Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

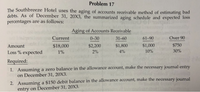

Transcribed Image Text:Problem 17

The Southbreeze Hotel uses the aging of accounts receivable method of estimating bad

debts. As of December 31, 20X3, the summarized aging schedule and expected loss

percentages are as follows:

Aging of Accounts Receivable

Current

0-30

31-60

61-90

Over 90

Amount

$18,000

$2,200

$1,800

$1,000

$750

Loss % expected

10%

30%

1%

2%

4%

Required:

1. Assuming a zero balance in the allowance account, make the necessary journal entry

on December 31, 20X3.

2. Assuming a $150 debit balance in the allowance account, make the necessary journal

entry on December 31, 20X3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bad Debt Expense: Aging Method Glencoe Supply had the following accounts receivable aging schedule at the end of a recent year. The balance in Glencoes allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off. Required: 1. Determine bad debt expense. 2. Prepare the journal entry to record bad debt expense. 3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?arrow_forwardAging Method Bad Debt Expense Cindy Bagnal, the manager of Cayce Printing Service, has provided the following aging schedule for Cayces accounts receivable Cindy indicates that the $121,100 of accounts receivable identified in the table does not include $4,600 of receivables that should be written off. Required: 1. Journalize the $4,600 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts (round each aging category to the nearest dollar). 3. If the balance in allowance for doubtful accounts before the $4,600 write-off was a debit of $700, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forwardAging Method Bad Debt Expense Carol Simon, the manager of Handy Plumbing has provided the following aging schedule for Handys accounts receivable: Carol indicates that the $125,200 of accounts receivable identified in the table does not include $9,400 of receivables that should be written off. Required: 1. Journalize the $9,400 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts. 3. If the balance in allowance for doubtful accounts before the $9,400 write-off was a debit of $550, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forward

- Required information [The following information applies to the questions displayed below.] Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 56,000 7% Accounts receivable Percent uncollectible Total 0 $ 670,000 $ 416,000 Req A Req B and C 3% Complete this question by entering your answers in the tabs below. 1 to 30 $ 110,000 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $14,000 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,000 debit. Estimated balance of allowance for uncollectibles 4%arrow_forwardQuestion Content Area Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class PercentUncollectible Not past due 1% 1-30 days past due 5 31-60 days past due 25 61-90 days past due 35 Over 90 days past due 50 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff IndustriesAging of Receivables Scheduleblank Customer Balance Not PastDue 1-30 DaysPast Due 31-60 DaysPast Due 61-90 DaysPast Due Over 90 DaysPast Due Subtotals 840,000 495,600 184,800 75,600 42,000 42,000 Conover Industries 18,100 18,100 Keystone Company 18,200 18,200 Moxie Creek Inc. 6,600 6,600 Rainbow Company 10,000 10,000 Swanson Company 23,100 23,100 Total receivables 916,000 518,700 194,800 82,200 60,200 60,100 Percentage uncollectible 1% 5% 25% 35% 50% Allowance for Doubtful…arrow_forwardSubject: aarrow_forward

- Required a + b and all individual partsarrow_forwardSubject: accountingarrow_forwardEstimating Doubtful Accounts Easy Rider International is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, 20Y3, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Interval Balance PercentUncollectible Not past due $342,200 1 % 1–30 days past due 127,600 5 31–60 days past due 52,200 25 61–90 days past due 29,000 35 91–180 days past due 29,000 50 Over 180 days past due 19,200 70 $599,200 Estimate what the balance of the allowance for doubtful accounts should be as of December 31, 20Y3. Enter your answers as positive amounts. Age Interval EstimatedUncollectibleAmount Not past due $ 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due Over 180 days past due Total $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning