FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The Sunshine Corporation manufactures cellular modems. It manufactures its own cellular modem circuit boards (CMCB), an

important part of the cellular modem. It reports the following cost information about the costs of making CMCBS in 2017 and the

expected costs in 2018:

E (Click the icon to view the costs.)

(Click the icon to view the make-versus-buy information.)

- X

Requirements

1. Calculate the total expected manufacturing cost per unit of making CMCBS in 2018.

2. Suppose the capacity currently used to make CMCBS will become idle if Sunshine purchases CMCBS from Moonbeam. On

the basis of financial considerations alone, should Sunshine make CMCBS or buy them from Moonbeam? Show your

calculations.

Requirement 1. Calculate the total expected manufacturing cost per unit of making CMCBS in 2018.

Total Manufacturing

Manufacturing

Costs of CMCB

Cost per Unit

3.

Now suppose that if Sunshine purchases CMCBS from Moonbeam, its best alternative use of the capacity currently used for

CMCBS is to make and sell special circuit boards (CB3S) to the Eleanor Corporation. Sunshine estimates the following

incremental revenues and costs from CB3S:

Direct materials

Direct manufacturing labor

Total expected incremental future revenues

$1,900,000

Variable batch manufacturing costs

Total expected incremental future costs

$2,025,000

On the basis of financial considerations alone, should Sunshine make CMCBS or buy them from Moonbeam? Show your

calculations.

Fixed manufacturing costs

Avoidable fixed manufacturing costs

Unavoidable fixed manufacturing costs

More info

Total manufacturing costs

Sunshine manufactured 9,000 CMCBS in 2017 in 50 batches of 180 each. In

2018, Sunshine anticipates needing 14,000 CMCBS. The CMCBS would be

produced in 100 batches of 140 each. The Moonbeam Corporation has

approached Sunshine about supplying CMCBS to Sunshine in 2018 at $350 per

CMCB on whatever delivery schedule Sunshine wants.

Transcribed Image Text:- X

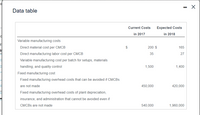

Data table

Current Costs Expected Costs

in 2017

in 2018

Variable manufacturing costs

Direct material cost per CMCB

200 $

165

Direct manufacturing labor cost per CMCB

35

27

Variable manufacturing cost per batch for setups, materials

handling, and quality control

1,500

1,400

Fixed manufacturing cost

Fixed manufacturing overhead costs that can be avoided if CMCBS

are not made

450,000

420,000

Fixed manufacturing overhead costs of plant depreciation,

insurance, and administration that cannot be avoided even if

CMCBS are not made

540,000

1,960,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Legrand Company produces hand cream. In 2018, their financial information is as follows:Each jar sells for: $3.40Total variable cost (materials, labor, and overhead) per jar: $2.55Total fixed cost: $58,140Total jars sold in 2018: 81,6001. Calculate the margin of safety in units?arrow_forwardThe C and K Company makes a household appliance with model number X400. The goal for 2017 is to reduce direct materials usage per unit. No defective units are currently produced. Manufacturing conversion costs depend on production capacity defined in terms of X500 units that can be produced. The following additional data are available for 2016 and 2017: 2016 2017 Units of X400 produced and sold 12,000 13,800 Selling price $145 $140 Direct materials (square feet) 36,000 34,800 Direct manufacture costs per square foot $13 $15 Manufacturing capacity for X400 (units) 14,000 13,900 Total conversion costs $406,000 $403,100 Conversion costs per units of capacity $29 $29 Calculate the operating income in 2016 and 2017. Calculate the growth, price-recovery, and productivity component that explain the change in operating income from 2016 to 2017.arrow_forwardBenoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data forvariable cost per unit and total fixed costs were as follows: Questions: a) Compute the selling price per unit in 2019, using the equation method. b) Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income statement for the year ended December 31, 2019, detailing the components of total fixed costs and clearly showing contribution and net income. c) Calculate Benoit’s break-even point in units and in sales dollars. d) Calculate…arrow_forward

- Please help with a - carrow_forwardMeale Company makes a household appliance with model number X500. The goal for 2015 is to reduce direct materials usage per unit. No defective units are currently produced. Manufacturing conversion costs depend on production capacity defined in terms of X500 units that can be produced. The industry market size for appliances increased 10% from 2014 to 2015. The following additional data are available for 2014 and 2015: Units of X500 produced and sold Selling price Direct materials (square feet) Direct material costs per square foot Manufacturing capacity for X500 (units) Total conversion costs Conversion costs per unit of capacity 17) What is operating income for 2014? A) $450,000 B) $1,000,000 C) $750,000 D) $700,000 18) What is operating income for 2015? A) $1,045,000 B) $726,000 C) $486,000 D) $476,000 2014 10,000 $100 30,000 $10 12,500 $250,000 $20 2015 11,000 $95 29,000 $11 12,000 $240,000 $20arrow_forwardplease answer all three requirements thankuarrow_forward

- Suppose the smartphone manufacturer Peony Electronics provides the following information for its costs last month (in millions): (Click the icon to view the costs.) Read the requirements. Requirements 1, 2 and 3. Classify each of these costs according to its place in the value chain. Within the production category, break the costs down further into three subcategories: Direct Materials, Direct Labor, and Manufacturing Overhead. Then calculate the total cost for each value chain category. (Enter amounts in millions. If an input field is not used in the table, leave the input field empty; do not enter a zero.) Cost Delivery expense Salaries of salespeople Chipset Exterior case for phone Assembly-line workers' wages Technical support hotline Depreciation on plant and equipment Rearrange production process 1-800 (toll-free) line for customer orders Scientists' salaries Total costs Cost R and D $ 14 Peony Electronics Value Chain Cost Classification Direct Design Materials LA 60 5 $…arrow_forwardThe jarvis corporation produces bucket loader assemblies for the tractor industry. The product has a long term life expectancy. Jarvis has a traditional manufacturing and inventory system. Jarvis is considering the installation of a just-in-time inventory system to improve its cost structure. In doing a full study using its manufacturing engineering team as well as consulting with industry JIT experts and the main vendors and suppliers of the components Jarvis uses to manufacture the bucket loader assemblies, the following incremental cost-benefit relevant information is available for analysis: The Jarvis cost of investment capital hurdle rate is 15%. One time cost to rearrange the shop floor to create the manufacturing cell workstations is $275,000. One time cost to retrain the existing workforce for the JIT required skills is $60,000. Anticipated defect reduction is 40%. Currently there is a cost of quality defect assessment listed as $150,000 per year. The setup time for…arrow_forwardWe have been asked to analyze our denim jeans line by labor cost (from $13.00 to $16.00 by $0.25) and electricity costs (from 0.85 to 1.50 by 0.05). Fixed Cost = $184,000 Material cost per pair = $9.17 Revenue per pair = $29.99 Quantity = 27,500 If we are to be profitable, what must the electricity cost be if our labor cost is $13.25 per hour?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education