Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Kindly help me with general accounting question

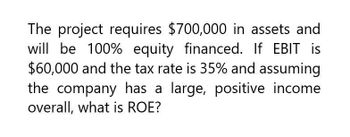

Transcribed Image Text:The project requires $700,000 in assets and

will be 100% equity financed. If EBIT is

$60,000 and the tax rate is 35% and assuming

the company has a large, positive income

overall, what is ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wizard Co. is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 40%. What will be the ROE (return on equity) for this project if it produces an EBIT of -$40,000? When calculating the tax effects, assume that Wizard Co. as a whole will have a large, positive income this year. O -3.0% O -3.7% O -4.4% O -3.1%arrow_forwardPlease solve this problemarrow_forwardNeed help with this Question with explanation of the questionarrow_forward

- I want to answer this questionarrow_forwardWizard Co. is considering a project that will require $500,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 30%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $145,000? 20.3% 17.3% 14.2% 16.2% Determine what the project’s ROE will be if its EBIT is –$60,000. When calculating the tax effects, assume that Wizard Co. as a whole will have a large, positive income this year. -9.2% -8.4% -8.8% -7.6% Wizard Co. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 13%. What will be the project’s ROE if it produces an EBIT of $145,000? 25.2% 36.2% 29.9% 31.5% What will be the project’s ROE if it produces an EBIT of –$60,000 and it finances 50% of the project with equity and 50% with debt? When calculating the…arrow_forwardAAA Inc. is evaluating a project that will require $500,000 in assets. The project is financed with equity only and is expected to generate earnings before interest and taxes of $90,000. The firm has a tax rate of 16%. What is the ROE (return on equit for this project? a. 16.00% b. 18.15% O c. 10.75% O d. 15.12%arrow_forward

- A new project is being considered by a P company. The debt-equity ratio of .75. The company's cost of equity is 15.0 percent, and the after-tax cost of debt is 4.0 percent. The project is considered riskier by the company than the company as a whole and an adjustment factor should be use of +1.2 percent. Calculate the project cost of capital if the tax rate is 32 percent? A) 10.08 percent B) 11.49 percent C) 11.02 percent D) 16.14 percentarrow_forwardSuppose Woodsburg’s capital structure is 60% equity and 40% debt, and that its marginal tax rate increases. What will happen to Woodsburg’s weighted average cost of capital (WACC)?arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forward

- Universal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…arrow_forwardneed help with this question please provide correct optionarrow_forwardSolve this question pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you