FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Please Introduction and both subparts answer please without plagiarism

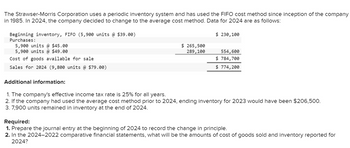

Transcribed Image Text:The Strawser-Morris Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company

in 1985. In 2024, the company decided to change to the average cost method. Data for 2024 are as follows:

Beginning inventory, FIFO (5,900 units @ $39.00)

Purchases:

5,900 units @ $45.00

5,900 units @ $49.00

Cost of goods available for sale.

Sales for 2024 (9,800 units @ $79.00)

Additional information:

$ 265,500

289,100

$ 230,100

554,600

$ 784,700

$ 774,200

1. The company's effective income tax rate is 25% for all years.

2. If the company had used the average cost method prior to 2024, ending inventory for 2023 would have been $206,500.

3. 7,900 units remained in inventory at the end of 2024.

Required:

1. Prepare the journal entry at the beginning of 2024 to record the change in principle.

2. In the 2024-2022 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported for

2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Distinguish between object classes and instances.arrow_forwardWhat information is provided by this statement? Describe the steps to create the statement - choose either the direct or indirect method in your response.arrow_forwardPlease provide the introductory part and answer for question D.arrow_forward

- Briefly discuss the nature of Single entry and double entry system.arrow_forward16. Which form of the report should be in proper format with suitable headings, sub-headings, and paragraphs? a. Graphical Form b. All of the options c. Tabular Form d. Descriptive formarrow_forwardexplain piecemeal acquisition Please give full explaination.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education