College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The Polaris Company uses a job-order costing system. The following transactions occurred in October:

- Raw materials purchased on account, $211,000.

- Raw materials used in production, $191,000 ($152,800 direct materials and $38,200 indirect materials).

- Accrued direct labor cost of $49,000 and indirect labor cost of $21,000.

Depreciation recorded on factory equipment, $106,000.- Other manufacturing

overhead costs accrued during October, $130,000. - The company applies

manufacturing overhead cost to production using a predetermined rate of $9 per machine-hour. A total of 76,300 machine-hours were used in October. - Jobs costing $513,000 according to their

job cost sheets were completed during October and transferred to Finished Goods. - Jobs that had cost $451,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 28% above cost.

Can you please help me with the following:

Prepare

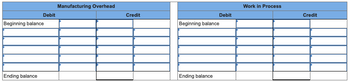

Transcribed Image Text:Debit

Beginning balance

Ending balance

Manufacturing Overhead

Credit

Debit

Beginning balance

Ending balance

Work in Process

Credit

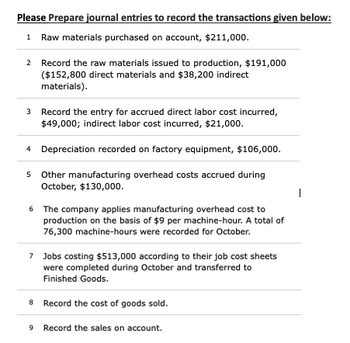

Transcribed Image Text:Please Prepare journal entries to record the transactions given below:

1 Raw materials purchased on account, $211,000.

2

Record the raw materials issued to production, $191,000

($152,800 direct materials and $38,200 indirect

materials).

3 Record the entry for accrued direct labor cost incurred,

$49,000; indirect labor cost incurred, $21,000.

4 Depreciation recorded on factory equipment, $106,000.

5 Other manufacturing overhead costs accrued during

October, $130,000.

6 The company applies manufacturing overhead cost to

production on the basis of $9 per machine-hour. A total of

76,300 machine-hours were recorded for October.

7 Jobs costing $513,000 according to their job cost sheets

were completed during October and transferred to

Finished Goods.

Record the cost of goods sold.

9 Record the sales on account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain what is Flow Cost Accounting, its nature.arrow_forwardDOCUMENT FLOWCHARTPrepare a flowchart that illustrates the sequence in which the followingsource documents are prepared.a. Bill of materialsb. Sales forecastc. Materials requisitiond. More tickete. Production schedulef. Route sheetg. Work ordearrow_forwardIt is the collection of cost data in some way through an accounting system A. Cost allocation OB. Cost Absorption C. Cost Assignment OD. Cost accumulationarrow_forward

- 1. DOCUMENT FLOWCHART Prepare a flowchart that illustrates the sequence in which the following source documents are prepared. a. Bill of materials b. Work order c. Sales forecast d. Materials requisition e. Move ticket f. Production schedule g. Route sheetarrow_forwardcoparrow_forwardDistinguish between the qualities and aims of cost accounting, as well as between the nature and significance of a task cost sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College