FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please dont provide image based or handwritten solution thank you

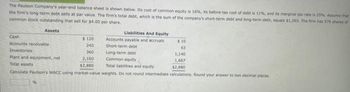

Transcribed Image Text:The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 16%, its before-tax cost of debt is 11%, and its marginal tax rate is 25%. Assume that

the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,203. The firm has 576 shares of

common stock outstanding that sell for $4.00 per share.

Assets

Cash

Accounts receivable

Inventories

Plant and equipment, net

Total assets

$120

240

360

2,160

$2,880

Calculate Paulson's WACC using market-value

Liabilities And Equity

Accounts payable and accruals

Short-term debt

$10

63

Long-term debt

1,140

Common equity

1,667

Total liabilities and equity

$2,880

weights. Do not round intermediate calculations. Round your answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 16%, its before-tax cost of debt is 11%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,207. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Cash Accounts receivable Inventories Plant and equipment, net Total assets % Liabilities And Equity Accounts payable and accruals Short-term debt $ 120 240 360 2,160 $2,880 Total liabilities and equity Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. Long-term debt Common equity $ 10 57 1,150 1,663 $2,880arrow_forwardThe Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 9%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,181. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Liabilities And Equity $ 120 Accounts payable and accruals Short-term debt 240 360 Long-term debt 2,160 Common equity $2,880 Total liabilities and equity Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. Assets Cash Accounts receivable Inventories Plant and equipment, net Total assets % $ 10 61 1,120 1,689 $2,880arrow_forwardThe Paulson Company’s year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 40%. Assume that the firm’s long-term debt sells at par value. The firm’s total debt, which is the sum of the company’s short-term debt and long-term debt, equals $1,167. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Calculate Paulson’sWACC using market-value weights.AssetsCash $ 120Accounts receivable 240Inventories 360Plant and equipment, net 2,160Total assets $2,880 Liabilities and EquityAccounts payable and accruals $ 10Short-term debt 47Long-term debt 1,120Common equity 1,703Total liabilities and equity $2,880arrow_forward

- The Pawlson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 9%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firm’s total debt, which is the sum of the company’s short-term debt and long-term debt, equals $1,160. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 60 Inventories 360 Long-term debt 1,100 Plant and equipment, net 2,160 Common equity 1,710 Total assets $2,880 Total liabilities and equity $2,880 Calculate Pawlson's WACC using market-value weights. Round your answer to two decimal places. Do not round your intermediate calculations. %???? I am unsure what this question is asking. Help with formula please!arrow_forwardSkolits Corporation has a cost of equity of 11.2 percent and an aftertax cost of debt of 4.62 percent. The company's balance sheet lists long-term debt of $370, 000 and equity of $630,000. The company's bonds sell for 105.3 percent of par and the market - to - book ratio is 2.98 times. If the company's tax rate is 25 percent, what is the WACC?arrow_forwardSkolits Corp. has a cost of equity of 11.8 percent and an aftertax cost of debt of 4.44 percent. The company's balance sheet lists long-term debt of $340,000 and equity of $600,000. The company's bonds sell for 104.1 percent of par and market-to-book ratio is 2.80 times. If the company's tax rate is 39 percent, what is the WACC?arrow_forward

- Reagan Corp has net income of $843,800 for the year. Their share price is $13.54 and they have 311,890 outstanding. What is the firm's price-earnings ratio?arrow_forwardUpton Umbrellas has a cost of equity of 11.7 percent, the YTM on the company's bonds is 6.3 percent, and the tax rate is 21 percent. The company's bonds sell for 103.3 percent of par. The debt has a book value of $411,000 and total assets have a book value of $953,000. If the market-to-book ratio is 2.77 times, what is the company's WACC?arrow_forwardFFDP Corporation has yearly sales of $29.9 million and costs of $15.7 million. The company’s balance sheet shows debt of $55.9 million and cash of $39.9 million. There are 1,960,000 shares outstanding and the industry EV/EBITDA multiple is 9.4. a. What is the company’s enterprise value? b. What is the stock price per share?arrow_forward

- Upton Umbrellas has a cost of equity of 10.6 percent, the YTM on the company's bonds is 5.2 percent, and the tax rate is 22 percent. The company's bonds sell for 92.6 percent of par. The debt has a book value of $378,000 and total assets have a book value of $942,000. If the market-to-book ratio is 2.44 times, what is the company's WACC? Multiple Choice O 8.09% 5,38% 7.85% 8.68% Darrow_forwardNonearrow_forwardJerry Jeff, Inc. has 12, 800 shares of common stock outstanding at a price per share of $70 and the rate of return on the stock is 11.41 percent. The value of Jerry Jeff's debt is $373, 230 and the required rate of return on the debt is 6.03 percent. What is the Jerry Jeff's WACC if the tax rate is 21 percent? A. 8.89% B. 9.83% C. 9.46% D. 8.72%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education