Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

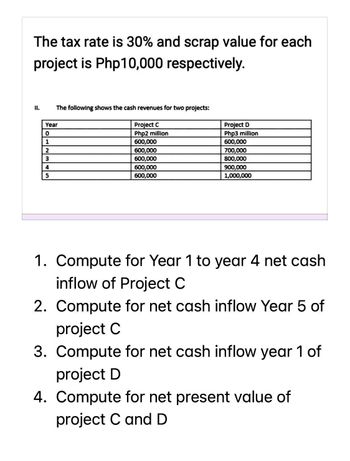

Transcribed Image Text:The tax rate is 30% and scrap value for each

project is Php10,000 respectively.

II.

The following shows the cash revenues for two projects:

Year

0

1

2

3

4

5

Project C

Php2 million

600,000

600,000

600,000

600,000

600,000

Project D

Php3 million

600,000

700,000

800,000

900,000

1,000,000

1. Compute for Year 1 to year 4 net cash

inflow of Project C

2. Compute for net cash inflow Year 5 of

project C

3. Compute for net cash inflow year 1 of

project D

4. Compute for net present value of

project C and D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Kindly answer #4 will surely given an upvote thank you

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Kindly answer #4 will surely given an upvote thank you

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Project A Cost $364,000 and offeres 7 annual net cash inflows of $92,000 The company requires a discount rate of 8% Determine the net present value of project Aarrow_forwardThe initial investment of a project is OMR 30,000. The profit after interest and tax (Cash inflows) for Year 1 is OMR 20,000 and for Year 2 is OMR 26,000. The scrap value is OMR 3,000 and the discount rate is 10%. (The present value of OMR 1 at 10% discount factor for year 1 is 0.909 and Year 2 is 0.826). In this case, the Net present Value (NPV) of the project is: a. OMR 9,656 b. None of these c. OMR 16,000 d. OMR 12,134arrow_forwardAfter paying GH¢ 30,000 for an initial investigation on projects assessments, the finance department of Finger Foods Plc provided the following end-of-year cash flows for the investment projects. Project Initial T0 Outlay ¢000 T1 ¢000 T2 ¢000 T3 ¢000 T4 ¢000 Abo (A) (1,500) (500) 1,200 600 300 Baa (B) (2,000) (1,000) 2,500 2,500 2,500 Cal (C) (1,750) 500 1,100 1,400 1,000 Dok (D) (2,500) 700 900 1,300 300 Eak (E) (1,600) (500) 200 2,800 2,300 You have just been promoted from the position of a Finance Officer to the new rank of A financial Analyst after your MBA programme. As a result, the managing director has written a memorandum to you with the cash flows from the various projects, as shown above, to appraise the projects and advise management on the best decision the company can take to maximize the company's value. The company's cost of capital is 15% and its corporation tax is 30%.…arrow_forward

- Hh.27.arrow_forwardGiven the following information: Price/Unit 225 VC/Unit 75 FC 500,000 Tax Rate 21% Rate 10% Machine Cost 3,000,000 Life 4 Depreciation Straight Line Using the FBE units, calculate the annual operating cash flows for the project. (Round to 2 decimals)arrow_forwardThe following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project A Project B Project C Initial Cost 240,000.00 260,000.00 200,000.00 Expected life 5 5 4 Scrap value expected 10,000.00 15,000.00 10,000.00 Expected Cash Inflows: End Year 1 85,000.00 95,000.00 45,000.00 End Year 2 70,000.00 70,000.00 65,000.00 End Year 3 65,000.00 55,000.00 95,000.00 End Year 4 60,000.00 50,000.00 100,000.00 End Year 5 50,000.00 50,000.00 The company estimates cost of capital is 18%. The table below shows the present value of $1 at 14%, 18% and 22%. Periods 14% 18% 22% 1 0.877 0.847 0.820 2 0.769 0.718 0.672 3 0.675 0.609 0.551 4 0.592 0.516 0.451 5 0.519 0.437 0.370 6 0.456 0.370 0.303 Required: Calculate:(b) The accounting rate of return for each…arrow_forward

- An investment has the following annual cash flow 1st year-Php50,000 2nd year- Php 65.000 3rd year - Php 45,000 4th year Php 40.000 Sth year - Php 40,000 The current cost of the investment is Php700,000. The investment can be sold at the end of Sth year for Pho700,00. The entity can borrow funds for 10%. Requirement: Compute the following * Present Value of the Investment b. Net present value of the investment Show your solunonsarrow_forwardConsider a project with inflows of $20,000 and outflows of $13,000. If the tax rate is 33%, and if the cash flow in Year 1 is $6,500, what is the depreciation amount? Select one: a. $5,485 b. $5,387 c. $5,333 d. $5,438 e. $5,529arrow_forwardPresented below are the two alternatives with their cash flow details. The initial investment fund for both is PhP10 Million. Annual Cash Inflows (in 'ooo) Plan C PhP3,000 Plan D PhP1,000 Year 1 2 5,000 2,000 3 2,000 3,000 4 3,000 4,000 2,000 5 Total 5,000 PHP15.000 PhP15.000 The rate of return required for both projects is 8 percent compounded annually. The cash inflows occur at the end of each year. Determine the project to be accepted using the NPV method. Show all your computations.arrow_forward

- Monroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year Project 0 ($11,368,000) 1 $ 2,127,589 2 $ 3,787,552 3 $ 3,125,650 4 $ 4,115,899 5 $ 4,556,424 Round to two decimal places.arrow_forwardCompute the payback period for both the projects.arrow_forwardX will pay $80,000 for a project that will generate the following cash flows: YEAR 1 2 3 4 5 7 8 CASH FLOW $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $30,000 $30,000 The payback period for the investment is: O 7 years O 6.25 years O 7 years O 7.33 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education