FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

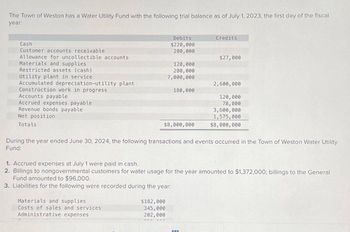

Transcribed Image Text:The Town of Weston has a Water Utility Fund with the following trial balance as of July 1, 2023, the first day of the fiscal

year:

Debits

Credits

Cash

$220,000

Customer accounts receivable

200,000

Allowance for uncollectible accounts

$27,000

Materials and supplies

120,000

Restricted assets (cash)

280,000

Utility plant in service

7,000,000

Accumulated depreciation-utility plant

2,600,000

Construction work in progress

180,000

Accounts payable

120,000

Accrued expenses payable

78,000

Revenue bonds payable

3,600,000

Net position

Totals

1,575,000

$8,000,000

$8,000,000

During the year ended June 30, 2024, the following transactions and events occurred in the Town of Weston Water Utility.

Fund:

1. Accrued expenses at July 1 were paid in cash.

2. Billings to nongovernmental customers for water usage for the year amounted to $1,372,000; billings to the General

Fund amounted to $96,000.

3. Liabilities for the following were recorded during the year:

Materials and supplies

Costs of sales and services

Administrative expenses

$182,000

345,000

202,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below.] The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2024, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Debits Adjustments: $ 29,400 53,000 VILLAGE OF SEASIDE PINES ENTERPRISE FUND Reconciliation of Operating Income to Net Cash Provided by Operating Activities For the year ended December 31, 2024 722,000 98,000 504,000 51,000 17,700 40,900 19,700 $ 1,535,700 Credits $ 112,000 32,600 51,000…arrow_forwardResidents of the town of Sunny View, Arizona authorized a $5,000,000 renovation to theirhistoric town hall on November 15, 2022. Financing for the project consists of $2,500,000 froma 5 percent serial bond issue, $1,500,000 from a state grant, and $1,000,000 from the GeneralFund. Debt service for the serial bonds will be provided by a one-quarter-cent city sales taximposed on every dollar of sales in the city. Required: Complete the necessary journal entries to record the related transactions in the town's capitalprojects fund, debt service fund, and governmental activities at the government-wide level. Youmay ignore entries in the General Fund. The town has a calendar year-end. n. The sales tax collections for debt service amounted to $250,000. o. Central Paving and Construction gave a final billing to the town for $2,000,000. Upon last inspection by the Public Works Department, a leak was discovered in the roof.p. Public works employees installed a new sidewalk and landscaping at a…arrow_forward25arrow_forward

- The City of Castleton’s General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Debits Credits Cash $ 476,000 Taxes Receivable—Delinquent 601,000 Allowance for Uncollectible Delinquent Taxes $ 189,120 Interest and Penalties Receivable 28,080 Allowance for Uncollectible Interest and Penalties 12,960 Inventory of Supplies 17,900 Vouchers Payable 166,500 Due to Federal Government 77,490 Deferred Inflows of Resources—Unavailable Revenues 427,000 Fund Balance—Nonspendable—Inventory of Supplies 17,900 Fund Balance—Unassigned 232,010 $ 1,122,980 $ 1,122,980 Prepare a General Fund balance sheet as of June 30, 2020.arrow_forwardFocarrow_forwardplease do not give images formatarrow_forward

- Scenario and General Fund budgetary journal entries The scenario: Croton City maintains four governmental-type funds: a General Fund, a Library Special Revenue Fund, a Capital Projects Fund, and a Debt Service Fund. Croton City started its calendar year 2019 with the following General Fund balances (all numbers are in thousands of dollars). Debits Credits Cash $1,800 Property taxes receivable 800 Salaries payable $700 Deferred property tax revenues 300 Unassigned fund balance - 1,600 Totals $2,600 $2,600 Croton has adopted the following budgetary and accounting policies: Encumbrance accounting is used only for the acquisition of supplies and for the award of contracts for construction and construction-related activities. Open encumbrances lapse at the end of the year, but are considered in developing the next year's budget. Because final income tax returns are not required to be filed until April 15 of the year following the end of a calendar…arrow_forwardDuring January 2023, General Fund supplies ordered in the previous fiscal year and encumbered at an estimated amount of $2,000 were received at an actual cost of $2,200. The entry to record this transaction will require a debit to: Multiple Choice Expenditures-2023 in the amount of $200. Expenditures-2023 in the amount of $2,200. Expenditures-2022 in the amount of $200. Expenditures-2022 in the amount of $2,200.arrow_forwardAs of July 1, 2017, the Village of Boiling Springs decided to purchase a privately operated swimming pool and to create a swimming pool (enterprise) fund. During the year, the following transactions occurred: A permanent contribution of $600,000 was received from the general fund. b.Revenue bonds were sold at par in the amount of $1,200,000. c.Several items were purchased for cash, with a cost breakdown as follows: land, $300,000; building, $400,000, land improvement, $400,000; equipment, $200,000; and supplies, $150,000. d.Charges for services amounted to $600,000, all received in cash. Cash expenses included salaries of $200,000; utilities of $100,000; and interest of $72,000. f.Supplies were consumed in the amount of $120,000. Depreciation was recorded as follows: building, $20,000, land improvement, $20,000; and equipment, $20,000. The books were closed. Close all accounts to net position. Required: Prepare a Statement of Revenues, Expenses, and Changes in Fund Net…arrow_forward

- A county's general fund has $4,000,000 in supplies on hand at the beginning of 2020. It purchases $25,000,000 in supplies and uses supplies costing $26,000,000 during 2020. If the county uses the consumption method to report supplies inventories, what balances appear in the general fund financial statements for 2020? Multiple Choice Expenditures of $26,000,000 and fund balance-nonspendable of $3,000,000 Expenditures of $25,000,000 and fund balance--unassigned of $3,000,000 Expenditures of $25,000,000 and fund balance-nonspendable of $3,000,000 Expenditures of $26,000,000 and fund balance--unassigned of $3,000,000arrow_forward1. Assume that the City of Juneau maintains its books and records to facilitate the preparation of its fund financial statements. The City pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the General Fund had earned $120,000 on Monday, Tuesday, and Wednesday (June 28, 29, and 30). What entry, if any, should be made in the City s General Fund? a. Debit Expenditures; Credit Wages and Salaries Payable. b. Debit Expenses; Credit Wages and Salaries Payable. c. Debit Expenditures; Credit Encumbrances. d. No entry is required.arrow_forwardPrepare journal entries to record the following events in the city of Rosewood’sWater Commission enterprise fund: a. From its general fund revenues, the city transferred $300,000, which is restricted for the drilling of additional wells. b. Billings for water consumption for the month totaled $287,000, including $67,000 billed to other funds within the city. c. TheWater Commission collected $42,000 from other funds and $190,000 from other users on billings in item (b). d. To raise additional funds, the utility issued $700,000 of 5%, 10-year revenue bonds at face value. Proceeds are restricted to the development of wells. e. The contract with the well driller showed an estimated cost of $930,000. f. The well driller bills $360,000 at year-end. g. The utility pays a $300,000 bill from the well driller.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education