Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

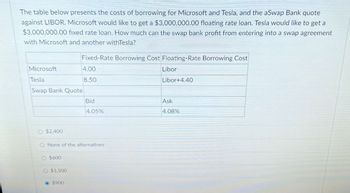

Transcribed Image Text:The table below presents the costs of borrowing for Microsoft and Tesla, and the aSwap Bank quote

against LIBOR. Microsoft would like to get a $3,000,000.00 floating rate loan. Tesla would like to get a

$3,000,000.00 fixed rate loan. How much can the swap bank profit from entering into a swap agreement

with Microsoft and another withTesla?

Fixed-Rate Borrowing Cost Floating-Rate Borrowing Cost

Microsoft

Tesla

Swap Bank Quote

4.00

8.50

Libor

Libor+4.40

Bid

Ask

4.05%

4.08%

O $2,400

O None of the alternatives

O $600

$1,500

$900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following table to answer the question about the money supply given the following hypothetical data for an economy. Item Billions of Dollars $2,000 350 80 Checkable Deposits Small Time Deposits Currency Held By The Public Savings Deposits, Including Money-Market Deposit Accounts Money-Market Mutual Funds Held By Individuals Money-Market Mutual Funds Held By Businesses 1,300 600 700 Refer to the table above. The size of the M1 money supply is: Select one: O a. $1,940 O b. S2,730 O c. None of the above O d. S2,220 O e. $2,080 Activate Windows Go to Settings to activatearrow_forwardA large bank is quoting the following spot exchange rates for number of YEN per USD, number of THB per USD and number of YEN per THB respectively. YEN/USD = 116.91 -- 116.95 THB/USD = 44.30 -- 44.40 YEN/THB = 2.6900 -- 2.7100. You are trader at Axe Capital, a US hedge fund, and your job is to try to find arbitrages in the currency markets. You have 10 mio USD risk capital provided by your fund. Using the 10 mio USD risk capital, how much arbitrage (guaranteed risk-free) profit can you make. If there is no arbitrage possible, enter zero. Give your answer in USD to the nearest USD. Please Do your calculation in excel and do not round anything until the very end.arrow_forwardSuppose that the assets of a bank consist of $100 million of loans of BBB-rated corporations. The PD for the corporations is estimated as 1%. The average maturity is five years and the LGD is 60%. What is the total risk-weighted assets for credit risk under the Basel II advanced IRB approach? Question 5Answer a. $178.1 million b. $13.2 million c. $165.4 million d. $100 millionarrow_forward

- fINANCEarrow_forward3) Suppose there is a 10% reserve requirement, and the bank has the following Balance Sheet Assets Reserves Loans Securities Liabilities 55M Deposits 250M Bank Capital 45M 350M 50M Now, let's suppose there is a deposit outflow of $60 million. If the bank only finances its reserve shortages by borrowing from the Federal Reserve, show the bank's balance sheet after the deposit outflow and receiving the loan from the Fed.arrow_forwardSuppose that a commercial bank's current quote for transactions involving the United States dollar is A$1.3214 A$1.3298. (a) State the ask and bid prices for the bank. (b) Calculate the bid/ask spread for the bank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education