FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

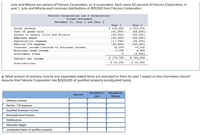

Transcribed Image Text:Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of Falcons Corporation. In

year 1, Julio and Milania each received distributions of $10,000 from Falcons Corporation.

Falcons Corporation (an s Corporation)

Income Statement

December 31, Year 1 and Year 2

Year 1

$ 320,000

(41,000)

(40,000)

(30,000)

(17,000)

(30,000)

10,000

Year 2

$ 450,000

(62,000)

(80,000)

(60,000)

(34,000)

(50,000)

18,500

Sales revenue

Cost of goods sold

Salary to owners Julio and Milania

Employee wages

Depreciation expense

Section 179 expense

Interest income (related to business income)

Municipal bond income

Government fines

1,700

4,400

(2,000)

$ 173,700

$ 184,900

Overall net income

$ 20,000

$ 50,000

Distributions

a. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above?

Assume that Falcons Corporation has $220,000 of qualified property (unadjusted basis).

Allocated to

Julio

Allocated to

Amount

Milania

Ordinary Income

Section 179 expense

Qualified business income

Municipal bond income

Distributions

Allocated wages

Unadjusted basis of qualified property

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

The top picture was helpful for the separately stated items and I got most of the numbers on my own, but how do you calculate the QBI and allocated wages for this problem?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

The top picture was helpful for the separately stated items and I got most of the numbers on my own, but how do you calculate the QBI and allocated wages for this problem?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Castle and Dave formed an S corporation that is owned as follows: Castle 75% and Dave 25%. The corporation distributes an asset to each owner. The corporation has a basis of $45,000 for each asset. The fair market value of each of the assets is as follows: Castle $90,000 and Dave $50,000. a. What is the recognized gain for the corporation? b. How much of the gain does Castle report? c. How much of the gain does Dave report?arrow_forwardVan and Floyd formed a corporation during the year. In exchange for one-half of the outstanding shares of the corporation's voting stock, which had a total par value of $400, 000, Van contributed property with a fair market value of $200,000 for which he paid $300,000 in a prior year. Floyd contributed property with a fair market value of $200,000 for which he paid $100,000 in a prior year and received the other one-half of the outstanding stock. How much gain or loss will Van and Floyd recognize on the transfer of property? A. Van will recognize $100, 000 loss; Floyd will recognize $100, 000 gain. B. No gain or loss to either Van or Floyd. C. Van will recognize $0 loss; Floyd will recognize $100,000 gain. D. None of the answers are correct.arrow_forwardJulio and Milania are owners of Falcons Corporation, an S corporation. They each own 50 percent of Falcons Corporation. In year 2, Julio and Milania each received distributions of $25,000 from Falcons Corporation. Sales revenue Cost of goods sold Falcons Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Salary to owners Julio and Milania Employee wages Depreciation expense Section 179 expense Interest income. Municipal bond income Government fines Overall net income Distributions Ordinary Income Year 1 Year 2 $300,000 $430,000 (40,000) (60,000) (40,000) (80,000) (50,000) (25,000) (20,000) (40,000) (30,000) (50,000) 12,000 22,500 1,500 0 Amount a. What amount of ordinary income and separately stated items are allocated to them for year 2 based on the information above? 4,000 (2,000) $158,500 $174,500 $ 30,000 $ 50,000 Julio Milaniaarrow_forward

- he Whitewater LLP is equally owned by three partners and shows the following balance sheet at the end of the current tax year. Basis FMV Cash $81,000 $81,000 Unrealized receivables 0 27,000 Land 27,000 108,000 $108,000 $216,000 Petula, capital $36,000 $72,000 Prudence, capital 36,000 72,000 Primrose, capital 36,000 72,000 $108,000 $216,000 Partner Petula is an active (i.e., "general") partner retiring from the service-oriented partnership. She receives $81,000 cash, none of which is stated to be for goodwill. a. How much of the payment is for "unstated goodwill"? b. How is the $81,000 allocated between a § 736(a) income payment and a § 736(b) property payment? The $81,000 cash payment is allocated as follows:§ 736(a) income payment: § 736(b) property payment:arrow_forwardHelen owns 30% of a flow-through entity. The capital gain comes from the sale of a piece of equipment that Helen contributed to the entity. At the time of contribution, the piece of equipment had a basis of $45,000 and a fair market value of $50,000. The entity reports the following amounts before any payments to the owners: O/S Item Amount Sales Revenue 30,000 Dividends received 10,000 Tax-exempt interest income 15,000 Capital gain 5,000 Charitable contributions 1,000 Cost of Goods Sold 10,000 General Business Expenses 3,000 a) In the O/S column above, write ‘O’ for any ordinary business items and write ‘S’ for any separately stated items. b) Assume that the entity is an S-Corp, and that Helen is also an employee of the…arrow_forwardGeorge and Nancy form EB Corporation. George transfers land (basis of $100 and fair market value of S110) for 10 shares plus $10 cash. Nancy transfers $5 cash for 2 shares in EB Corporation, what gains do george and Nancy recognize, what is the stock basisarrow_forward

- To acquire a 1/3 interest in the T LLC (a partnership), on January 1 of this year D contributed some land he held for investment. He purchased the land for $120,000. Unfortunately, the land decreased in value and was only worth $90,000 on the date of contribution. A few years later, T LLC sells the land for $84,000. At the beginning of that year, D's capital account was $200,000. Compute the gain or loss to T LLC when it sold the land_____________________ Compute the capital account for D immediately after the sale________________arrow_forwardFacts: Ellie and Linda are equal owners in Otter Enterprises, a calendar year business. Ellie has a basis in Otter Enterprises of $80,000 at the beginning of the year. Linda has a basis in Otter Enterprises of $60,000 at the beginning of the year. Assume that Otter Enterprises has no debt. Otter Enterprises has $320.000 of gross income and $210.000 of operating expenses. In addition. Otter has a long-term capital gain of $15.000 and makes distributions to Ellie and Linda of $25,000 each. Required: Discuss the impact of this information on the taxable income of Otter. Ellie, and Linda if Otter is: A. A partnership. B. An S corporation. C. AC corporation. Include in your discussion (1) the amount and character of any income recognized by Ellie, Linda, and Otter (including Otter's taxable income and the amount of any tax paid by Otter) in each business entity form; and (2) Ellie and Linda's basis in Otter Enterprises at the end of the year in each business entity form. Show your work and…arrow_forwardIn Year 1 you invested $500,000 in exchange for a 40% partnership interest in ABC, LP. You later received a K-1 from ABC reporting $50,000 as your share of ABC’s Year 1 taxable income. During Year 1 you received a cash distribution from ABC of $75,000. You received a K-1 from ABC reporting $85,000 as your share of ABC’s Year 2 NOL. During Year 2 you received a cash distribution from ABC of $90,000. You received a K-1 from ABC reporting $110,000 as your share of ABC’s Year 3 taxable income. During Year 3 you received a cash distribution from ABC of $125,000. After all of the above, what is your adjusted tax basis in your partnership interest in ABC? $________arrow_forward

- At the beginning of the current year, Tymoe, an S corporation, was owned by two individual shareholders, Tyler and Moe. Tyler owns 52% and Moe owns 48%. During the year, Tymoe had ordinary income of $480,000, a net long-term capital gain of $45,000, and charitable contributions of $12,000. What is the amount of ordinary income, capital gain, and charitable contribution from Tymoe's activities that Tyler and Moe must each report in the current year?arrow_forwardRamona and Hermione formed Wiley Corporation on January 2. Ramona contributed cash of $300,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: FMV Building $112,500 Land 262,500 Total $375,000 Adjusted Tax Basis $30,000 120,000 $150,000 To equalize the exchange, Wiley Corporation paid Hermione $75,000 in addition to her stock. i. Assume Hermione's adjusted tax basis in the land was $375,000. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione seperately?arrow_forwardIn the current year, Tom , Jay , and Dana form Ares Corporation. Tom contributes land (a capital asset) having a $62,500 FMV (fair market value) in exchange for 165 shares of stock. He purchased the land three years ago for $65,000. Jay contributes machinery (Sec. 1231 property purchased four years ago) having a $115,000 adjusted basis and a $37,500 FMV in exchange for 105 shares of Ares stock. Dana contributes services worth $25,000 in exchange for 60 shares of Ares stock.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education