FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

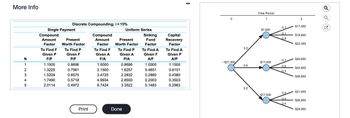

Transcribed Image Text:The tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is

two years, and MARR = 15% per year. Based on this information,

a. What are the E(PW), V(PW), and SD(PW) of the project?

b. What is the probability that PW ≥ 0?

Click the icon to view the tree diagram.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year.

a. Calculate the E(PW), V(PW), and SD(PW) of the project.

(Round to the nearest dollar.)

E(PW) = $

V(PW) =

SD(PW) = $

million ($)2 (Round to two decimal places.)

b. The probability that PW 20 is

(Round to the nearest dollar.)

(Round to two decimal places.)

Transcribed Image Text:More Info

N

12345

Discrete Compounding; i = 15%

Single Payment

Compound

Amount

Factor

To Find F

Given P

F/P

1.1500

1.3225

1.5209

1.7490

2.0114

Present

Worth Factor

To Find P

Given F

P/F

0.8696

0.7561

0.6575

0.5718

0.4972

Print

Compound

Amount

Factor

To Find F

Given A

F/A

1.0000

2.1500

3.4725

4.9934

6.7424

Uniform Series

Present

Worth Factor

To Find P

Given A

PIA

0.8696

1.6257

2.2832

2.8550

3.3522

Done

Sinking

Fund

Factor

To Find A

Given F

A/F

1.0000

0.4651

0.2880

0.2003

0.1483

Capital

Recovery

Factor

To Find A

Given P

A/P

1.1500

0.6151

0.4380

0.3503

0.2983

0

- $27,000

0.3

0.5

0.2

Time Period

1

$7,000

$11,000

$17,500

0.1

0.1

0.8

0.1

0.6

0.3

0.2

0.4

0.4

$17,000

$19,600

$23,300

$20,600

$24,800

$28,900

$21,000

$26,900

$29,900

Ⓒ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Please help me with show all calculation thankuarrow_forwardAn investment will provide the following future cash flows. Year 1 = 5,919 Year 2 = 8,327 Year 3 and 4 = 4,718 Year 5 = 3,048 Using a 9.01% discount rate, what is the present value of this investment?arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, , use the PI to determine which projects the company should accept. ..... What is the Pl of project A? (Round to two decimal places.)arrow_forward

- Refer to two projects with the following cash flows: Year Project A Project B 0 -$110 -$110 1 45 55 2 45 55 3 45 55 4 45 If the opportunity cost of capital is 11%, what is the profitability index for each project?arrow_forwardWhat is the payback period for project E? Data Table - X years (Round to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flow Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 $46,000 $100,000 $20,000 $9,200 $9,200 $10,000 $9,200 $40,000 $9,200 $30,000 $9,200 $0 $9,200 $0 Print Donearrow_forwardWhen an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) When an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) Initial cost of the investment minus the annual net cash inflow Average amount of the investment divided by the average annual net income Initial cost of the investment divided by the annual net cash inflow Present value of net cash inflow divided by the initial cost of the investment Future value of net cash inflow divided by the initial cost of the investment Present value of the net cash inflow minus the initial cost of the investment Annual net cash inflow minus the initial cost of the investment Average annual net income divided by the average amount of the investmentarrow_forward

- Payback period. What are the payback periods of projects E and F in the following table: ? Assume all the cash flow is evenly spread throughout the year. If the cutoff period is 3 years, which project(s) do you ассept? ..... What is the payback period for project E? years (Round to one decimal place.)arrow_forwardAccounting Draw the cash flow diagram for the given project below and then calculate the project net profit. The following table shows the activities description, dependency, duration, and cost elements. Assume the followings: Project overhead 8%. Tax 3%. Bond 1.25%. Profit 6%. Interest rate 9% per year. Down payment 10% with a guarantee letter, which costs 0.25% per month paid to the bank at the project start date. A performance guarantee letter of 10% will be submitted from contractor at the project begin. Invoices are submitted every month and will be paid a month later. Retention 10% and will be paid at the last invoice. Subcontractors: retention 10% will be paid at the last invoice, down payment 20%. Labor: labor expenses to be paid bi-weekly. Equipment: equipment expensesarrow_forwardan investment under consideration has a payback of six years and a cost of 885000. Assume the cash flows are conventional. If the required return is 12% what is the worst case NPV. Please use excel when showing how you got therarrow_forward

- uring the initial cash outflow? For payback period calp pack period for project A? i Data Table nd to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flor B. $15,000 S7,500 S7.500 S7,500 S7.500 S7,500 S7.500 $90,000 $36,000 $27,000 $18,000 $9,000 SO Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 $0 Print Donearrow_forwardCompute the IRR, NPV, PI, and payback period for the following two projects. Assume the required return is 12%. See the table attached.arrow_forwardWhich of the following comes closest to the net present value (NPV) of a project whose initial investment is $5 and which produces two cash flows: the first at the end of year 2 of $3 and the second at the end of year 4 of $7? The required rate of return is 13%? Select one: a. $1.84 b. $0 c. $1.64 d. $2.05 e. $2.26arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education