FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

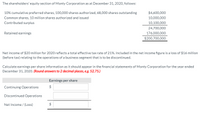

Transcribed Image Text:The shareholders' equity section of Monty Corporation as at December 31, 2020, follows:

10% cumulative preferred shares, 100,000 shares authorized, 68,000 shares outstanding

$4,600,000

Common shares, 10 million shares authorized and issued

10,000,000

Contributed surplus

10,100,000

24,700,000

Retained earnings

176,000,000

$200,700,000

Net income of $20 million for 2020 reflects a total effective tax rate of 21%. Included in the net income figure is a loss of $16 million

(before tax) relating to the operations of a business segment that is to be discontinued.

Calculate earnings per share information as it should appear in the financial statements of Monty Corporation for the year ended

December 31, 2020. (Round answers to 2 decimal places, eg. 52.75.)

Earnings per share

Continuing Operations

$

Discontinued Operations

Net Income / (Loss)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gary Company reported the following amounts in the equity section of its Dec. 31, 2020, statement of financial position. Share capital - Preference. 8%, P100 par (10,000 shares authorized, 2,000 shares issued) P200,000 Share capital-ordinary, P5 par (100,000 shares authorized, 20,000 shares issued) 100,000 Share premium 125,000 Retained earnings 450,000 Total 875,000 During 2021, Gary took part in the following transactions concerning equity. Paid the annual 2020 P8 per share dividend on preference shares and a P2 per share dividend on ordinary shares. These dividends had been declared on Dec. 31, 2020. Purchase 2,700 shares of its own outstanding ordinary shares for P40 per share. Gary uses the cost method. Reissued 700 treasury…arrow_forwardassistarrow_forwardCompany B had net income for the fiscal year ended December 31, 2020 of $5 million. There were 500,000 common shares outstanding throughout 2020. The average market price of the common shares for the entire fiscal year was $50. Company tax rate was 25% for 2020. Company B had the following potential common shares outstanding during 2020: • Options to buy 100,000 common shares at $45 per share. • 100,000 convertible preferred shares entitled to a cumulative dividend of $10 per share. Each preferred share is convertible into 1.5 common shares. • 4% convertible bonds with a principal amount of $30 million, issued at par. Each $1,000 bond is convertible into 25 common shares. For the fiscal year ended December 31, 2020, what is the basic and diluted EPS using IFRS?arrow_forward

- Information from the financial statemets of Henderson-Niles Industries included the following at December 31, 2021: 12 Comnon shares outstanding throughout the year Convertible preferred shares (convertible into 32 million shares of common) Convertible 8% bonds (convertible into 13.5 million shares of common) 100 million 60 million $900 million Henderson-Niles's net income for the year ended December 31, 2021, is $520 million. The income tax rate is 25%. Henderson-Niles paid dividends of $2 per share on its preferred stock during 2021. 01:54:48 Required: Compute basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Round "Earnings per share" answers to 2 decimal places.) Numerator Denominator Earnings per share Basic Diluted I ||| |arrow_forwardAt 31 December 2019, B Plc had post-tax profits was $2,500,000 and had an issued share capital of $2,000,000 comprising 2,000,000 ordinary shares of 50p each and 1,000,000 $1 10% preference shares that are classified as equity. Assume that the post-tax profits for 2018 and 2019 were same at $ 2,500,000. The time-weighted number of shares was as follows: No. of Shares Shares (nominal value 50p) in issue at 01 January 2019 2,000,000 Shares issued for cash at market price on 30 September 2019 1,000,000 On 30 September 2019, B plc made a right issue of one share for every two shares (i.e one new share for every two shares held) at $3.25 per share. The following information is also given for B Plc as at 31 December 2019: Share option in existence 1,000,000 shares issuable in 2020 at $3.25 per share. An average market price per share of $4%; 1. Convertible 8% preference shares of $1 each totaling $2,000,000 convertible at one ordinary share for every five convertible preference shares. 2.…arrow_forward17. Following data were taken from the records of Bassam Company for year 2020: Sales Revenues:$1,000,000; Rent revenues $6,000; Cost of Goods Sold $560,000, Selling expenses $70,000; Administrative and General Expenses $90,000; Interest expenses 20,000; Preference Shares Dividends declared and paid $60,000; Ordinary Shares Dividends declared and paid $80,000; tax rate 25%; No. of common shares outstanding 200,000 shares. Calculate Earnings per share (round answer to the nearest cent)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education