Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

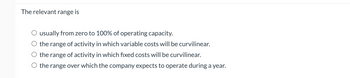

Transcribed Image Text:The relevant range is

O usually from zero to 100% of operating capacity.

the range of activity in which variable costs will be curvilinear.

the range of activity in which fixed costs will be curvilinear.

O the range over which the company expects to operate during a year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Break-Even Sales Under Present and Proposed Conditions Portmann Company, operating at full capacity, sold 1,000,000 units at a price of $190 per unit during the current year. Its income statement is as follows: Sales $190,000,000 Cost of goods sold (102,000,000) Gross profit $88,000,000 Expenses: Selling expenses $15,000,000 Administrative expenses 14,700,000 Total expenses (29,700,000) Operating income $58,300,000 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative 50% 50% expenses Management is considering a plant expansion program for the following year that will permit an increase of $13,300,000 in yearly sales. The expansion will increase fixed costs by $4,500,000 but will not affect the relationship between sales and variable costs. Required:arrow_forwardWhat time period does life cycle costing for a product cover? a. Short periods of one accounting year b. The product’s entire life time c. A quarter to a year d. An undetermined period of timearrow_forwardPlease I need help in this question. Answer as soon as possible. Period Question: Estimate average cost per unit as per life cycle costing 1 2 3 4 5 Estimated production (units) J 12,000 18,000 80,000 25,000 8,000 Fixed cost per annum (AED) C 60,000 60,000 60,000 60,000 60,000 Variable cost @ AED 2 (AED) 24,000 36,000 1,60,000 50,000 16,000 Total cost (AED) 84,000 96,000 2,20,000 1,10,000 76,000 Cost per unit (AED) 7.00 5.33 2.75 4.40 9.50arrow_forward

- Consider a company that rents a building for £500,000 a year for the purpose of manufacturing between 100,000 and 120,000 units of production (the relevant range of activity). What will happen to the rental cost per unit of production as production levels increase? The rental cost per unit of production will: a. Behave in a non-linear fashion b. Increasec. Decreased. Remain fixedarrow_forwardWhat is the effect on the cost per unit if activity increased by 10%? O A. Decrease by 10% O B. Decrease by less than 10% C. Increase by less than 10% D. Remain constantarrow_forward1 Wolverine Company's average cost per unit is $1.425 at the 16,000-unit level of activity and $1.38 at the 20,000-unit level of activity. The selling price is $3.00 per unit. Assume that all of the activity levels mentioned in this problem are within the relevant range. Predict the following items for Wolverine Company: Required: 1. Variable cost per unit. 2. Total fixed cost per period. 3. Total expected costs at the 18,000-unit level of activity. 4. Total Contribution Margin at the 18,000 unit level of production and sales.arrow_forward

- Burnham Industries incurs these costs for the month: A. What Is the prime cost? B. What is the conversion cost?arrow_forwardA company has developed a production cost equation for its lone product: Y = 30 + 5X, where X is based on the number of labor hours. Assuming a relevant range of 10 to 20 labor hours, what is the estimated production cost at zero (0) labor hour? a. P 30 b. P 80 c. P130 d. The exact amount cannot be determined without additional informationarrow_forwardManufacturing costs for product X include direct materials $18 per unit, direct labor $4 per unit, variable overhead $2 per unit, and fixed overhead $3 per unit, for a total of $27 per unit. If production volume is increased by 10 units, how much will total manufacturing costs change in the short term? Assume that the new production volume is in the relevant range. (hint: the total cost equation might be useful here) increase by $240 not enough information need to know the original volume increase by $220 increase by $250 O increase by $270arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College