FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

All equipment costs will continue to be

Q.Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that the production and sales quantity is not known. For what production and sales quantity would TechGuide (i) upgrade the equipment or (ii) replace the equipment?

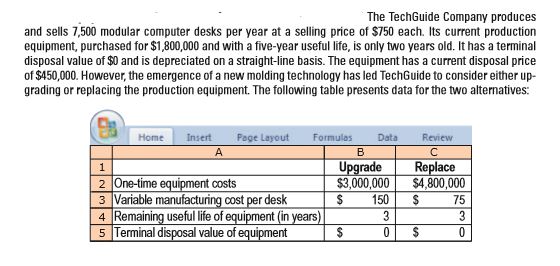

Transcribed Image Text:The TechGuide Company produces

and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production

equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal

disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price

of $450,000. However, the emergence of a new molding technology has led TechGuide to consider either up-

grading or replacing the production equipment. The following table presents data for the two alternatives:

Home

Insert

Page Layout

Formulas

Data

Review

Upgrade

$3,000,000

Replace

$4,800,000

2 One-time equipment costs

3 Variable manufacturing cost per desk

4 Remaining useful life of equipment (in years)

5 Terminal disposal value of equipment

150

75

3

3

24

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A characteristic of the payback method is that it: (See your Chapter 25 notes, page 9) Uses accrual accounting inflows in the numerator of the calculation Uses the estimated expected useful life of the asset in the denominator of the calculation Incorporates cash flows received after the payback period has been reached Is based on accounting income Incorporates the time value of money Ignores total project profitabilityarrow_forwardThe use of natural resources in an economic activity involves setting up a project forharvesting (i.e. extracting) these resources. For the project to be viable, both economic andfinancial indicators - such as net present value (NPV) and internal rate of return (IRR)considering time value of money - are employed. a) Briefly explain the concept of "time value of money". b) Moreover, explain how you will use NPV and IRR to determine the viability of a project.arrow_forwardWhich of the following is not considered a capital investment? 18 Multiple Cholce Ask The development of a new product line. The purchase of a large machine. The acquisition of a subsidlary company. The purchase of a large order of raw materlals used In the production process.arrow_forward

- Hi, number 3 still appears to be unanswered for this problem. How do you determine relevant cash flow (after-tax) at project disposal (termination)?arrow_forwardTRUE OR FALSE FIFO produces a better matching of expenses and revenue when prices are rising. US GAAP requires LIFO when prices are rising. Accumulated depreciation is a liability account. Net book value and fair value are interchangeable. Land and land improvements are depreciated in the same way.arrow_forwardDepreciation is the allocation of the cost of a plant asset over its useful life in a rational and systematic manner. The asset being depreciated remains at historical cost and the accumulated depreciation account serves as a contra account to lower the asset balance on the books. Question: Explain why this lowered value is, or is not, the market value of the asset in any given accounting period. Support your answer with examples explaining your choice.arrow_forward

- Which depreciation method will compute the most depreciation expense over the life of the asset? O Declining-balance will produce the most depreciation expense. O Units-of-production will produce the most depreciation expense. O All methods will produce equal depreciation expense over the life of the asset. O Straight-line will produce the most depreciation expensearrow_forwardProperty, plant and equipment (fixed assets) assets are depreciated because: a. The accrual basis of accounting requires matching of costs to revenues. b. Cash basis of accounting requires depreciation. c. The book values equal market values. d. The replacement cost of plant assets may fluctuate over time.arrow_forward4. Modified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR Consider the following situation: Cold Goose Metal Works Inc. is analyzing a project that requires an initial investment of $600,000. The project's expected cash flows are: Year Year 1 Year 2 Year 3 Year 4 Cold Goose Metal Works Inc.'s WACC is 7%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 17.50% 14.00% Cash Flow $350,000 -100,000 450,000 400,000 19.25%arrow_forward

- Which of the following best describes depreciation?A It is a means of spreading the payment for the asset over its total estimated lifeB It represents the decline in the market value of the assetC It is a means of spreading the cost of an asset over its estimated useful lifeD It is a way of estimating the cash needed to replace the asset in the futurearrow_forward1. Which of the following should be included in the initial outlay? A. Purchase price of new equipmentB. Increased working capital requirementsC. Pre-existing firm overhead reallocated to the new projectD. A and B above 2. Which of the following is NOT included in the calculation of the initial outlay for a capitalbudget? A. Additional working-capital investmentsB. Training expensesC. InstallationD. All is included in the initial outlay 3. Dividend policy is influenced by: A. a firm's capital structure mix.B. a company's investment opportunities.C. a company's availability of internally generated funds.D. all of the above. 4.Which of the following dividend policies will cause dividends per share to fluctuate themost? A. Stable dollar dividendB. Constant dividend payout ratioC. Small, low, regular dividend plus a year-end extraD. No difference between the various dividend policies 5.Which of the following statements would be consistent with the bird-in-the-hand dividendtheory? A.…arrow_forwardA long-term asset that is retired from operations and held for disposal or sale is valued at ________. Group of answer choices value in use replacement cost lower of cost or market lower of carrying value or net realizable valuearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education