ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text::=

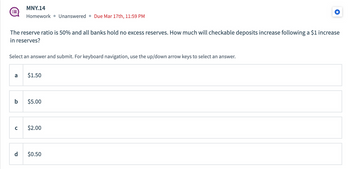

The reserve ratio is 50% and all banks hold no excess reserves. How much will checkable deposits increase following a $1 increase

in reserves?

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

MNY.14

Homework Unanswered Due Mar 17th, 11:59 PM

C

b $5.00

P

$1.50

$2.00

$0.50

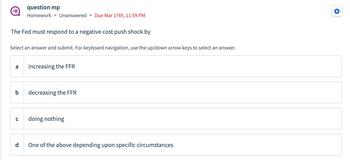

Transcribed Image Text:The Fed must respond to a negative cost push shock by

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

b

question mp

Homework Unanswered Due Mar 17th, 11:59 PM

с

d

increasing the FFR

decreasing the FFR

doing nothing

One of the above depending upon specific circumstances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the required reserve ratio (RRR) in U.S. is 10 percent and you deposit $5,000, which is wired from your parents’ bank account in Germany to your checking account in the U.S. National Bank, then the change in the U.S. money supply eventually should be Group of answer choices a $45,000 increase. a $5,000 increase. no change. a $50,000 increase.arrow_forwardFind the value of money multiplier if the required reserve ratio is 50%?arrow_forwardThe State Bank of Oswald has cash reserves of $5,000, loans of $495,000, and deposits of $500,000. The bank maintains a reserve requirement of 1 percent. Calculate (show work) this bank’s excess reserves and write the answer below.arrow_forward

- 1.4 Suppose you transfer $4,000 from your money market mutual fund account to your checking account. What is the immediate impact of this transfer on M1 and M2? 1.5 Why do banks create money? Do they create money to help the Federal Reserve control the money supply or is there a more basic reason? 1.6 Suppose that the required reserve ratio is 2 percent, and you deposit $100,000 of currency into Chase Bank. What is the potential increase in deposits in the banking system brought about by your deposit? What is the potential change in the money supply?arrow_forwardSuppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 10%. Paolo, a client of First Main Street Bank, deposits $500,000 into his checking account at First Main Street Bank. Complete the following table to reflect any changes in First Main Street Bank's T-account (before the bank makes any new loans). Assets Liabilities Complete the following table to show the effect of a new deposit on excess and required reserves when the required reserve ratio is 10%. Hint: If the change is negative, be sure to enter the value as negative number. Amount Deposited Change in Excess Reserves Change in Required Reserves (Dollars) (Dollars) (Dollars) 500,000 Now, suppose First Main Street Bank loans out all of its new excess reserves to Lucia, who immediately uses the funds to write a check to Kenji. Kenji deposits the funds immediately into…arrow_forwardAssuming a bank only keeps enough of its reserves to meet its reserve requirement, how much money is created after the Federal Reserve purchases $40,000 worth of bonds from a bank (this means they deposit $40,000 in that bank's reserve account) and there is a 25% reserve requirement? Hint: enter your answer without a comma or $ sign. Example: if the answer is $44,000 enter 44000 as your answer. Show Transcribed Text Assuming a bank only keeps enough of its reserves to meet its reserve requirement, how much money is created when a bank receives a deposit from an individual of $60,000 and there is a 10% reserve requirement. Hint: enter your answer without a comma or $ sign. Example: if the answer is $44,000 enter 44000 as your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education