FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

a cash budget for Feb and March

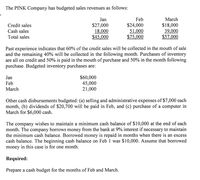

Transcribed Image Text:The PINK Company has budgeted sales revenues as follows:

Jan

Feb

March

$27,000

18,000

$45,000

$24,000

51,000

$75,000

$18,000

39,000

$57,000

Credit sales

Cash sales

Total sales

Past experience indicates that 60% of the credit sales will be collected in the mouth of sale

and the remaining 40% will be collected in the following month. Purchases of inventory

are all on credit and 50% is paid in the mouth of purchase and 50% in the month following

purchase. Budgeted inventory purchases are:

$60,000

45,000

21,000

Jan

Feb

March

Other cash disbursements budgeted: (a) selling and administrative expenses of $7,000 each

month, (b) dividends of $20,700 will be paid in Feb, and (c) purchase of a computer in

March for $6,000 cash.

The company wishes to maintain a minimum cash balance of $10,000 at the end of each

month. The company borrows money from the bank at 9% interest if necessary to maintain

the minimum cash balance. Borrowed money is repaid in months when there is an excess

cash balance. The beginning cash balance on Feb 1 was $10,000. Assume that borrowed

money in this case is for one month.

Required:

Prepare a cash budget for the months of Feb and March.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- ll. Subject Accountingarrow_forwardPrepare a production budget for January and February 2017.arrow_forwardRequired: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. Budgeted Gross Margin SHADEE CORPORATION Budgeted Income Statement Budgeted Net Operating Income May Junearrow_forward

- Perez Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Perez expects sales in January year 1 to total $210,000 and to increase 20 percent per month in February and March. All sales are on account. Perez expects to collect 68 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 8 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of year 1. Determine the amount of sales revenue Perez will report on the year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of year 1. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Prepare a sales budget for the first quarter of year 1.arrow_forwardBudgeted cash payments. Would I begin with Cost of Direct materiasl purchase of April-3,010, May-3,650,June-4,015, 2nd Quarter -10,675?arrow_forwardCan you show how you got the numbers for question 6? Can you show me how to prepare the following: Prepare a selling and administrative expenses budget for January Prepare a budgeted income statement for Januaryarrow_forward

- Dd.1arrow_forwardPrepare a production budget for the months of April, May, and June.arrow_forwardA merchandiser, provides the following information for its December budgeting process: November 30 inventory 1,620 units Budgeted sales for December 4,050 units Desired December 31 inventory 2,835 units Budgeted purchases in December are:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education