution? Explain.arrow_forwardWhich one of the following statements regarding fiscal policy and the budget is (2) correct?(a) When the government plans to stimulate economic activity, it can increasespending or reduce taxes;arrow_forward

- How does the typical state budget process work, and what are the various actors involved in that process? What are the main characteristics of a sustainable budget? What are the main sources of revenues for states and local governments? Is it possible to balance the demands for government services with existing revenue sources? What have been the various approaches advocated to reform budgeting processes at the state and local levels? What are the five key areas of future state and local budget needs? Which one do you think is the most critical and why? Explain. assignment #10 be sure to cite your source(s) using APA Stylearrow_forward4. What have been the various approaches advocated to reform budgeting processes at the state and local levels? 5. What are the five key areas of future state and local budget needs? Which one do you think is the most critical and why? Explain.arrow_forward_________________ Are those expenditure of the government which neither cause any increase in the government asset or nor cause any reduction in the government liability.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education