ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

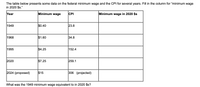

Transcribed Image Text:The table below presents some data on the federal minimum wage and the CPI for several years. Fill in the column for “minimum wage

in 2020 $s."

Year

Minimum wage

CPI

Minimum wage in 2020 $s

1949

$0.40

23.8

1968

$1.60

34.8

1995

$4.25

152.4

2020

$7.25

259.1

2024 (proposed)

$15

306 (projected)

What was the 1949 minimum wage equivalent to in 2020 $s?

Expert Solution

arrow_forward

Step 1

In economics, the inflation rate shows the overall increase in the price level in the economy over a particular period of time. Inflation over time generally reduces the purchasing power of money.

The rate of inflation between any two particular time periods is calculated by using the value of CPI in those two years. In the field of macroeconomics, inflation is divided into two categories demand-pull inflation and cost-push inflation.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following table shows a person's nominal and real wages for three years, as well as the price level (price index) for each year, using the first year as the base year. Fill in the blanks in the table. Then calculate the annual inflation rate for each year (not including the base year). Instructions: Round your answers to 2 decimal places. Nominal Wage ($) Real Wage ($) Inflation Rate (%) Year Price Level 1 7.00 140 5.00 2. 9.00 7.00 150.00 3 11 160.00 7.50arrow_forward. Use the following data to answer the questions below. Dec. 2020 Dec. 2021 CPI 260.474 278.8027 Price of bread $2.25 $2.40 Hourly wage $11 $11 i. What is the annual rate of inflation? ii. What is the real price of bread each year? iii. What is the real wage in each year?arrow_forwardThe reference base period for the CPI is 1982 – 1984. In April 2020, the CPI was 256.4 . What can we conclude from this information? The CPI in April 2020 tells us that the _______ of the prices paid by urban consumers for a fixed basket of consumer goods and services was _______. A. inflation rate; 156.4 percent per year B. inflation rate; 256.4 percent per year C. average; 256.4 percent higher in April 2020 than the average of 1982 – 1984 D. average; 156.4 percent higher in April 2020 than the average of 1982 – 1984arrow_forward

- Economicarrow_forwardHere are some recent data on the US consumer price index: Year CPI Year CPI Year CPI 2016 240.0 2011 224.9 2006 201.6 2015 237.0 2010 218.1 2005 195.3 2014 236.7 2009 214.5 2004 188.9 2013 233.0 2008 215.3 2003 184.0 2012 229.6 2007 207.3 2002 179.9 Compute the inflation rate of each year 2003-2016 and determine which were years of inflation. In which years did deflation occur? In which years did disinflation occur? Was there hyperinflation in any year?arrow_forwardYou have just graduated from college. You, your older sister, your mother and your father are comparing the starting salaries in your first jobs. The year you each started your first job, the CPI in that year and your staring salary are given below. Which of you started your first job with the highest real income? Instructions: Enter your responses rounded to two decimal places. Year Family member CPI Starting Salary Real Income 1980 Your father 0.82 $14,500 $ 1985 Your mother 1.08 $17,800 $ 2010 Your older sister 2.18 $39,200 $ 2017 You 2.44 $41,500 $ The family member that started with the highest real income was (Click to select) your older sister .arrow_forward

- 13. In 2018 your annual salary was $54,370 per year and the CPI was 133.4. In 2022 your annual salary was $59,140 and the CPI was 151.2. a. What should your annual salary have been in 2022 if your 2018 annual salary increased at the rate of inflation from 2018 to 2022? Round your answer to the nearest dollar. b. By what percent was your actual 2022 salary above or below your inflation adjusted salary from part (a)? You must specifically state whether it was above or below the inflation adjusted salary. (answer as a % to 2 decimals)arrow_forwardQ32arrow_forwardAP Macroarrow_forward

- The federal minimum wage in 1991 was $4.25. The value of the CPI in 1991 was 136.2 The value of the CPI in 2018 was 251.107. The federal minimum wage in 2018 was $7.25. Round your answers to two decimal places. The real value of the minimum wage in 1991 measured in base year dollars was $ . The real value of the minimum wage in 1991 measured in 2018 dollars was $ . Minimum wage workers were better off in 1991 than they were in 2018. Enter T for true or F for false.arrow_forwardOn Orca Island, people consume fish sandwiches and snow cones. Use the data in the table to calculate the inflation rate from 2013 to 2014, based on the Consumer Price Index (CPI). Take 2013 as your base year. Round your answer to two decimal places. Price in Quantity in Price in Quantity in 2013 2013 2014 2014 Fish $7.00 800 $8.00 750 sandwiches Snow cones $4.00 1500 $4.50 1100 -5.60 inflation rate: Incorrect %arrow_forwardThe table shows the quantities of the goods Suzie bought and the prices she paid during two consecutive weeks. Suzie's CPI market basket contains the goods she bought in Week 1. Calculate the cost of Suzie's CPI market basket in Week 1 and in Week 2. What percentage of the CPI market basket is gasoline? Calculate the value of Suzie's CPI in Week 2 and her inflation rate in week 2. The cost of Suzie's CPI market basket in Week 1 is $ >>> Answer to 2 decimal places. m Week 1 Item Coffee Books Gasoline Week 2 Item Coffee Books Gasoline Concert Quantity 8 cups 1 25 gallons Quantity 8 cups 4 15 gallons 1 ticket Price $4.00 a cup $25.00 each $2.00 a gallon Price $4.00 a cup $12.50 each $2.50 a gallon $95 eacharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education