FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

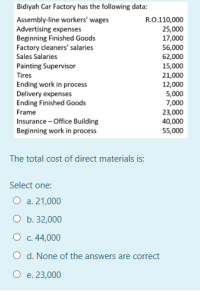

Transcribed Image Text:The total cost of direct materials is:

Select one:

O a. 21,000

O b. 32,000

О с. 44,000

O d. None of the answers are correct

O e. 23,000

Expert Solution

arrow_forward

Step 1

Direct materials costs are those costs of materials which can be directly be related to manufacturing of Cars.

Here, Tires cost of $21,000 and Frames cost of $23000 is the direct material cost.

Direct materials = Tires + Frames = 21000 + 23000 = $44,000

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- direct material cost per equivalent unit is a1.10 and there are 2,000 physical units 100% complete with respect to materials. what are the total cost of these 2,000 physical units are 50% complete with respect to conversion and conversion costs are 3.55 per equivalent unitarrow_forwardQuestion 1: Assume the following information pertaining to Star Company: Prime costs $ 202,000 Conversion costs 235,000 Direct materials used 89,900 Beginning work in process 104,300 Ending work in process 83,800 Total manufacturing cost is calculated to be: Multiple Choice $324,900. $33,000. $112,100. $347,100. $122,900.arrow_forwardprovide solutionarrow_forward

- Crane is an electronics components manufacturer. Information about the company's two products follows: AM-2 FM-9 Units produced 20,000 4,000 Direct labor hours required for production 10,000 15,000 Units per batch 4,000 400 Shipping weight per unit 0.50 Ibs. 10 Ibs. The company incurs $786,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.arrow_forwardCosts associated with two alternatives, code-named Q and R, being considered by Albiston Corporation are listed below: Alternative Q Alternative R Supplies costs $ 74,000 $ 74,000 Power costs $ 34,200 $ 33,400 Inspection costs $ 27,000 $ 33,400 Assembly costs $ 39,000 $ 39,000 Required: a. Which costs are relevant and which are not relevant in the choice between these two alternatives? b. What is the differential cost between the two alternatives?arrow_forwardCost pool $58,200 $88,500 Total cost in cost pool O $7,200 pool 1 pool 2 pool 3 Compute allocated capacity costs for product Alpha. $18,000 $7,500 $63,000 $45,000 not enough information need to know the total number of cost driver units Number of cost driver units product Alpha 20 20 30 -- product Beta 30 5 12arrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardnttps:25A%252F%252HM..mh A company allocates materials handling cost to the company's two products using the below data: Product A Product B Total expected units produced 5,400 11,800 Total expected material 530 470 moves Expected direct labor-hour 670 150 per unit The total materials handling cost for the year is expected to be $182,000. If the materials handling cost is allocated on the basis of direct labor-hours, how much of the total materials handling cost would be allocated to the Product B? (Round your intermediate calculations to 5 decimal places.) Multiple Choice $97,944 $74,263 $35,671 $59.791arrow_forwardXYZ Mfg. estimated its different overhead costs as follows:Costs Cost FormulasDepreciation P1,000Lubricants P1,500 + PO.50 per machine hourMachine setup P0.30 per machine hourMaintenance P200 + PO.10 per machine hourUtilities P2,000 + PO.60 per machine hour Total overhead costs expected at activity level of 300 machine hours must be:a. P4,700b. P4,950c. P5,000d. P5,150arrow_forward

- The following standard costs pertain to a component part manufactured by Ashby Company:Direct materials$2Direct labour5Manufacturing overhead 20 Standard cost per unit $27The company can purchase the part from an outside supplier for $25 per unit. The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision. Assume that direct labour is an avoidable cost in this decision. What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?arrow_forwardHansabenarrow_forwardThe following data have been collected for four different cost items. Cost at Cost 100 Cost at Item units 140 units W $8,000 $10,560 X $5,000 $ 5,000 $6,500 $ 9,100 Z $6,700 $ 8,580 NAX Y Which of the following classifications of these cost items by cost behavior is correct? A) B) C) D) Cost W variable mixed variable mixed Cost X fixed fixed fixed fixed Cost Y mixed variable variable mixed Cost Z variable mixed variable mixedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education