FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Buy P 1-P Low Cost High Cost Purchase Cost C1 = 35,000+ 0.08 x 2,500,000 C2 = 35,000+ 0.12 x 2,500,000 C3 = 200,000

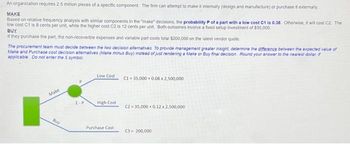

Transcribed Image Text:An organization requires 2.5 million pieces of a specific component. The firm can attempt to make it internally (design and manufacture) or purchase it externally

MAKE

Based on relative frequency analysis with similar components in the "make" decisions, the probability P of a part with a low cost C1 is 0.38. Otherwise, it will cost C2. The

low cost C1 is 8 cents per unit, while the higher cost C2 is: 12 cents per unit. Both outcomes involve a fixed setup investment of $35,000.

BUY

if they purchase the part, the non-recoverble expenses and variable part costs total $200,000 on the latest vendor quote.

The procurement team must decide between the two decision alternatives. To provide management greater insight, determine the difference between the expected value of

Make and Purchase cost decision alternatives (Make minus Buy) instead of just rendering a Make or Buy final decision Round your answer to the nearest dollar, if

applicable Do not enter the $ symbol

Make

Buy

Low Cost

High Cost

Purchase Cost

C1 =35,000+ 0.08 x 2,500,000

C2=35,000+ 0.12 x 2,500,000

C3-200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Date Date 1/9/18 10/9/18 Dollar Rate Dollar Rate 1,16 Price in Euros Price in Dollars Price in Dollars Difference 1,18 Model 300 VRG 625 RTM 475 GRM 200 GRM 650 MTY 600 RTM 500 MTY 46.900 € $55.342 $54.404 $938 66.700 € $78.706 $77.372 $1.334 96.100 € 122.600 € 164.900 € 214.400 € 247.300 € $113.398 $111.476 $1.922 $144.668 $142.216 $2.452 $194.582 $191.284 $3.298 $252.992 $291.814 $248.704 $286.868 $4.288 $4.946 1) Most of your exports to the US belong to the model 600 RTM. The experience shows that, if the price of this product rises over 215000 dollars, the exported units will be reduced. If this product is priced in euros, and assuming the trend shown in question 1 continues, what would be the consequences for your company's exports?arrow_forwardNonearrow_forwardam. 115.arrow_forward

- QUESTION 2 S = 48 X = 50 C=$4 P = $3 A straddle requires purchasing one call and one put on the same asset with the same strike price. For this data the payoff for a straddle is a. $2 O b.-$1 Oc. $0 O d.-$7 O e. -$5arrow_forwardnot use ai pleasearrow_forwardQS 18-15 (Static) Interpreting a CVP chart LO P2 Solve for each of the items below. Dollars $25,000 $20,000 $15,000 $10,000 $5,000 $0 (b) 0 200 400 600 (c) (d). 1. Units produced at break-even point 2. Dollar sales at break-even point 3. Capacity in units 4. Are fixed costs greater than $10,000? 5. If 1,400 units are produced and sold, is there a profit or a loss? (a) (e) 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 Units produced and soldarrow_forward

- Sales VC Complete the shaded cells below: Year 1 $32,960,000 13,440,000 Year 2 Year 3 Year 4 $54,590,000 22,260,000 $44,805,000 18,270,000 $40,170,000 Year 5 $27,810,000 16,380,000 11,340,000 Fixed costs 5,300,000 5,300,000 5,300,000 5,300,000 5,300,000 Dep EBT 5,501,650 $8,718,350 9,428,650 6,733,650 4,808,650 3,438,050 $17,601,350 $14,501,350 $13,681,350 $7,731,950 Tax NI $6,800,313 +Dep OCF 1,918,037 5,501,650 $12,301,963 3,872,297 $13,729,053 5,501,650 $19,230,703 3,190,297 3,009,897 1,701,029 $11,311,053 $10,671,453 $6,030,921 5,501,650 $16,812,703 5,501,650 $16,173,103 5,501,650 $11,532,571 NWC Beg End $0 0 NWC CF $6,592,000 $10,918,000 $8,961,000 $8,034,000 $5,562,000 Net CF Salvage BV of equipment Taxes Salvage CF Net CF Time 0 2 3 5 12345arrow_forwardOption A В -А C-B C-A -4500 -7500 -9000 -3000 -1500 -4500 1500 3000 3400 1500 400 1900 2. 2000 3000 3740 1000 740 1740 3 2500 3000 4114 50 1114 1614 8/C or AB/C 0.91 1.18 1.07 1.11 1.31 1.04 Your accountant has provided you with the table below comparing three alternatives using benefit-cost ratio analysis and an MARR of 6%, the best option is: Option A Option B O Option C There is not enough information provided. Yeararrow_forwardNo chatgpt used i will give 5 upvotes typing pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education