Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

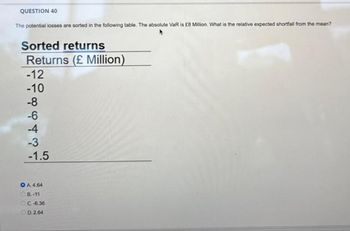

Transcribed Image Text:QUESTION 40

The potential losses are sorted in the following table. The absolute VaR is £8 Million. What is the relative expected shortfall from the mean?

Sorted returns

Returns (£ Million)

-12

-10

-8

-6

-4

-3

-1.5

OA. 4.64

B.-11

C.-6.36

D.2.64

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kk.163.arrow_forwardIn the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 10 On average, profit (loss) amounts deviate from the expected profit by ______ thousand. a $114.77 thousand b $112.52 thousand c $110.31 thousand d $108.15 thousandarrow_forwardYYYYMM Return(Stk1) Return(Stk2) Return(Market) Return(T-bill) 201701 7.75% 3.00% 6.18% 0.20% 201702 1.27% 2.12% 1.63% 0.20% 201703 7.63% 1.50% 1.56% 0.15% 201704 9.25% -1.01% 2.09% 0.30% 201705 10.20% 2.66% 4.25% 0.30% 201706 4.33% 2.59% 0.41% 0.30% 201707 12.25% 10.41% 6.05% 0.35% 201708 4.98% -2.94% 2.37% 0.45% 201709 2.19% -1.69% -1.49% 0.20% 201710 4.05% 3.43% 2.51% 0.20% 201711 13.78% 8.29% 3.30% 0.15% 201712 2.01% 1.96% 2.54% 0.30% 201801 14.19% 23.60% 9.92% 0.30% 201802 -6.77% -4.18% -6.21% 0.55% 201803 -5.23% -10.14% -2.44% 0.60% 201804 -4.54% 1.93% 2.38% 0.20% 201805 2.32% -1.32% -1.10% 0.20% 201806 -1.35% -7.01% -4.97% 0.15% 201807 -9.80% -1.86% -1.29% 0.30% 201808 -4.28% -1.95% -2.43% 0.30% 201809 -4.94% 0.27% -0.36% 0.75% 201810 -17.39% -7.14% -10.11% 0.30% 201811 16.85% 9.62% 6.11% 0.55% 201812 0.64% -0.61% -2.49% 0.60% 201901 10.19% 7.68% 8.11% 0.20% 201902 -2.95% 10.90% 2.47% 0.20% 201903 7.50% 2.26% 1.46% 0.20%…arrow_forward

- Benefits of diversification. What is the expected return of investing in asset M alone?arrow_forwardAn insurance company’s projected loss ratio is 79.53 percent, and its loss adjustment expense ratio is 7.51 percent. It estimates that commission payments and dividends to policyholders will add another 13.96 percent. What is the minimum yield on investments required in order to maintain a positive operating ratio? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education