Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-k

t

ces

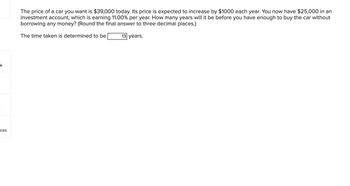

The price of a car you want is $39,000 today. Its price is expected to increase by $1000 each year. You now have $25,000 in an

investment account, which is earning 11.00% per year. How many years will it be before you have enough to buy the car without

borrowing any money? (Round the final answer to three decimal places.)

The time taken is determined to be

13 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You’d like to buy a small ranch when you retire in 38 years. You estimate that in 38 years you’ll need $9 million to do so. If your savings can earn 1.0% per month, how much will you need to save each month (for 38 years), starting next month, in order to reach your goal? Round to the nearest cent. [Hint: We are trying to solve for the cash flows of an annuity. The formula we need to use is dictated by whether we are given the PV or the FV of that annuity. Also, we are given the monthly interest rate, which is i/m in our formulas.]arrow_forwardYou're trying to save to buy a new $68,000 sports car. Currently, you have saved $36840 which is invested at 4.9 percent annual interest. How many years will it be before you purchase the car assuming the price of the car remains constant?arrow_forwardIt’s time to get a new laptop. The laptop is $1,800. You could put money aside for it each month for one year. If you put the money in an account that earns 4.5%, how much will you have to save each month?Your other option is to finance it over two years paying 7.1%. How much would your monthly payment be?What are the total acquisition costs of each option?arrow_forward

- You plan to graduate in 4 years, and then travel to Italy for 3 weeks. The trip will cost $1,500. If you can earn an annual interest rate of 8%, how much do you have to save right now to have enough money for your trip? Instead, the interest rate is 0.667% per month. How much do you need to save right now?arrow_forwardYou will have $100,000 exactly 7 years from now. You began with an investment of $50,000 at Time Zero. What rate of interest did you earn?arrow_forwardYou have decided to buy a car this year at a price of $18,000. You're planning to take out a loan for the full price of the vehicle at an interest rate of .5% per month. For the first two years (24 months), you decide to repay $600 per month. How much will you have to pay each month for the remainder of the three-year loan (12 months remain) to exactly pay off the car in full at the end of the three-year term? Hint: Consider the monthly interest rate, the number of periods in months, and the monthly cash flows. $433 $500 $443 $600 O $419arrow_forward

- Today, your dream car costs $67,700. You feel that the price of the car will increase at an annual rate of 2.6 percent. If you plan to wait 6 years to buy the car, how much will it cost at that time.arrow_forwardYou want to purchase a car 4 years from now, and you plan to save $4,500 per year, beginning immediately. You will make 4 deposits in an account that pays 6.3% interest. Under these assumptions, how much will you have 4 years from today? (please round your answer to two decimal points)arrow_forwardI want to buy a Tesla Model S. in 10 years. The only problem is that it will cost $90,000! how much would I have to deposit each month into a savings plan offering 5.6% APR in order to have enough saved to buy the car in 10 years? What percent of the total amount saved will come from interest if I go with the monthly savings plan?arrow_forward

- A news article forecasts that it will cost around $36,871 to purchase a Lexus NX300 in 2024. How much will you have to invest today at 6.96% per year to have the $36,871 available for the purchase of the car four years from today?arrow_forwardYang is considering buying an asset that, starting 5 years from now, will pay $10,000 per year forever. Assume that the required return is 7.25%. What is the most Yang should pay for this asset?arrow_forwardAI Derover wants to buy a used jeep in five years. He estimates the cost will be $13,000 If he invests $8,500 now at a rate of 10% compounded semiannually, will he have enough money to buy the jeep at the end of five years? Show your work (Round your answer to the nearest cent.) Yes he will have 13,845 60arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education