FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

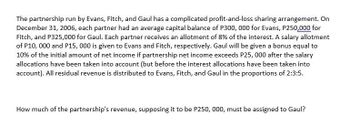

Transcribed Image Text:The partnership run by Evans, Fitch, and Gaul has a complicated profit-and-loss sharing arrangement. On

December 31, 2006, each partner had an average capital balance of P300, 000 for Evans, P250,000 for

Fitch, and P325,000 for Gaul. Each partner receives an allotment of 8% of the interest. A salary allotment

of P10,000 and P15, 000 is given to Evans and Fitch, respectively. Gaul will be given a bonus equal to

10% of the initial amount of net income if partnership net income exceeds P25, 000 after the salary

allocations have been taken into account (but before the interest allocations have been taken into

account). All residual revenue is distributed to Evans, Fitch, and Gaul in the proportions of 2:3:5.

How much of the partnership's revenue, supposing it to be P250, 000, must be assigned to Gaul?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jenkins, Willis, and Trent invested $252,000, $441,000, and $567,000, respectively, in a partnership. During its first year, the firm recorded profit of $639,000. d- The partners agreed to share profit by providing annual salary allowances of $123,000 to Jenkins, $133,000 to Willis, and $68,000 to Trent; allowing 10% interest on the partners’ beginning investments; and sharing the remainder equally. Record to close income summary account.arrow_forwardMemanarrow_forwardFarmer and Taylor formed a partnership with capital contributions of $245,000 and $295,000, respectively. Their partnership agreement calls for Farmer to receive a $79,000 per year salary allowance. The remaining income or loss is to be divided equally. Assuming net income for the current year is $189,000, the journal entry to allocate net income is: dit Fo Debit Income Summary, $189,000; Credit Farmer, Capital, $94,500; Credit Taylor, Capital, $94,500. Debit Income Summary, $189,000; Credit Farmer, Capital, $166,000; Credit Taylor, Capital, $23,000. Debit Income Summary, $189,000; Credit Farmer, Capital, $48,840; Credit Taylor, Capital, $140,160. Debit Income Summary, $189,000; Credit Farmer, Capital, $134,000; Credit Taylor, Capital, $55,000. Debit Income Summary, $189,000; Credit Taylor, Capital, $134,000; Credit Farmer, Capital, $55,000.arrow_forward

- Ebanks, Brown, and Thomas are partners. They carry on a business jointly as EBT surveyors and share profits and losses in the ratio 25:45: 30. The trading account profit as at 31 December 2021 was $6,500,000 after charging a nominal tax of $750,000. Notes: The partners receive interest on their capital accounts at 9.5 % on the balance of their partner capital at the end of the budget year. The interest on the capital account was not included in the income statement. Include in the income statement is $80,000 salary per month for each partner. The partnership paid motor vehicle expenses for vehicles owned by the partners as follows: Ebanks -$ 50,000 Brown - $80,000 Thomas - $130,000 The partners did not use the vehicles for the partnership business. Profit on disposal was $180,000. Depreciation on plant and machinery for the year was $900,000. In recognition of the new IFRS 9 standard, a provision for bad…arrow_forwardheng invested $108,000 and Murray invested $208,000 in a partnership. They agreed to share incomes and losses by allowing a $62,000 per year salary allowance to Zheng and a $42,000 per year salary allowance to Murray, plus an interest allowance on the partners' beginning-year capital investments at 10%, with the balance to be shared equally. Assuming net income for the current year is $109,000, the journal entry to allocate net income is: Debit Income Summary, $109,000; Credit Zheng, Capital, $54,500, Credit Murray, Capital, $54,500. Debit Income Summary, $109,000; Credit Zheng, Capital, $36,600, Credit Murray, Capital, $72,400. Debit Zheng, Capital, $59,500, Debit Murray, Capital, $49,500; Credit Income Summary, $109,000; Debit Income Summary, $109,000; Credit Zheng, Capital, $59,500, Credit Murray, Capital, $49,500. Debit Income Summary, $109,000; Credit Zheng, Capital, $42,900, Credit Murray, Capital, $66,100.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education