EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

# General Account

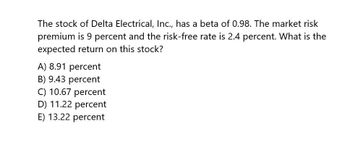

Transcribed Image Text:The stock of Delta Electrical, Inc., has a beta of 0.98. The market risk

premium is 9 percent and the risk-free rate is 2.4 percent. What is the

expected return on this stock?

A) 8.91 percent

B) 9.43 percent

C) 10.67 percent

D) 11.22 percent

E) 13.22 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- FlavR Co stock has a beta or 2.04, the current risk-free rate is 2.04 percent, and the expected return on the market is 9.04 percent. What is FlavR Co's cost of equity? a. 16.32% b.20.48% c. 13.12% d. 11.08%arrow_forwardGiven correct answer financial accountingarrow_forwardprovide correct answer of this Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT