ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:)

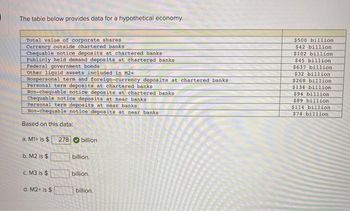

The table below provides data for a hypothetical economy.

Total value of corporate shares

Currency outside chartered banks.

Chequable notice deposits at chartered banks

Publicly held demand deposits at chartered banks.

Federal government bonds

Other liquid assets included in M2+

Nonpersonal term and foreign-currency deposits at chartered banks

Personal term deposits at chartered banks

Non-chequable notice deposits at chartered banks

Chequable notice deposits at near banks

Personal term deposits at near banks

Non-chequable notice deposits at near banks

Based on this data:

a. M1+ is $

b. M2 is $

c. M3 is $

d. M2+ is $

278

billion

billion.

billion,

billion.

$500 billion

$42 billion

$102 billion.

$45 billion.

$637 billion

$32 billion

$268 billion

$134 billion

$94 billion

$89 billion

$114 billion

$74 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If a borrower defaults on a home loan, the bank is likely to do all of the following except -- sell the house foreclose on the home loan pay the borrower interest on the money recovered by selling the house evict the borrower from the housearrow_forwardAssets Liabilities Required Reserves: $360000 Deposits: $1250000 Loans $150000 Capital: 0 Bonds: $740000 The above is the T-Accounts for TD bank. If the reserve ratio is 20 percent, what is the change in loans after the excess reserves are loaned out? Answer:arrow_forwardIn general, ordinary people only know that bank products and services are limited to conventional savings and loans, even though there are many more. There are many interesting banking products that can be used, including Islamic bank products or Islamic banking products that have not been widely known by the public. Currently, there are several types of Islamic bank products that are tailored to the needs and developments of the times. It should be noted that Islamic banks do not only serve hajj savings or umrah savings, but there are also several other products, including business capital loans. Explain what you know about Islamic productsarrow_forward

- There are various theoretical reasons why economies of scale should occur in the banking industry: 1 Specialization of labour. There is considerable scope for this as cashiers, loan officers, account managers, foreign exchange managers, investment analysts and programmers can all increase their productivity with increased volume of output. 2 Indivisibilities. Banks make use of much computer and telecommunications technology. Larger institutions are able to use better equipment and spread fixed costs more easily. 3 Marketing. Much of this involves fixed costs, in terms of reaching a given size of market; large institutions can again spread these costs more easily. 4 Financial. Banks have to raise finance, mainly from depositors. Larger banks can do this more easily and at lower cost, meaning that they can afford to offer their depositors lower interest rates. There are also reasons why banks should gain from economies of scope; many of their products are related and banks have…arrow_forwardIn principle, securitizations are useful because, they allow a bank to transfer the operational risk of liabilities to other banks. they allow banks to recover the principal of the securitized loans immediately. Both the above are correct. None of the above is correct.arrow_forward"deposits at other banks (shown as asset of commercial bank) is usually deposits from small banks at larger banks (referred to as correspondent banking)" Please extend how the text in parenthesis involve in deposits at other banks in the above statement. Explain with some example to make it easier to understand the relationship between deposits at other banks and correspondent banking. Thank you.arrow_forward

- Problem 3 The current Discount Rate is 0.5%. The current Federal Funds Rate is 0.5%. The interest paid on Excess Reserves is 0.25%. Nonborrowed Reserves are $3.848tn. a) Using this information, carefully construct a channel system graph of the current market for Nonborrowed Reserves. b) What is happening to the Federal Funds Rate? c) Why do you think this is?arrow_forwardBanks would be expected to minimize holding excess reserves because this practice is illegal. not profitable. technically difficult. subject to a stiff excess reserves tax.arrow_forward11. Calculating %age Exx *3* When the price of product "X" increases 15 percent (+15%), the quantity demanded of "X" decreases 12 percent (-12%). The price elasticity of demand for "X" is: O "-1.25" and the demand for "X" is "relatively inelastic." "-1.25" and the demand for "X" is "relatively elastic." O "-1.25" and "X" is a "normal" good. O "-0.80" and the demand for "X" is "relatively elastic." O "-0.80" and the demand for "X" is "relatively inelastic." Save & Continue Continue without savingarrow_forward

- There are various theoretical reasons why economies of scale should occur in the banking industry: 1 Specialization of labour. There is considerable scope for this as cashiers, loan officers, account managers, foreign exchange managers, investment analysts and programmers can all increase their productivity with increased volume of output. 2 Indivisibilities. Banks make use of much computer and telecommunications technology. Larger institutions are able to use better equipment and spread fixed costs more easily. 3 Marketing. Much of this involves fixed costs, in terms of reaching a given size of market; large institutions can again spread these costs more easily. 4 Financial. Banks have to raise finance, mainly from depositors. Larger banks can do this more easily and at lower cost, meaning that they can afford to offer their depositors lower interest rates. There are also reasons why banks should gain from economies of scope; many of their products are related and banks have…arrow_forwardThe banking industry A) should have an efficiency advantage in gathering information that would eliminate the need for the money markets. B) exists primarily to mediate the asymmetric information problem between saver-lenders and borrower-spenders. C) is subject to more regulations and governmental costs than the money markets. D) all of the above are true. E) only A and B of the above are true.arrow_forwardBanks are illiquid because their: Group of answer choices liabilities are greater than their assets. deposits are less liquid than their loans. assets are greater than their liabilities. loans are less liquid than their deposits.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education