FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

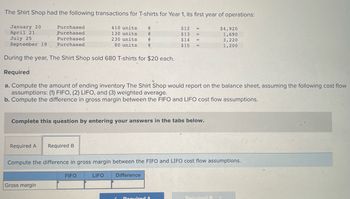

Transcribed Image Text:The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations:

- **January 20**: Purchased 410 units @ $12 = $4,920

- **April 21**: Purchased 130 units @ $13 = $1,690

- **July 25**: Purchased 230 units @ $14 = $3,220

- **September 19**: Purchased 80 units @ $15 = $1,200

During the year, The Shirt Shop sold 680 T-shirts for $20 each.

**Required:**

a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average.

b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions.

**Instructions:**

Complete this question by entering your answers in the tabs below.

**Difference in Gross Margin Calculation Table:**

| | FIFO | LIFO | Difference |

|---------|------|------|------------|

| Gross Margin | | | |

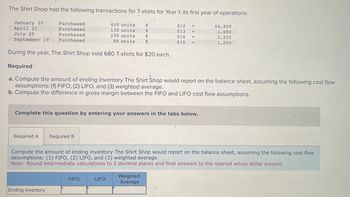

Transcribed Image Text:### T-Shirt Shop Inventory and Cost Analysis

**Transactions:**

The Shirt Shop had the following transactions for T-shirts in Year 1, its first year of operations:

- **January 20:** Purchased 410 units at $12 each, totaling $4,920.

- **April 21:** Purchased 130 units at $13 each, totaling $1,690.

- **July 25:** Purchased 230 units at $14 each, totaling $3,220.

- **September 19:** Purchased 80 units at $15 each, totaling $1,200.

During the year, 680 T-shirts were sold at $20 each.

**Required Calculations:**

**a.** Compute the ending inventory of T-shirts based on the following cost flow assumptions:

1. **FIFO (First-In, First-Out)**

2. **LIFO (Last-In, First-Out)**

3. **Weighted Average Cost**

**b.** Calculate the difference in gross margin between the FIFO and LIFO cost flow assumptions.

**Instructions for Completion:**

- Input answers under the "Required A" and "Required B" tabs.

- Note: Round intermediate calculations to two decimal places and final answers to the nearest whole dollar amount.

**Table for Recording Results:**

| | FIFO | LIFO | Weighted Average |

|--------------|------|------|------------------|

| Ending Inventory | | | |

This analysis aids in understanding how different inventory valuation methods impact financial statements, specifically the ending inventory and gross margin.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. CONCEPTUAL CONNECTION Suppose 200,000 EERES WEIC pro sold) but that the company had a beginning finished goods inventory of 10,000 tents produced in the prior year at $40 per unit. The company follows a first-in, first-out policy for its inventory (meaning that the units produced first are sold first for purposes of cost flow). What effect does this have on the income statement? Show the new statement. Problem 2-55 Cost of Goods Manufactured, Cost of Goods Sold Hayward Company, a manufacturing firm, has supplied the following information from its ac- counting records for the month of May: Direct labor cost $10,500 Material handling $ 3,750 Purchases of raw materials 3,475 Materials inventory, May 1 Work-in-process inventory, May 1 Finished goods inventory, May 1 Materials inventory, May 31 Work-in-process inventory, May 31 Finished goods inventory, May 31 15,000 Supplies used Factory insurance Commissions paid Factory supervision Advertising 675 12,500 350 6,685 2,500 9,500 2,225…arrow_forwardDuring the year, Wright Company sells 320 remote-control airplanes for $100 each. The company has the following inventory purchase transactions for the year. Date Transaction Number of Units Unit Cost Total Cost Jan. 1 Beginning inventory 50 $ 72 $ 3,600 May. 5 Purchase 200 75 15,000 Nov. 3 Purchase 100 80 8,000 350 $ 26,600 Calculate ending inventory and cost of goods sold for the year, assuming the company uses weighted-average cost. (Round your average cost per unit to 4 decimal places.) eighted Average Cost Cost of Goods Available for Sale Cost of Goods Sold − Weighted Average Cost Ending Inventory − Weighted Average Cost # of units Average Cost per unit Cost of Goods Available for Sale # of units sold Average Cost per Unit Cost of Goods Sold # of units in ending inventory Average Cost per unit Ending Inventory Beginning Inventory 50 $3,600 Purchases:…arrow_forwardHow do I solve this?arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education