Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

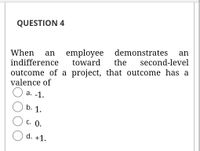

Transcribed Image Text:QUESTION 4

employee demonstrates

the

an

When

an

indifference

toward

second-level

outcome of a project, that outcome has a

valence of

а. -1.

b. 1.

С. 0.

d. +1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7. Competitive position index and calculation of the price/rent for a subject property - example 8. Analysis of the absorption rate of the project - Fair Market Share - examplearrow_forwardA dependent project is one whose acceptance or rejection is based on: (a) Its rate of return with respect to the MARR (b) The amount of capital available for investment (c) A decision about another project (d) The amount receivable in salvage value of the existing assetarrow_forwardq7arrow_forward

- EX8-14 (Algo) Given the time-phased work packages... Given the time-phased work packages and network, complete the baseline budget form for the project. 0 0 0 A 3 Design 3 3 A Design prototype B Build prototype C Order parts Legend ES ID EF SLK Descrip LS DUR LF ID A B C D E F G D Prepare production E Prepare marketing F Assemble and test G Launch Total 3 0 B 5 Build 3 2 5 Budget Cumulative 21 12 17 62 32 36 12 192 Soccer Toy Project Cost By Week ($000) 3 5 12 20 5 2 10 0 14956682 1 10 2 2 4 18 18 5 0 1 6 5 0 5 5 1 6 ... C 8 с Order 3 9 D 9 Prod. 4 9 E 10 Mktg 5 11 8 22 16 4 6 0 0 0 0 0 0 Enter the appropriate values in the truncated portion of the budget form shown below. 4 5 0 Enter the appropriate values in the truncated portion of the budget form shown below. 0 0 0 0 0 12 Time Periods 8 9 F 11 0 Assy. 9 2 11 9 11 0 11 10 G 12 Launch 1 12arrow_forwardConsider a project with an initial investment of $60,000, a 6 year useful life (and study period), and a $10,000 salvage value. You expect an annual net revenue of $15,000 (before tax), a MARR before tax of 15.3%, and an effective tax rate of 35%. The capital equipment is to be depreciated using MACRS GDS and a 3 year class life. A)For the cash flow , compute after-tax MARR and evaluate the cash flow using an equivalent worth method. B) Develop the after-tax cash flows for the project of using a 4 year class life and MACRS ADS. Draw the after-tax cash flow diagram.arrow_forwardExamine the scenario: Consider that the current price of a juice per can is $8, buyers want to buy 300 cans of juices, sellers are willing to sell 600 cans of juices at that current price. Assessment questions: 4a. Identify the problem created with this market of juices based on the scenario above. (1) 4b. As a student in economics, suggest a solution of the problem you identified. Relate your answerwith a valid real life example toned in the business context.arrow_forward

- What is the future value of $50,000.00 invested this year @ 5%, for 15 years?arrow_forwardb. What is the expected value for the rezoned apartments, if the rezoning cost is included (but land cost is excluded)? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected value million c. If the land is rezoned, what should the contractor decide? O Build shopping center O Build apartments d. What is the expected revenue, if the land is not rezoned (excluding the land cost)? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected revenue million e. What is the expected net profit of entire project, including all applicable costs? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected net profit millionarrow_forwardSuppose you are a project manager of a power plant project and there is a penalty in your contract with the main client for every day you deliver the project late. You need to decide which sub-contractor is appropriate for your projects critical path activities. But while selecting a sub-contractor, you should take into consideration the costs and delivery dates. • Sub-contractor A bids 200,000 OMR. You estimate that there is a 35% possibility of completing 50 days late. As per your contract with the client, you must pay a delay penalty of 4,500 OMR per calendar day for every day you deliver late.• Sub-contractor B bids 260,000 OMR. You estimate that there is a 13% possibility of completing 15 days late. As per your contract with the client, you must pay a delay penalty of 4,500 OMR per calendar day for every day you deliver late. Determine which sub-contractor is appropriate for your projects critical path activities. Both sub- contractors promise successful delivery and high-quality…arrow_forward

- Please do not give solution in image format thankuarrow_forwardYou are the project manager of the NHQ Project, which is part of the HQQ Program to construct a condominium building. Samuel, the program manager, has required that you document any variances to costs, schedule, scope, and quality expectations as part of the program governance. You believe that your project team now has an internal failure cost that needs to be documented for Samuel. Which of the following is an example of internal failure cost? Group of answer choices Project team training Rework Random quality audits Quality auditsarrow_forwardOnly Typing answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON