FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

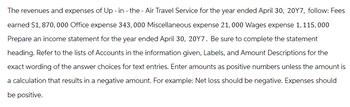

Transcribed Image Text:The revenues and expenses of Up - in - the - Air Travel Service for the year ended April 30, 20Y7, follow: Fees

earned $1,870,000 Office expense 343,000 Miscellaneous expense 21, 000 Wages expense 1, 115,000

Prepare an income statement for the year ended April 30, 20Y7. Be sure to complete the statement

heading. Refer to the lists of Accounts in the information given, Labels, and Amount Descriptions for the

exact wording of the answer choices for text entries. Enter amounts as positive numbers unless the amount is

a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should

be positive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What should I do with the contracts that were issued for contracted services in the amount of $91,750. Note: Enter debits before credits. Transaction General Journal Debit Credit 05 .arrow_forwardWrite a journal entry for the following beginning balance: “accounts receivable (net of allowance of 5200) 235,884"arrow_forwardAfter the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $754,825 and Allowance for Doubtful Accounts has a balance of $18,222. What is the net realizable value of accounts receivable?arrow_forward

- The ledger of Larkspur Company at the end of the current year shows Accounts Receivable $92,000, Credit Sales $850,000, and Sales Returns and Allowances $37,000. (a) (b) (c) If Larkspur uses the direct write-off method to account for uncollectible accounts, journalize the entry if on July 7 Larkspur determines that Matisse company's $900 balance is uncollectible. Assume Larkspur uses the allowance method to account for uncollectible accounts. If Allowance for Doubtful Accounts has a credit balance of $1,500 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (b) Assume Larkspur uses the allowance method to account for uncollectible accounts. If Allowance for Doubtful…arrow_forwardYour company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this?arrow_forwardJournal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forward

- 1. The following account balances were extracted from the accounting records of Macy Corporation at the end of the year:Accounts Receivable $1,100,000Allowance for Uncollectible Accounts (Credit) $37,000Uncollectible-Account Expense $63,000What is the net realizable value of the accounts receivable? Select one:A. $1,163,000B. $1,137,000C. $1,100,000D. $1,063,000 Please show all steps.arrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwarda. If the note is issued with a 45-day term, journalize the entries to record (refer to the company's Chart of Accounts for exact wording of account titles): 1. the issuance of the note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education