The

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

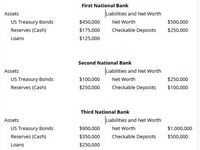

So based on the question asked, we just focus on the change in loan potential creation of the additional deposited $400,000 in the Second National Bank, rather than the new loan can be created from all three banks, is it correct? Please explain further.

Thank you so much in advance.

Will the amount of new loan be affected if the additional $400,000 was deposited in the Second National Bank?

Will the additional $400,000 which was deposited in the Second National Bank affect the new loan?

So based on the question asked, we just focus on the change in loan potential creation of the additional deposited $400,000 in the Second National Bank, rather than the new loan can be created from all three banks, is it correct? Please explain further.

Thank you so much in advance.

Will the amount of new loan be affected if the additional $400,000 was deposited in the Second National Bank?

Will the additional $400,000 which was deposited in the Second National Bank affect the new loan?

- Could you add more information regarding the below statement? "The Federal Reserve System plays a massive role in not only the economy of the united states but alos in the global economy. The US dollar is one of the most popular and well recognized forms of currency all around the world, making it the basis for many financial transactions and trades. This popularity and standardization in regards to the dollar makes it one of if not the most important currency in the world, whose value has implications on nearly every aspect of trade, consumers, and even other countries wellbeing. Because of this, the fed, who has the ability to influence the value of the dollar and the economy, is likely the most important financial institution of the world, because of it's ability to severely impact both positively and negatively the united states economy and the world economy. With the recent inflation, I do think that the fed should take some action to mitigate the risk of any catastrophic…arrow_forward6. One of the banking innovations in the 1960s was the payment of interest on certain types of demand deposits. Assume that interest is paid on money at the nominal rate Rm, which equals (R − x), where x is the nominal return on bonds, which is exogenously determined by market structures and the cost of servicing deposits. (i) Use Baumol’s transactions demand model to derive the demand function for money. (ii) Generalizing the above demand function to md(y, R, x), shows the behavior of the LM curve for shifts in x and P. (iii) What is the effect of an increase in x on aggregate demand, output and price level in the neoclassical model? (iv) Assuming that both R and x always increase by the expected rate of inflation, do (ii) and (iii) again.arrow_forwardYou are given the following balance sheet of the Summer Bank (21) Balance sheet of the Winter bank Assets Liabilities Cash $ 8,000 Deposited with the Fed $ 5,000 Loans $ 117,000 Deposits $ 80,000 Capital $ 50,000 Total $ 130,000 Total $ 130,000 The required reserve ratio (RRR) on all deposits is 5% d,What would be the excess reserves of this bank after the RRR is changed to 4%? e.How much new amount of loan will this bank be able to create with the RRR of 4%? f.How much new amount of loan the entire banking system be able to create because of the excess reserves? g.What happened to the money supply after the RRR was decreased to 4% from 5%?arrow_forward

- Since the Fed has begun paying interest on bank reserves at the Fed, do barks still want to avoid holding excess reserves? Context: If lending was more profitable than the currently very low interest rate (formerly zero) that could be received from the Fed on excess reserves, we would still normally expect barks to lend out excess reserves rather than maintain them as excess reserves Judging from the fact that there has been a huge increase in holdings of excess reserves in the barking system, however, there may well be other constraints (such as Basel III) that may be limiting bank's willingness to lend out excess reserves.arrow_forwardWhich of the following actions by the Bank of Canada will result in an immediate increase of approximately $600 million in excess reserves for banks? (Assume a target reserve ratio of 30%.) OA. Transfer $600 million out of commercial bank deposits into its own accounts OB. Purchase $857 million of government securities from the non-bank public, because of the 30% target reserve ratio OC. Purchase $600 million of government securities from the non-bank public OD. Purchase less than $600 million of government securities from the non-bank public E. Sell $857 million of government securities to banks, because of the 30% target reserve ratio OF. Sell $600 million of government securities to banks G. Sell less than $600 million of government securities to banksarrow_forwardSuppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 25 %. Refer to the balance sheet below. Enter your answers as whole numbers. A) What is the amount of excess reserves in this commercial banking system? What is the maximum amount the banking system might lend? Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent. What is the size of the monetary multiplier? B) Using the original figures, answer the questions in part A assuming the reserve ratio is 20%. What is the amount of excess reserves in this commercial banking system? What is the maximum amount the banking system might lend? Show in columns 1(b) and 1'(b) how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier? What is the resulting difference in the amount that the commercial banking…arrow_forward

- Which of the following is true? The leverage ratio is 50 meaning that for every $1 in capital the bank has $50 in assets. The leverage ratio is 45 meaning that for every $200 of capital the bank has $45 in deposits. The leverage ratio is 50 meaning that for every $200 of capital the bank has $50 in assets. The leverage ratio is 45 meaning that for every $1 of capital the bank has $45 in deposits.arrow_forwardUsing the M1 definition of Money, M1 = _____________ Category Amount Currency and coin held by the public $1,000 Checking account balances $2,000 Traveler's checks $50 Savings Account balances $4,000 Small denomination time deposits (CD) $3,000 Money market deposit accounts in banks (MMDA) $1,500 Money Market Mutual Fund Shares (MMMF) $2,500 Bitcoins $1,000 Select one: a. 7050 b. 2050 c. 3050 d. 1050arrow_forwardAssume that the following asset values (in millions of dollars) exist in Ironmania: Category Value (Millions) Federal Reserve Notes in circulation $700 Money market mutual funds (MMMFS) held by individuals 400 Corporate bonds 300 Iron ore deposits 50 Currency in commercial banks 110 Savings deposits, including money market deposit accounts (MMDAS) 140 Checkable deposits 1,600 Small-denominated (less than $100,000) time deposits 100 Coins in circulation 40 Instructions: Enter your answers as a whole number. a. What is MM in Ironmania? million b. What is M2 in Ironmania? millionarrow_forward

- 2arrow_forwardWorking through an open-market operation Assume that the following balance sheet portrays the state of the banking system. The banks currently have no excess reserves. Assets Liabilities and Net Worth (Billions of Dollars) Total reserves 10 Checkable deposits 25 Loans 5 Securities 10 Total 25 Total 25 What is the required reserve ratio? 5% 40% 25% 10% Suppose that the Federal Reserve (the "Fed") sells $3 million of bonds to a bond dealer, who pays the Fed by writing a check against the funds in her checking account. What is the initial impact of this transaction? The banking system's holdings of securities fall by $3 million, and the banking system's total reserves rise by $3 million. Checkable deposits fall by $3 million, and the banking system's total reserves fall by $3 million. Checkable deposits fall by $3 million, and the banking system's holdings of securities fall by $3 million.…arrow_forwardAccording to the equation of exchange, if the money supply is $700 million, real GDP is $1,600 million, and nominal GDP is $3,220 million, then the velocity of money is equal to: O 3.5 2.01 2.29 O 5 O 4.6arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education