FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

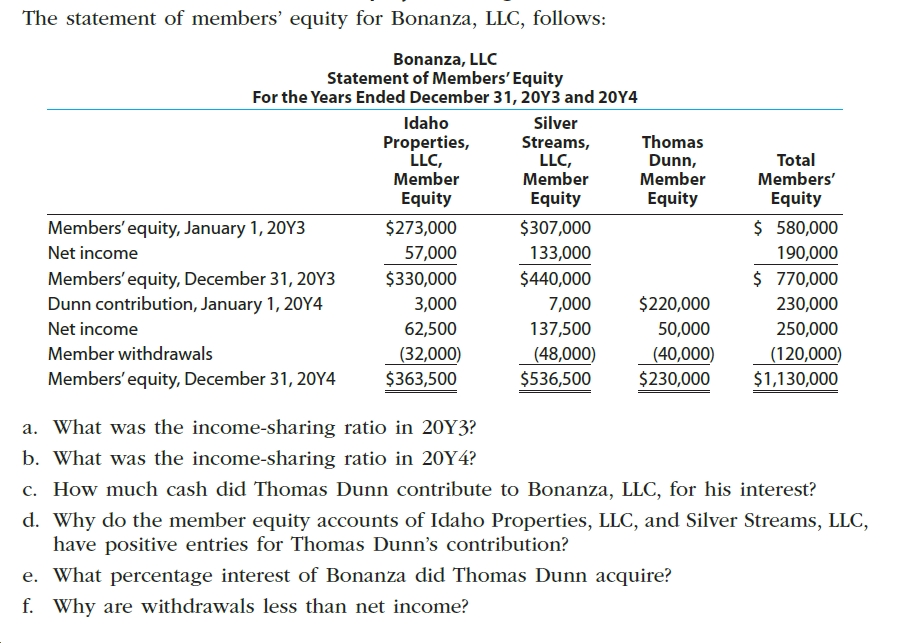

Transcribed Image Text:The statement of members' equity for Bonanza, LLC, follows:

Bonanza, LLC

Statement of Members' Equity

For the Years Ended December 31, 20Y3 and 20Y4

Idaho

Silver

Properties,

LLC,

Member

Equity

Thomas

Streams,

LLC,

Member

Equity

Total

Members'

Dunn,

Member

Equity

Equity

$ 580,000

Members' equity, January 1, 20Y3

$273,000

$307,000

Net income

57,000

133,000

190,000

$ 770,000

Members' equity, December 31, 20Y3

Dunn contribution, January 1, 20OY4

$330,000

$440,000

$220,000

3,000

7,000

230,000

137,500

250,000

Net income

62,500

50,000

Member withdrawals

(32,000)

$363,500

(48,000)

(40,000)

$230,000

(120,000)

$1,130,000

$536,500

Members'equity, December 31, 20Y4

a. What was the income-sharing ratio in 20Y3?

b. What was the income-sharing ratio in 20Y4?

c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest?

d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC,

have positive entries for Thomas Dunn's contribution?

e. What percentage interest of Bonanza did Thomas Dunn acquire?

f. Why are withdrawals less than net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Presented below is the balance sheet of Novak Corporation for the current year, 2020. NOVAK CORPORATIONBALANCE SHEETDECEMBER 31, 2020 Current assets $ 488,570 Current liabilities $ 383,570 Investments 643,570 Long-term liabilities 1,003,570 Property, plant, and equipment 1,723,570 Stockholders’ equity 1,773,570 Intangible assets 305,000 $3,160,710 $3,160,710 The following information is presented. 1. The current assets section includes cash $153,570, accounts receivable $173,570 less $13,570 for allowance for doubtful accounts, inventories $183,570, and unearned rent revenue $8,570. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value. 2. The investments section includes the cash surrender value of a life insurance contract $43,570; investments in common stock, short-term $83,570 and long-term $273,570; and bond sinking fund $242,860. The cost and fair value of investments in common stock are the…arrow_forwardStatement of Shareholders' Equity On January 1, 2019, Powder Company provided the following shareholders' equity section of its balance sheet: Contributed Capital: Preferred stock, $100 par $ 92,800 Common stock, $5 par 37,500 Additional paid-in capital on preferred stock 21,500 Additional paid-in capital on common stock 58,700 Total contributed capital $210,500 Retained earnings 185,000 Total Shareholders' Equity $395,500 During 2019, the following transactions and events occurred and were properly recorded: 1. Powder issued 1,800 shares of common stock at $13 per share. 2. Powder issued 330 shares of preferred stock at $120 per share. 3. Powder earned net income of $38,950. 4. Powder paid a $8 per share dividend on the preferred stock and a $1 per share dividend on the common stock outstanding at the end of 2019. Required: Prepare Powder's statement of shareholders' equity (include retained earnings) for 2019. POWDER COMPANY Statement of Shareholders' Equity For Year Ended December…arrow_forwardSW Company provides the Equity & Liability information below for analysis. SW Company had net income of $365, 700 in 2023 and $335,800 in 2022. Equity and Liabilities 2023 2022 Share capital-common (137,700 shares issued) $ 1,417,500 $ 1,417,500 Retained earnings (Note 1) 417,700 311, 300 Accrued liabilities 10,300 6,500 Notes payable (current) 82,700 65,500 Accounts payable 59,500 179,000 Total equity and liabilities $1,987,700 $ 1,979,800 Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023. Required: 1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,454,000 at December 31, 2021.) (Round your answers to 1 decimal place.) 2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.)arrow_forward

- You find the following financial information about a company: net working capital = $1,071; fixed assets $7,297; total assets = $11,686; and long-term debt = $4,381. What is the company's total equity? Multiple Choice $3,987 $8,539 $4,389 $6,457 $9,387arrow_forwardBalance Sheet Jack and Jill Corporation's year-end 2018 balance sheet lists current assets of $246,000, fixed assets of $796,000, current liabilities of $193,000, and long-term debt of $296,000. What is Jack and Jill's total stockholders' equity?arrow_forwardSubject : Accountingarrow_forward

- Balance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forwardThe balance sheet for the Capella Corporation is as follows: Assets Liabilities and Shareholders' Equity Current assets $ 300 Current liabilities $ 110 Net fixed assets 1, 200 Long-term debt 500 Shareholders' equity 890 Total assets $ 1,500 Total liabilities and shareholders' equity $ 1, 500 What is the Net Working Capital for Capella Corporation?arrow_forwardThe balance sheet for Munoz Corporation follows: Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity $ 235,000 762,000 $997,000 $160,000 457,000 617,000 380,000 $997,000 Required Compute the following. (Round "Ratios" to 1 decimal place.) ace Working capital Current ratio Debt to assets ratioarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education