ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

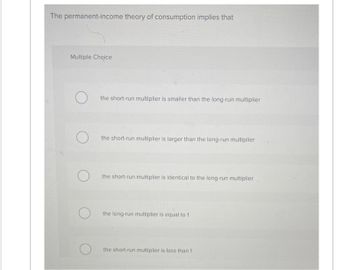

Transcribed Image Text:The permanent-income theory of consumption implies that

Multiple Choice

O

the short-run multiplier is smaller than the long-run multiplier

the short-run multiplier is larger than the long-run multiplier

the short-run multiplier is identical to the long-run multiplier

the long-run multiplier is equal to 1

the short-run multiplier is less than 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Calculate the equilibrium income by using the consumption function formula. 1. Y =C 2. Y= C+I 3. Y = C+I+G 4. Y= C+I+G+Nx Given: C = 100; I = 150; G = 100; m= 50; x=35; change in DY = 900; change in C = 630arrow_forwardExplain the concept of the 100X Multiplier using the idea of diminishing marginal utility.arrow_forwardCalculate the value of multiplier if change in income is $1100 million and the change in investment is $350 millionarrow_forward

- The marginal propensity to consume is a)the average amount of income that is consumed or spent b)the ratio of consumption to income c)the ratio of the change in consumption to a change in income d)the ratio of income to consumptionarrow_forwardi need 1, 2, 3 parts Solutionarrow_forward3. If the consumption function is C= $200 billion + 0.9Y, a) How much do consumers spend with income of $3 trillion? b) How much do they save?arrow_forward

- In each of the following cases, calculate the values of MPC, MPW, and the spending multiplier. Enter your responses below rounded to 2 cecimal places. a. A $6 million increase in income leads to a $900,000 rise in consumption on domestic items. MPC is therefore and the spending multiplier is , MPW is b. A $8 million decrease in income results in a $0.8 million drop in consumption on domestic items. MPC is therefore and the spending multiplier is |. MPW is c. A $4 million decrease in income causes a $3.2 milion drop in withdrawals. MPC is therefore 1. MPW is and the spending multiplier isarrow_forwardCameron’s income is $1000 and her Consumption expenditure is $700. What is her MPC? Group of answer choices a. 0.7 b. 0.3 c. We do not have enough information to calculate her MPC. d. 700arrow_forwardThe simple multiplier is: a) consumption spending divided by saving. b) one divided by one minus the marginal propensity to consume. c) one plus the marginal propensity to consume. d) one divided by one plus the marginal propensity to consume. e) the MPC.arrow_forward

- 3. When the following event occurs, the change in Real GDP = Event: The government increases its education funding by $60 billion; the marginal propensity to consume is 0.6. the multiplier.arrow_forwardMacmillan Learning (Table: Consumption and Savings) Based on the table, the marginal propensity to consume is propensity to consume Income Consumption Spending Saving $30,000 $30,000 $0 40,000 35,000 5,000 50,000 40,000 10,000 0.5; varies with the level of income $5,000; is $5,000 $10,000; is $35,000 2; varies with the level of income and the averagearrow_forwardConsumption and Saving- End of Chapter Problem Which one of the following reasons makes it easier to forecast the impact of an income change on consumption for hand-to-mouth consumers than for consumption smoothers? It is easier because hand-to-mouth consumers only spend their permanent income. hand-to-mouth consumers save a large portion of their income. the marginal propensity to consume is 1 for consumption smoothers. hand-to-mouth consumers spend their entire income as they earn it.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education