FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

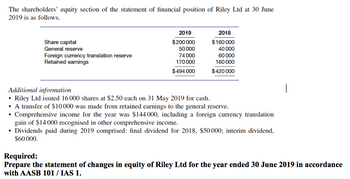

Transcribed Image Text:The shareholders' equity section of the statement of financial position of Riley Ltd at 30 June

2019 is as follows

Share capital

General reserve

Foreign currency translation reserve

Retained earnings

2019

$200000

50000

74000

170000

$494000

2018

$160 000

40000

60000

160000

$420 000

Additional information

Riley Ltd issued 16000 shares at $2.50 each on 31 May 2019 for cash

A transfer of $10000 was made from retained earnings to the general reserve.

Comprehensive income for the year was $144 000, including a foreign currency translation

gain of $14 000 recognised in other comprehensive income.

Dividends paid during 2019 comprised: final dividend for 2018, $50 000; interim dividend,

$60 000

Required:

Prepare the statement of changes in equity of Riley Ltd for the year ended 30 June 2019 in accordance

with AASB 101 IAS 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Prince Corporation's accounts provided the following information at December 31, 2019: Total income since incorporation $840,000 Total cash dividends paid 260,000 Total value of stock dividends distributed 60,000 Additional paid-in capital from treasury stock 140,000 What should be the current balance of retained earnings? a.$670,000 b.$580,000 c.$610,000 d.$520,000arrow_forwardHere is the trial balance of MAEMBE Ltd as at 30 April 2024 DR CR TZS TZS Share capital: authorised and issued 200,000.0 Stock as at 30 April 2023 102,994.0 Debtors 227,219.0 Creditors 54,818.0 8% debentures 40,000.0 Fixed assets replacement reserve 30,000.0 General reserve 15,000.0 Profit and loss account as at 30 April 2023 12,411.0 Debenture interest 1,600.0 Equipment at cost 225,000.0 Motor vehicles at cost 57,200.0 Bank 4,973.0 Cash 62.0 Sales 880,426.0 Purchases 419,211.0 Returns inwards 18,400.0 Carriage inwards 1,452.0 Wages and salaries 123,289.0 Rent, business rates and insurance 16,240.0 Discounts allowed 3,415.0 Directors’ remuneration 82,400.0 Provision for depreciation at 30 April 2023: Equipment 32,600.0 Motor vehicles 18,200.0 TOTAL 1,283,455.0 1,283,455.0 Given the following information as at 30 April 2024, draw up a profit and loss account and balance sheet for the year to that date: (i) Stock TZS 111,317. (ii) The share…arrow_forwardThe balance sheet for Tactex Controls Inc., provincially incorporated in 2018, reported the following components of equity on December 31, 2019. Tactex Controls Inc. Equity Section of the Balance Sheet December 31, 2019 Contributed capital: Preferred shares, $2.3 cumulative, unlimited shares authorized; 22,000 shares issued and outstanding Common shares, unlimited shares authorized; 77,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 394,000 737,000 $1,131,000 380,000 $1,511,000 2020 Jan. 1 Sold 32,000 common shares at $10.84 per share. 5 $ In 2020 and 2021, the company had the following transactions affecting shareholders and the equity accounts: The directors declared a total cash dividend of $233,000 payable on Feb. 28 to the Feb. 5 shareholders of record. Dividends had not been declared for the years 2018. and 2019. All of the preferred shares had been issued during 2018. Feb. 28 Paid the dividends declared on January 5. July 1 Sold…arrow_forward

- What is the Financial Analysis of each year?arrow_forwardcompute the amount of stock issuance for December 2019 assets 85000. liabilities 24000. net income 14000. cash dividends 0. December 2018 assets 60,000. liabilities 40,000arrow_forwardWhite Corporation provided you with the following summary of total assets and liabilities at January 1, 2021 and at December 31, 2021.Assets, January 1, 2021 - P9,000,000Assets, December 31, 2021 - P12,000,000Liabilities, January 1, 2021 - P3,200,000Liabilities, December 31, 2021 - P4,500,000During 2021, the company issued 10,000 shares of its P100 par ordinary share at P150 per share and declared dividends of P280,000. There were no other changes affecting the equity accounts. How much is White Corporation’s profit for the year 2021?arrow_forward

- J2.arrow_forwardOn Dec 15, 2019 the board of directors of Flexsttel declared a cash dividend. The dividend is payable on Jan 8, 2019, of $0.80 per share on the 2,000,000 common shares outstanding. On dec 15, 2019 Flexsteel should: A. Decrease retained earnings $1.6 million and increase expenses $1.6 million B. Debit dividends $1.6 million and credit dividends payable by $1.6 million C. Not prepare a journal entry because the event had no effect on the corporation's financial position until 2020. D. Decrease cash $1.6 million and decrease retained earnings $1.6 millionarrow_forwardAt 31 December 2019, B Plc had post-tax profits was $2,500,000 and had an issued share capital of $2,000,000 comprising 2,000,000 ordinary shares of 50p each and 1,000,000 $1 10% preference shares that are classified as equity. Assume that the post-tax profits for 2018 and 2019 were same at $ 2,500,000. The time-weighted number of shares was as follows: No. of Shares Shares (nominal value 50p) in issue at 01 January 2019 2,000,000 Shares issued for cash at market price on 30 September 2019 1,000,000 On 30 September 2019, B plc made a right issue of one share for every two shares (i.e one new share for every two shares held) at $3.25 per share. The following information is also given for B Plc as at 31 December 2019: Share option in existence 1,000,000 shares issuable in 2020 at $3.25 per share. An average market price per share of $4%; 1. Convertible 8% preference shares of $1 each totaling $2,000,000 convertible at one ordinary share for every five convertible preference shares. 2.…arrow_forward

- The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, 2018, is as follows: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior’s legal capital at December 31, 2019.arrow_forwardThe following information relates to Rose plc for the year ended 31 December 2019: £,000 Turnover Operating costs Trading profit Net interest payable Exceptional charges Tax expenses Profit after tax 700 476 224 2 222 77 145 66 79 Rose plc had 100,000 ordinary shares of £1 each in issue throughout the year. Rose plc has in issue warrants entitling the holders to subscribe for a total of 50,000 shares in the company. The warrants may be exercised after 31 December 2025 at a price of £1.10 per share. The average fair value of shares was £1.28. The company had paid an ordinary dividend of £15,000 and a preference dividend of £9,000 on preference shares classified as equity. Required: Calculate the basic EPS for Rose plc for the year ended 31 December 2019, in accordance with best accounting practice. Calculate the diluted EPS figure, to be disclosed in the statutory accounts of Rose plc in respect of the year ended 31 December 2019. Briefly…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education