FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

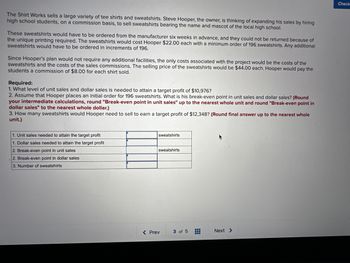

Transcribed Image Text:The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring

high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school.

These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of

the unique printing required. The sweatshirts would cost Hooper $22.00 each with a minimum order of 196 sweatshirts. Any additional

sweatshirts would have to be ordered in increments of 196.

Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the

sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $44.00 each. Hooper would pay the

students a commission of $8.00 for each shirt sold.

Required:

1. What level of unit sales and dollar sales is needed to attain a target profit of $10,976?

2. Assume that Hooper places an initial order for 196 sweatshirts. What is his break-even point in unit sales and dollar sales? (Round

your intermediate calculations, round "Break-even point in unit sales" up to the nearest whole unit and round "Break-even point in

dollar sales" to the nearest whole dollar.)

3. How many sweatshirts would Hooper need to sell to earn a target profit of $12,348? (Round final answer up to the nearest whole

unit.)

Unit sales ded attain target profit

1. Dollar sales needed to attain the target profit

2. Break-even point in unit sales

2. Break-even point in dollar sales

3. Number of sweatshirts

sweatshirts

sweatshirts

< Prev

3 of 5

#

Next >

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Sdarrow_forwardWholemark is an Internet order business that sells one popular New Year's greeting card once a year. The cost of the paper on which the card is printed is $0.05 per card, and the cost of printing is $0.15 per card. The company receives $2.15 per card sold. Since the cards have the current year printed on them, unsold cards have no salvage value. Its customers are from the four areas: Los Angeles, Santa Monica, Hollywood, and Pasadena. Based on past data, the number of customers from each of the four regions is normally distributed with a mean of 2,000 and a standard deviation 500. (Assume these four are independent.) What optimal production quantity for the card? isarrow_forwardDiamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forward

- The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $20.00 each with a minimum order of 151 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 151. Since Hooper’s plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $40.00 each. Hooper would pay the students a commission of $8.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of…arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance and could not be returned because of the unique printing required. The sweatshirts would cost Hooper $23.00 each with a minimum order of 168 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 168. Because Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $46.00 each. Hooper would pay the students a commission of $6.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $11,424? 2.…arrow_forwardNaturalmaid processes organic milk into plain yogurt. Naturalmaid sells plain yogurt to hospitals, nursing homes, and restaurants in bulk, one-gallon containers. Each batch, processed at a cost of $880, yields 750 gallons of plain yogurt. The company sells the one-gallon tubs for $5.00 each and spends $0.14 for each plastic tub. Naturalmaid has recently begun to reconsider its strategy. Management wonders if it would be more profitable to sell individual-sized portions of fruited organic yogurt at local food stores. Naturalmaid could further process each batch of plain yogurt into 16,000 individual portions (3/4 cup each) of fruited yogurt. A recent market analysis indicates that demand for the product exists. Naturalmaid would sell each individual portion for $0.58. Packaging would cost $0.06 per portion, and fruit would cost $0.10 per portion. Fixed costs would not change. Should Naturalmaid continue to sell only the gallon-sized plain yogurt (sell as is) or convert the plain yogurt…arrow_forward

- Cassandra Boat Builders builds and sells powerboats with a hull constructed primarily of teak wood. The boat building season is during Spring and Summer. The company begins building each boat only after a firm commitment was made by a specific buyer. Since the price of teak wood tends to fluctuate, Cassandra purchases several future contracts with different due dates during the building season to hedge the risk of fluctuating wood prices. During the 20X1 boat building season, the price of teak wood increased and reduced the Company's gross margin by $250,000. However, due to the increases in the teak wood prices, Cassandra realized a $240,00 gain on the related future contracts. Cassandra designates the futures as a cash flow hedge of an anticipated transaction. Which of the following entries (presented in summary format) should Cassandra Boat Builders make to recognize the gain from the future contracts? Multiple Choice Future contract 240,000 Gain on future…arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $22.00 each with a minimum order of 196 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 196. Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $44.00 each. Hooper would pay the students a commission of $5.00 for each shirt sold. Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $13,328?…arrow_forwardThe Shirt Works sells a large variety of tee shirts and sweatshirts Steve Hooper, the owner, is thinking of expanding his sales by hiring high school students, on a commission basis, to sell sweatshirts bearing the name and mascot of the local high school These sweatshirts would have to be ordered from the manufacturer six weeks in advance, and they could not be returned because of the unique printing required. The sweatshirts would cost Hooper $20.00 each with a minimum order of 220 sweatshirts. Any additional sweatshirts would have to be ordered in increments of 220 Since Hooper's plan would not require any additional facilities, the only costs associated with the project would be the costs of the sweatshirts and the costs of the sales commissions. The selling price of the sweatshirts would be $40.00 each. Hooper would pay the students a commission of $600 for each shirt sold Required: 1. What level of unit sales and dollar sales is needed to attain a target profit of $12.320? 2.…arrow_forward

- Grant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 25,000 units of one of its most popular products. Grant currently manufactures 50,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no marketing costs on the special order. The sales manager of Grant wants to set the bid at $14 because she is sure that Grant will get the business at that price. Others on the executive committee of the firm object, saying that Grant would lose money on the special order at that price. Units Manufacturing costs: Direct materials Direct labor Factory overhead Total manufacturing costs Unit cost 50,000 Required 2 Required 4 75,000 $ 200,000 250,000 350,000 $ 800,000 $ 1,125,000 $ 16 $15 Required: 2. What is the relevant cost per unit? What do ou think the minimum short-term bid price per unit should be? What would be the impact on short-term operating income if the order is…arrow_forwardTim Urban, owner/manager of Urban's Motor Court in Key West, is considering outsourcing the daily room cleanup for his motel to Duffy's Maid Service. Tim rents an average of 50 rooms for each of 365 nights (365 x 50 equals the total rooms rented for the year). Tim's cost to clean a room is $13.00. The Duffy's Maid Service quote is $18.00 per room plus a fixed cost of $26,000 for sundry items such as uniforms with the motel's name. Tim's annual fixed cost for space, equipment, and supplies is $61,000. Based on the given information related to costs for each of the options, the crossover point for Tim = ☐ room nights (round your response to the nearest whole number).arrow_forwardAnnie's Homemade has been invited to submit a bid to cater a Memorial Day picnic with 60 servings of four flavors for a total of 240 pre-packaged servings of ice cream. Annie's' average ingredient and packaging costs (including cup, lid, spoon, and stickers) are $1.50 per serving. It would cater the event with one manager, whose is paid an annual salary of $40,000 (or an average of $20.00 per hour), and two additional employees who are paid $8.00 per hour. The wedding party expects Annie's staff to remain on-site for two hours to serve ice cream. The round-trip drive time to the event plus the tent setup and breakdown time is 1.50 hours. The wedding is 40 miles round-trip and the company pickup truck's diesel fuel, diesel exhaust fluid, and oil expenses are $0.75 per mile. The manager catering the wedding would also spend 3.5 hours manufacturing the ice cream for the picnic and portioning it into six-ounce paper cups. He would be assisted by one employee for two hours who would apply a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education