ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

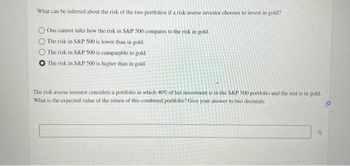

Transcribed Image Text:What can be inferred about the risk of the two portfolios if a risk-averse investor chooses to invest in gold?

One cannot infer how the risk in S&P 500 compares to the risk in gold.

The risk in S&P 500 is lower than in gold.

The risk in S&P 500 is comparable to gold.

O The risk in S&P 500 is higher than in gold.

The risk-averse investor considers a portfolio in which 40% of her investment is in the S&P 500 portfolio and the rest is in gold.

What is the expected value of the return of this combined portfolio? Give your answer to two decimals.

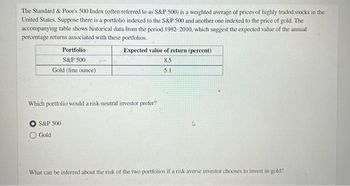

Transcribed Image Text:The Standard & Poor's 500 Index (often referred to as S&P 500) is a weighted average of prices of highly traded stocks in the

United States. Suppose there is a portfolio indexed to the S&P 500 and another one indexed to the price of gold. The

accompanying table shows historical data from the period 1982-2010, which suggest the expected value of the annual

percentage returns associated with these portfolios.

Portfolio

S&P 500

Gold (fine ounce)

Expected value of return (percent)

8.5

5.1

Which portfolio would a risk-neutral investor prefer?

S&P 500

Gold

4

What can be inferred about the risk of the two portfolios if a risk-averse investor chooses to invest in gold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following portfolio choice problem. The investor has initial wealth w and utility u(x) = . There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1-q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) What are risk preferences of this investor, are they risk-averse, risk neutral or risk-loving?arrow_forwardFrom the following equation for expected returns, explain what may cause stock prices to decrease in economic recessions: E(r) – risk-free rate = A*Var(r) A is the risk aversion for the average investor, and Var(r) is the variance of the market portfolio. Assume that investor risk aversion is constant.arrow_forwardAnswer full question.thank youarrow_forward

- 49) If stock prices follow a random walk, it means that stock prices are just as likely to rise as to fall at any given time. True Falsearrow_forwardIf the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?arrow_forwardIn stock index future hedging, the optimal number of contracts used to hedge depends on the beta of the equity portfolio when the stock index represents the entire stock market. Which of the following regarding the beta (in the above statement) is correct? The beta is the slope of the best fit line when the futures price (on the y-axis) is regressed against the spot price (on the x-axis). The beta is the slope of the best fit line when the spot price (on the y-axis) is regressed against the futures price (on the x-axis). The beta is the slope of the best fit line when the change in the futures price (on the y-axis) is regressed against the change in the spot price (on the x-axis). The beta is the slope of the best fit line when the change in the spot price (on the y-axis) is regressed against the change in the futures price (on the x-axis). None of the abovearrow_forward

- Suppose the world can be described in two states, and two stocks are available with future per share prices: State X Y 1 $10 $15 2 $20 $11 The current prices for stock X and Y are $13 and $10, respectively. a) Suppose now you have saved $3900 to invest in stocks (X and Y), what is your investment strategy to maximize your total wealth when the future is in State 1? b) Based on a), what is your investment strategy if you want to keep your future wealth as smooth as possible between the two States?arrow_forwardI need help with question darrow_forwardWhat is the present value of a firm with a four-year life span that earns the following stream of expected profit? Use a risk-adjusted discount rate of 10 percent. Treat all profits as being received at year-end. Year 1 - $20 000 Year 2 - $40 000 Year 3 - $70 000 Year 4 - $90 000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education