FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

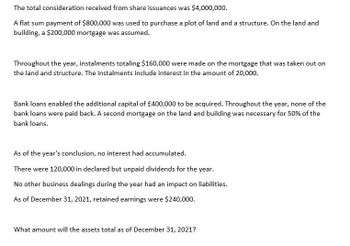

Transcribed Image Text:The total consideration received from share issuances was $4,000,000.

A flat sum payment of $800,000 was used to purchase a plot of land and a structure. On the land and

building, a $200,000 mortgage was assumed.

Throughout the year, instalments totaling $160,000 were made on the mortgage that was taken out on

the land and structure. The instalments include interest in the amount of 20,000.

Bank loans enabled the additional capital of £400,000 to be acquired. Throughout the year, none of the

bank loans were paid back. A second mortgage on the land and building was necessary for 50% of the

bank loans.

As of the year's conclusion, no interest had accumulated.

There were 120,000 in declared but unpaid dividends for the year.

No other business dealings during the year had an impact on liabilities.

As of December 31, 2021, retained earnings were $240,000.

What amount will the assets total as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5. 2. The City of Paradise issued Bonds of $1,250,000 for the Construction of a City Hall. The City Hall’s bonds are sold at a premium of $150,000; therefore the estimated cost of the Hall is $1,100,000. Required: a. Prepare general journal entries to record the issue of the bonds by General Fund. b. Prepare general journal entries to transfer the premium amount to the debt service fund.arrow_forwardMargery Corp. received $100,000 in interest from a bank this year, $80,000 of municipal bond interest. Margery Corp. paid $5,000 of interest expense on loans it secured to purchase the municipal bonds. What is the total, net BTD associated with these investments? Group of answer choices $75,000 favorable, permanent $85,000 favorable, permanent $80,000 favorable, permanent $85,000 favorable, temporaryarrow_forwardLisa County issued $5,000,000 of general obligation bonds at 101 to finance a capital project. The $50,000 premium was to be used for payment of interest. The transactions involving the premium should be accounted for in thea. capital projects funds, the debt service funds, and the general long-termdebt account group.b. capital projects funds and debt service funds only.c. debt service funds and the general long-term debt account group only.d. debt service funds only.arrow_forward

- On January 1, 20x1, Lawrence Lenders loaned $9.6 million to Wilkins Food Products, Inc. to purchase a frozen food storage facility. Wilkins signed a three-year, 4% installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the following for Lawrence Lenders: 1. Prepare the journal entry for lending the funds on January 1, 20x1. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment received on December 31, 20x1. 4. Prepare the journal entry for the third installment payment received on December 31, 20x3. Complete this question by entering your answers in the tabs below. Req 2 Saved Req 1 3 and 4 2021 Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.) Dec. 31 Cash…arrow_forwardThe county of Santa Clara is building a new park. The main financing source will be $1,000,000 bond issue. In addition, the general fund will transfer $100,000 transfer to fund the capital project. Please record the journal entries for the Capital Project Fund & the Government-Wide financial statements. 1. The county has signed a contract with Spectacular Construction to construct the park $1,000,000 2.The $1,000,000 bonds were issued at par 3. Spectacular Construction billed the county of Santa Clara $1,000,000 upon completion of the project 4. The park is completedarrow_forwardRiverbed Co. is building a new music arena at a cost of $5,652,000. It received a down payment of $642,000 from local businesses to support the project, and now needs to borrow $5,010,000 to complete the project. It therefore decides to issue $5,010,000 of 7%, 20- year bonds. These bonds were issued on January 1, 2024, and pay interest annually on each January 1. The bonds yield 9%. Prepare the journal entry to record the issuance of the bonds on January 1, 2024. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal place e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation January 1,2024 Cash Discount on Bonds Payable Bonds Payable Debit 4095316 914684 Credit 5010000 Prepare a bond amortization…arrow_forward

- The Valencia Development Company (VDC) is planning to sell a P100,000,000, 10-year, 12%, semiannual payment bond issue. Provisions for a sinking fund to retire the issue over its life will be included in the indenture. Sinking fund payments will be made at the end of each year, and each payment must be enough to retire 10% of the original amount of the issue. The last sinking fund payment will retire the last of the bonds. The bonds to be retired each period can be purchased on the open market or obtained by calling up to 5% of the original issue at par, at VDC’s option. How large must each sinking fund payment be if the company uses the option to call bonds at par? How large must each sinking fund payment be if the company decides to buy bonds on the open market? (You can only answer in words.)arrow_forwardIvanhoe Desalination Ltd. needed to raise $165,000,000 of additional capital to finance the design, development, and construction of its water desalination facility. Ivanhoe decided to issue bonds that pay interest of $2,475,000 on each of March 31 and September 30 and that will reach maturity on September 30, 2037. The bonds were issued at 93.2 on October 1, 2024, for $153,780,000, which represented a yield of 3.66%.arrow_forwardTri-States Gas Producers expects to borrow $800,000 for field engineering improvements. Two methods of debt financing are possible—borrow it all from a bank or issue debenture bonds. The company will pay an effective 8% per year to the bank for 8 years. The principal on the loan will be reduced uniformly over the 8 years, with the remainder of each annual payment going toward interest. The bond issue will be for 800 ten-year bonds of $1000 each that require a 6% per year dividend payment. (a) Which method of financing is cheaper after an effective tax rate of 40% is considered? (b) Which is the cheaper method using a before-tax analysis? Is it the same as the after-tax choice?arrow_forward

- The Vancouver Development Company (VDC) is planning to sell a$100 million, 10-year, 12%, semiannual payment bond issue. Provisions for a sinking fundto retire the issue over its life will be included in the indenture. Sinking fund payments willbe made at the end of each year, and each payment must be sufficient to retire 10% of theoriginal amount of the issue. The last sinking fund payment will retire the last of the bonds.The bonds to be retired each period can be purchased on the open market or obtained bycalling up to 5% of the original issue at par, at VDC’s option.a. How large must each sinking fund payment be if the company (1) uses the option tocall bonds at par or (2) decides to buy bonds on the open market? For part (2), you canonly answer in words.b. What will happen to debt service requirements per year associated with this issue overits 10-year life?c. Now consider an alternative plan where VDC sets up its sinking fund so that equal annualamounts are paid into a sinking…arrow_forwardOn 1 June 20x1, CLM received written confirmation from a local government agency that it would receive a $1 million grant towards the purchase price of a new office building. The grant becomes receivable on the date that CLM transfers the $10 million purchase price to the vendor. On 1 October 20x1 CLM paid $10 million in cash for its new office building, which is estimated to have a useful life of 50 years. By 1 December 20x1, the building was ready for use. CLM received the government grant on 1January 20x2. Required Discuss the possible accounting treatments of the above in the financial statements of CLM for the year ended 31 December 2x1.arrow_forwardPrepare journal entries to record each of these transactions in the general fund. Based on your entries, prepare a balance sheet and statement of revenues, expenditures, and changes in fund balance for the general fund. The Authority issued $2.5 million in long-term bonds. · The Authority purchased 4 acres of land for $500,000 in cash. · It sold one of the 4 acres of land for $125,000 in cash. · It made a $325,000 payment on the debt, consisting of $75,000 of interest and $250,000 of principal. · It lost a lawsuit filed by one of its renters and was ordered to pay $1 million in damages over 5 years. It made its first cash payment of $200,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education