ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

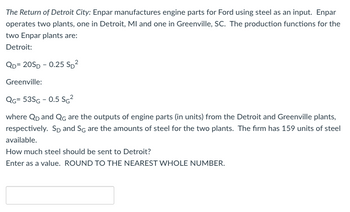

Transcribed Image Text:The Return of Detroit City: Enpar manufactures engine parts for Ford using steel as an input. Enpar

operates two plants, one in Detroit, MI and one in Greenville, SC. The production functions for the

two Enpar plants are:

Detroit:

QD=20SD -0.25 SD²

Greenville:

QG= 53SG - 0.5 SG²

where QD and QG are the outputs of engine parts (in units) from the Detroit and Greenville plants,

respectively. Sp and SG are the amounts of steel for the two plants. The firm has 159 units of steel

available.

How much steel should be sent to Detroit?

Enter as a value. ROUND TO THE NEAREST WHOLE NUMBER.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Let a two-output cost function be given byarrow_forwardEconomies of Scale. Figure 7.10b illustrates the situation in which a larger plant can attain a lower minimum average cost than a smaller plant. That is, economies of scale (or increas- ing returns to scale) exist. This is evident from the fact that the larger firm's ATC curve falls below the dashed line in the graph (m, is less than c). The greater efficiency of the large factory might come from any of several sources. This is the situation Elon Musk was count- ing on for his Shanghai gigafactory.arrow_forwardHow would you determine that a two-input Cobb-Douglas production function has decreasing returns to scale (DRS), increasing returns to scale (IRS) or constant returns to scale (CRS) depending on whether α1 + α2 is larger than, smaller than, or equal to one?arrow_forward

- S1. A firm's production function is well described by the equation Input prices are $10 per labor hour and $20 per machine hour, and the firm sells its output at a fixed price of $10 per unit. a. In the short run, the firm has an installed capacity of K = 50 machine hours per day, and this capacity cannot be varied. Create a spreadsheet (based on the example below) to model this production setting. Determine the firm's profit-maximizing employment of labor. Use the spreadsheet to probe the solution by hand before using your spreadsheet's optimizer. Confirm that MRPL = MCL. C 1 2 3 4 5 6 7 8 9 10 11 12 13 A B Labor MPL Q = 2L .01L² + 3K-.02K². 20.0 1.600 MRPL 16.0 MCL 10.0 D OPTIMAL INPUTS E F Capital 50.0 MPK 1.000 MRPK 10.0 MCK 20.0 G H Output Price MR Revenue Ave Cost I Profit 136.0 10.0 Cost 1200.0 8.8 10.0 1360.0 160.0 b. In the long run, the firm seeks to produce the output found in part (a) by adjusting its use of both labor and capital. Use your spreadsheet's optimizer to find…arrow_forwardShow that the two-input Cobb-Douglas production function (attached) has decreasing return in scale (DRS), constant return of scale (CRS) or increasing return of scale (ITS) depending on if alpha1 + alpha2 is smaller than, equal, or larger than 1.arrow_forwardtype plzarrow_forward

- How would you determine that a two-input Cobb-Douglas production function has decreasing returns to scale (DRS), increasing returns to scale (IRS) or constant returns to scale (CRS) depending on whether β is larger than, smaller than, or equal to one?arrow_forwardMirtha owns an online jewelry store that specializes in earrings. In March, she sells 50 pairs of earrings priced at $15. The cost of materials to create the 50 pairs of earrings was $100. The website she uses to sell her wares costs her $10 a month, and she is also charged 4% on each sale by the company that processes debit/credit card purchases. Which of the following best represents Mirth’s total cost? Group of answer choices A)The $750 Mirtha earned from earring sales minus the materials ($100), online website charge ($10), and payment processing charge (4%) B)The sum of the materials ($100), website charge ($10), and 4% payment processing charge (4%) C)The cost of all the materials used to create the earrings, $100 D)The costs of materials minus the costs it takes to run her business through the online store, in this case the $10 website charges and the 4% payment processing chargearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education