FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

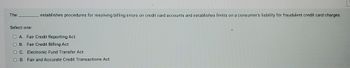

Transcribed Image Text:The

Select one:

establishes procedures for resolving billing errors on credit card accounts and establishes limits on a consumer's liability for fraudulent credit card charges.

O A. Fair Credit Reporting Act

B. Fair Credit Billing Act

O C.

Electronic Fund Transfer Act

OD. Fair and Accurate Credit Transactions Act

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Which of the following is NOT a client protection principle? a. Methods that prevent client of over-indebtedness b. Privacy of client data c. Adequate safeguards to prevent aggressive or abusive treatment of clients d. The number of loans assigned to a loan officerarrow_forwardThe safety of credit cards should be discussed, and certain precautions should be outlined.arrow_forwardAdvantages and disadvantages of accepting debit and credit card transactions as opposed to accepting personal Cheques from customers? (Consider both internal control and business reasons)arrow_forward

- IFRS requires all of the following when classifying receivables except Select one: O a. Indicate the receivables classified as current and non-current in the statement of financial position. O b. All of these answer choices are required by IFRS when classifying receivables. Oc Disclose all significant concentrations of credit risk arising from receivables. Od. Disclose any receivables pledged as collateral.arrow_forwardWhat is the objective of having a control system and what is the key points of a credit control system?arrow_forwardHow is a line of credit issued by a bank similar to a credit card?arrow_forward

- When referring to a note receivable or promissory note a.the note cannot be factored to another party b.the note may be used to settle an account receivable c.the note is not considered a formal credit instrument d.the maker is the party to whom the money is duearrow_forwardWhich of the following credit checks would be considered a soft check? A. Vehicle loan application B. job application C. student loan application D. Credit card application I don't need explanation just the answer :)arrow_forwardA good policy for a company for company credit cards requires: vendor receipts for all items charged receipts and reimbursement of personal expenses not authorized by company policy no personal expenses charged on the card unless authorized by company policy a and carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education