FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The solution must be under the GAAP standards

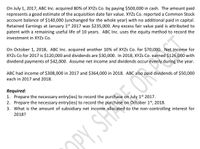

Transcribed Image Text:On July 1, 2017, ABC Inc. acquired 80% of XYZS Co. by paying $500,000 in cash. The amount paid

represents a good estimate of the acquisition date fair value. XYZS Co. reported a Common Stock

account balance of $140,000 (unchanged for the whole year) with no additional paid in capital.

Retained Earnings at January 1st 2017 was $235,000. Any excess fair value paid is attributed to

patent with a remaining useful life of 10 years. ABC Inc. uses the equity method to record the

investment in XYZS Co.

On October 1, 2018, ABC Inc. acquired another 10% of XYZS Co. for $70,000. Net Income for

XYZS Co for 2017 is $120,000 and dividends are $30,000. In 2018, XYZS Co. earned $126,000 with

dividend payments of $42,000. Assume net income and dividends occur evenly during the year.

ABC had income of $308,000 in 2017 and $364,000 in 2018. ABC also paid dividends of $50,000

each in 2017 and 2018.

Required:

1. Prepare the necessary entry(ies) to record the purchase on July 1st 2017.

2. Prepare the necessary entry(ies) to record the purchase on October 1st, 2018.

3. What is the amount of subsidiary net income allocated to the non-controlling interest for

2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The conceptual frameworks for IFRS and ASPE How is the general recognition criteria stated differently for both IFRS and ASPE? What are it's significant components?arrow_forward- can you give me scope, objective, accounting issues, measurement, disclosures about The IFRS for SMEs Standard.arrow_forwardWhat indexes does Target use to measure the LIFO provision?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education