ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

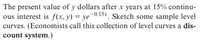

Transcribed Image Text:The present value of y dollars after x years at 15% continu-

ous interest is f(x, y) = ye¬0.15x. Sketch some sample level

curves. (Economists call this collection of level curves a dis-

count system.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose you start saving for retirement when you are 45 years old. You invest $5,000 the first year and increase this amount by 3% each year to match inflation for a total of 20 years. The interest rate is 10% per year. How much money will you have saved when you are 65 years old?arrow_forwardA rich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $3,000. Each year after that, you will receive a payment on the anniversary of the last payment that is 4% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 15% per year. a. What is today's value of the bequest? b. What is the value of the bequest immediately after the first payment is made? ARCKICHI a. What is today's value of the bequest? Today's value of the bequest is $(Round to the nearest dollar. b. What is the value of the bequest immediately after the first payment is made? The value of the bequest immediately after the first payment is made is $ (Round to the nearest dollar.)arrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $6000.00, r = 9.0%, t = 26 weeks (Round to the nearest cent.)arrow_forward

- can you solve this please with solnarrow_forwardPlease proceed with this problem In Year 2532, the world is “Exactly” different. Every second, minute, hour counts in comes to interest. Compute the future amount of an investment P 100,000 with an interest of 15% after 74 days, 2 hours, 6 minutes and 20 seconds.arrow_forwardU.S. / U.K. Foreign Exchange Rate, U.S. Dollars to One British Pound (n = 60 days) Date Rate 1-Nov 1.2950 4-Nov 1.2906 5-Nov 1.2870 6-Nov 1.2872 7-Nov 1.2829 8-Nov 1.2790 12-Nov 1.2855 13-Nov 1.2840 14-Nov 1.2879 15-Nov 1.2901 18-Nov 1.2965 19-Nov 1.2926 20-Nov 1.2918 21-Nov 1.2915 22-Nov 1.2829 25-Nov 1.2885 26-Nov 1.2850 27-Nov 1.2881 29-Nov 1.2939 2-Dec 1.2936 3-Dec 1.3002 4-Dec 1.3095 5-Dec 1.3165 6-Dec 1.3127 9-Dec 1.3157…arrow_forward

- Time-series data: are always associated with price-making firms. may exhibit trend or cyclical variation, but not both at the same time. may exhibit trend or cyclical variation at the same time. all of these answers are correct. Typed and correct answer please. I will rate accordingly.arrow_forwardEconomics Questions 1, 2, 3, and 4 How to solve and answer these four econ questions showed in the screenshot?arrow_forwardThe economy of Djibulistan is initially in long-run equilibrium. Then the CentralBank of Djibulistan increases the money supply.a. Assuming unexpected inflation as a result of the above-mentioned policy,explain any changes in output, unemployment, and inflation that arecaused by the monetary expansion. Explain your answer and conclusionsusing three graphs: IS-LM, AD-AS, and the Phillips curve. b. Assuming instead that resulting, inflation is expected, explain any changesin output, unemployment, and inflation that are caused by the monetaryexpansion. Explain your answer and conclusions using three graphs: ISLM, AD-AS, and the Phillips curve.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education