FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

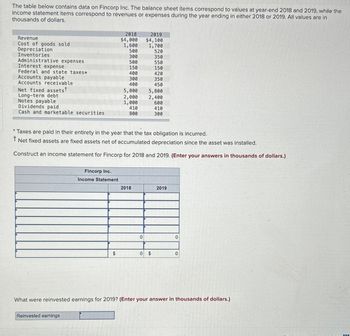

Transcribed Image Text:The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the

income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019. All values are in

thousands of dollars.

Revenue

Cost of goods sold

Depreciation

Inventories

Administrative expenses

Interest expense

Federal and state taxes*

Accounts payable

Accounts receivable

Net fixed assets

Long-term debt

Notes payable

Dividends paid

Cash and marketable securities

Fincorp Inc.

Income Statement

Reinvested earnings

2018

$4,000

1,600

$

500

300

500

150

400

300

400

5,000

2,000

1,000

410

800

* Taxes are paid in their entirety in the year that the tax obligation is incurred.

t

Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed.

Construct an income statement for Fincorp for 2018 and 2019. (Enter your answers in thousands of dollars.)

2018

2019

$4,100

1,700

0

520

350

550

150

420

350

450

5,800

2,400

600

410

300

0 $

2019

0

0

What were reinvested earnings for 2019? (Enter your answer in thousands of dollars.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Below are the accounts of Jayden Services for the year ended December 31, 2019. Accounts Payable Accounts Receivable Capital Cash Inventories 100,000 Long-term Debt Notes Payable Notes Receivable Property and Equipment Supplics and other payments 140,000 1,840,000 1,000,000 450,000 300,000 100,000 100,000 550,000 100,000 Compute and answer the following questions. 1. How much is the total current asset of the entity? 2. How much is the total non-current assets of the entity? 3. How much is the total current liability of the entity? 4. How much is the total non-current liability of the entity? 5. How much is the total assets of the entity? 2.arrow_forwardCompute the debt ratio from the data shown below: Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of $) Net sales Operating costs except depreciation Depreciation Earnings bef interest and taxes (EBIT) 2007 $1,290 9,890 13,760 $24,940 $18,060 $43.000 $8,170 6,020 4.730 $18,920 $8,815 $27.735 $5,805 2.460 $15.265 $43,000 2007 $51.600 48,246 903 $2,451 Karrow_forwardThe AHAI Company's balance sheet of December 31, 2018 is given below: Accounts payable Notes payable Accrued wages and taxes Long-term debt Common equity Total liabilities & equity Cash Accounts receivable Inventory Net fixed assets Total assets O a. $6 O b. $7 O c. $8 O d. $40 O e. $5 $10 25 40 95 $170 $20 25 15 30 80 $170 Sales during the past year were $1,000, and they are expected to increase to $2,000 during 2019. AHAI's fixed assets were used to 60% of capacity during 2018, but its current assets were at their proper levels. All assets except fixed assets increase at the same rate as sales, and fixed assets would also increase at the same rate if the current excess capacity did not exist. Assume that AHAI's profit margin will remain constant at 4.25 percent and that the company will continue to pay out 40 percent of its earnings as dividends. What amount of additional funds (AFN) will be needed during the next year assuming the company would use up the excess capacity before…arrow_forward

- Solve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forwardUse the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $38,576 Accounts receivable 62,104 Accrued liabilities 6,548 Cash 15,575 Intangible assets 39,083 Inventory 71,044 Long-term investments 90,442 Long-term liabilities 74,452 Marketable securities 38,270 Notes payable (short-term) 24,003 Property, plant, and equipment 652,967 Prepaid expenses 2,137 Based on the data for Harding Company, what is the amount of quick assets?arrow_forwardSelect the images below to enlarge. Balance Sheet Murawski Company Balance Sheet December 31 Current Assets Investments Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses Total current assets Property, plant, and equipment Intangibles and other assets Total assets Current liabilities Murawski Company Income Statement For the Years Ended December 31 Sales Revenue Costs and expenses Cost of goods sold Selling and Administrative expenses Interest expense Total costs and expenses 2022 Income before income taxes Income tax expense Net Income $330 $360 470 400 390 160 1,310 460 120 1,380 $900 $790 Long-term liabilities 410 380 Stockholder's equity - common 1,030 1,040 Total liabilities and stockholder's equity $2,340 $2,210 Income Statement 10 420 530 $2,340 2022 $3,800 2021 955 2,400 25 3,380 420 126 $294 10 380 510 $2,210 2021 $3,460 890 2,330 20 3,240 220 66 $154 Calculate the 2022 Times Interest Earned ratio. Use whole numbers rounded to 2 decimal places, if…arrow_forward

- use the following information to make a Common size income statementarrow_forwardThe comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Dux's accounting records is provided also. Assets Cash Accounts receivable Less: Allowance for uncollectible accounts Dividends receivable Inventory Long-term investment Land Buildings and equipment Less: Accumulated depreciation Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings DUX COMPANY Comparative Balance Sheets December 31, 2018 and 2017 ($ in 900s) Less: Treasury stock DUX COMPANY Income Statement For Year Ended December 31, 2018 ($ in 800s) Revenues Sales revenue Dividend revenue Expenses Cost of goods sold. Salaries expense Depreciation expense Bad debt expense Interest expense Loss on sale of building Income tax expense Net income $325 9 $334 134 39 33 1 22 6 31 266…arrow_forwardRatio Analysis Presented below are summary financial data from Porter's annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable (net) Total Current Assets Total Assets Current Liabilities Long-Term Debt- Shareholders' Equity Income Statement Interest Expense Net Income Before Taxes b. Quick ratio $1,850 19,100 9,367 39,088 123,078 38,450 7,279 68,278 Calculate the following ratios: (Round to 2 decimal points) a. Times-interest-earned ratio c. Current ratio 400 14,007arrow_forward

- Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). Target Corporation Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Total liabilities Walmart Inc. Income Statement Data for Year $65,357 $408,214 45,583 304,657 79,607 707 2,065 (94) (411) 1,384 7,139 $ 2,488 $ 14,335 Balance Sheet Data (End of Year) $18,424 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 15,101 26,109 $44,533 $11,327 17,859 15,347 $44,533 Beginning-of-Year Balances $44,106 $163,429 65,682 55,390 97,747 13,712 10,512 30,394 Other Dataarrow_forwardThe 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity 2020 $ 700,000 $ 860,000 1,600,000 1,100,000 2,000,000 1,500,000 4,900,000 4,340,000 $9,200,000 $7,800,000 $1,920,000 $1,760,000 2,400,000 2,500,000 1,900,000 1,900,000 2,980,000 1,640,000 $9,200,000 $7,800,000 Industry averages for the following profitability ratios are as follows: Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 2.5 times 35% Required: 1. Calculate the five profitability ratios listed above for Adrian Express. (Round your…arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education