Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

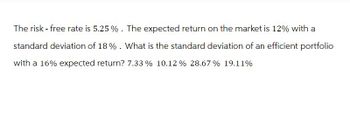

Transcribed Image Text:The risk - free rate is 5.25%. The expected return on the market is 12% with a

standard deviation of 18%. What is the standard deviation of an efficient portfolio

with a 16% expected return? 7.33 % 10.12% 28.67% 19.11%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The beta on risky asset A is 1.8 and the beta on risky asset Bis 1.1. The expected return on the market portfolio is 10% and the risk free rate of return is 4%. Consider a portfolio comprising the two riskypssets and the risk-free asset where you invest 50% in risky asset A and 30% in risky asset B. What is (i) the beta of a portfolio and fi) the expected return of the portfolio? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a None of the above b. (i) 0.97 and (ii) 9.829% (1) 1.23 and (ii) 9.8296 (1) 1.23 and (ii) 11.38% ) 0.97 and (ii) 11.38% earrow_forwardSuppose you invest equal amounts in a portfolio with an expected return of 16% and a standard deviation of returns of 20% and a risk-free asset with an interest rate of 4%; calculate the standard deviation of the returns on the resulting portfolio: none of the above 10% 20% 8%arrow_forwardUse the following information: E[rXOM] = 15.6%, standard deviationyOM = 15.9% %3D E[IMSI=29.7%, standard deviationMS = 35.2% Correlation of returns: PXOM.MS = 0.139, r=10% If the optimal amount to invest in the first asset (w) is 0.43, what is the variance of the risky portfolio when w=0.43? (write in decimal format using 5 decimal places)arrow_forward

- An investment has an expected return of 10% with standard deviation of 25%. What is the value at risk? -31.12% 31.12% 10% -25%arrow_forwardThe beta on risky asset A is 1.8 and the beta on risky asset B is 1.1. The expected return on the market portfolio is 10% and the risk free rate of return is 4%. Consider a portfolio comprising the two risky assets and the risk-free asset where you invest 50% in risky asset A and 30% in risky asset B. What is (i) the beta of a portfolio and (ii) the expected return of the portfolio? a None of the above b (i) 0.97 and (ii) 9.82% c (i) 1.23 and (ii) 9.82% d (i) 1.23 and (ii) 11.38% e (i) 0.97 and (ii) 11.38%arrow_forwardWhat is the expected return on asset A if it has a beta of 0.5, the expected market return is 13%, and the risk-free rate is 3%? O 6.5% 8% 9.5% 7% O 5%arrow_forward

- a. Assume that Carson has two choices to satisfy the increased demand for its products. It could increase production by 10 percent with its existing facilities by obtaining short-term financing to cover the extra production expense and then using a portion of the revenue received to finance this level of production in the future. Alternatively, it could issue bonds and use the proceeds to buy a larger facility that would allow for 50 percent more capacity. Which alternative should Carson select? b. Carson currently has a large amount of debt, and its assets have already been pledged to back up its existing debt. It does not have additional collateral. At this time, the credit risk premium it would pay is similar in the short-term and long-term debt markets. Does this imply that the cost of financing is the same in both markets? c. Should Carson consider using a call provision if it issues bonds? Why? Why might Carson decide not to include a call provision on the bonds? d. If Carson…arrow_forwardRisk-free rate is 7%, expected return on the market portfolio is 12%. Identify the correct equation for Security Market Line (SML): a. r = 5% + b(7%) b. r = 7% + b (12%) c. r = 7% + b (5%) d. r = 5% + b (12%)arrow_forwardConsider two types of assets: market portfolio (M) and stock A. The expected return is 8% and standard deviation of the market portfolio is 15%. The risk-free rate is 2%. The standard deviation of market portfolio returns is 15%. The standard deviation of stock A is 30%, and the beta coefficient is 1. Draw the capital market line and show the position of stock A.arrow_forward

- Haahaarrow_forwardRequired Return If the risk-free rate is 11.8 percent and the market risk premium is 7.6 percent, what is the required return for the market?arrow_forwardThe risk-free rate is 1.41% and the expected return on the market 10.36%. A stock with a β of 1.52 will have an expected return of ____%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education