Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

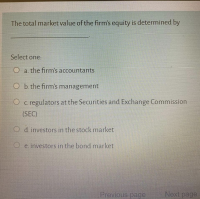

Transcribed Image Text:The total market value of the firm's equity is determined by

Select one:

O a. the firm's accountants

O b. the firm's management

O c. regulators at the Securities and Exchange Commission

(SEC)

O d. investors in the stock market

O e. investors in the bond market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 12. To which Organizations must a company report their financial results sells its stock on the organized stock market? a. American Institute of Certified Public Accountants (AICPA) b. Financial Accounting Standards Board (FASB) c. International Accounting Standards Board (IASB) d. Securities and Exchange Commission (SEC)arrow_forwardEvaluation of SONY coperation company's financial management (Exclusion of financial ratio study) a.Acquisition of capital. i. Utilisation of equity and debt. The student must identify the form of borrowings and shares, the specific capital markets in which they occur, the type of currencies involved, and other relevant details.arrow_forwardCapital structure decisions refer to the: blend of equity and debt used by the firm. dividend yield of the firm's stock. maturity date for the firm's securities. capital gains available on the firm's stock.arrow_forward

- 1. What percentage of total liabilities and stockholders’ equity is stockholders’ equity? What kinds of stock does the company have?arrow_forwardThe share capital of a company may consist of: Select one: a. Loans from banks. b. Ordinary or preference shares issued by the company either fully paid or partly paid. c. Debentures issued by the company. d. Secured and unsecured notes issued by the company.arrow_forwardWhen a firm conducts a seasoned equity offering and uses the proceeds to purchase a portion of the firm's outstanding debt, then the firm's Group of answer choices business risk increases. financial risk decreases. financial risk increases. business risk increases.arrow_forward

- first day. What was the total cost to the firm of issuing the securities?arrow_forwardDescribe the accounting for bonds payable, including bonds issued at face amount, bonds issued at a discount, and bonds issued at a premium? Describe how bonds are reported on the balance sheet? Describe how the times interest earned ratio is used to evaluate a company’s financial condition? Describe the advantages and disadvantages of the corporate form of business ownership? Describe the characteristics of corporate stock, the classes of stock, and the accounting entries for stock issuance? Search entries or author .arrow_forwardDiscuss how a company's primary financial statements are useful to potential investors who are trying to decide whether to buy stock in a company.arrow_forward

- In the United States and most other countries, the source of capital on which firms most heavily rely is OA. new common stock B. retained earnings OC. long-term debt OD. preferred stock.arrow_forwardWhich of the following affects the total Shareholders’ Equity? a. Declaration of a scrip dividend b. Declaration of share split c. Appropriation of retained earnings d. Retirement of treasury sharesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education