FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Question 15 of 17 View Policies Current Attempt in Progress The stockholders of Meadow Corp approved astock-option plan that grants the companys top three executives op tions to parchase a maximum of 1,000 shares each of Meadow' \$2 par common stock for \$19 per share. The options were granted on January 1 when the fair value of the stock was

$20

per share. Meadow determined that the fair value of the compensation is

$300,000

and the vesting period is three years. What amount of compensation expense from the options should Meadow record in the year the options were granted? \[ \begin{array}{l} \$ 20,000 \\ \$ 300,000 \\ \$ 60,000 \\ \$ 100,000.

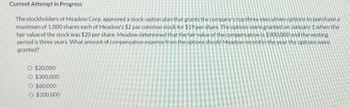

Transcribed Image Text:Current Attempt in Progress

The stockholders of Meadow Corp, approved a stock-option plan that grants the company's top three executives options to purchase a

maximum of 1,000 shares each of Meadow's $2 par common stock for $19 per share. The options were granted on January 1 when the

fair value of the stock was $20 per share. Meadow determined that the fair value of the compensation is $300,000 and the vesting

period is three years. What amount of compensation expense from the options should Meadow record in the year the options were

granted?

O $20,000

$300,000

O $60.000

O $100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardKnowledge Check 01 At January 1, Year 1, AMC Company grants 10,000 options that permit key executives to acquire 10,000 of the company’s $1 par common shares within the next five years, but not before December 31, Year 3 (the vesting date). The exercise price is the market price of the shares on the date of grant, $20 per share. The fair value of the options is $4 per option. Eighty percent of the options (or 8,000) are exercised on January 5, Year 4 when the market price is $30 per share. The remaining 20% of the options expire as unexercised when the market price is $18 per share. Prepare the appropriate journal entry for the expiration of the unexercised options.arrow_forwardQuestion 3 On 6 July 2021, Falta Limited paid $300 to purchase a put option on Zebra Limited when the market price per ordinary shares was $120. The option gives Falta Limited to sell 500 shares at an exercise price of $120 and the option expires on 1 February 2022. Market price per share $ Time value of put Option $ Date 30 September 2021 31 December 2021 123 180 115 100 1 February 2022 112 30 Required: Prepare the journal entries for Falta for the following dates: (a) On 6 July 2021 to record the investment in the put option. (b) On 30 September 2021 when Falta Limited prepared the financial statements. (c) On 31 December 2021 when Falta Limited prepared the financial statements. (d) On 1 February 2022 when Falta Limited settled the call option.arrow_forward

- 9arrow_forwardProblem 16-03 Novak Company adopted a stock-option plan on November 30, 2019, that provided that 74,400 shares of $5 par value stock be designated as available for the granting of options to officers of the corporation at a price of $10 a share. The market price was $12 a share on November 30, 2020.On January 2, 2020, options to purchase 29,800 shares were granted to president Tom Winter—14,200 for services to be rendered in 2020 and 15,600 for services to be rendered in 2021. Also on that date, options to purchase 16,600 shares were granted to vice president Michelle Bennett—8,300 for services to be rendered in 2020 and 8,300 for services to be rendered in 2021. The market price of the stock was $15 a share on January 2, 2020. The options were exercisable for a period of one year following the year in which the services were rendered. The fair value of the options on the grant date was $4 per option.In 2021, neither the president nor the vice president exercised their options because…arrow_forwardQuestion 10 of 17 -/1 E View Policies Current Attempt in Progress Crane Company issued 9000 shares of its $5 par value common stock having a fair value of $20 per share and 14000 shares of its $10 par value preferred stock having a fair value of $20 per share for a lump sum of $510000. How much of the proceeds would be allocated to the common stock? O $180000 O $310435 O $199565 O $206250 Save for Later Attempts: 0 of 1 used Submit Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education