Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

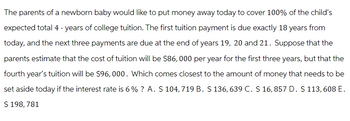

Transcribed Image Text:The parents of a newborn baby would like to put money away today to cover 100% of the child's

expected total 4 - years of college tuition. The first tuition payment is due exactly 18 years from

today, and the next three payments are due at the end of years 19, 20 and 21. Suppose that the

parents estimate that the cost of tuition will be $86,000 per year for the first three years, but that the

fourth year's tuition will be $96,000. Which comes closest to the amount of money that needs to be

set aside today if the interest rate is 6% ? A. $ 104, 719 B. $ 136, 639 C. $ 16,857 D. $ 113, 608 E.

$ 198, 781

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $40,000 when the child reaches the age of 18? Assume the money earns 7% interest, compounded quarterly. (Round your answer to two decimal places.)arrow_forwardYou are thinking of buying a house beside the College which you will rent to students. You expect to receive $2,000 a month in rental income. Your real estate agent estimates that you will be able to sell the property for $250,000 at the end of 46 months. You'd like a return of at least 0.2% per month. What is the most that you should pay for the house, assuming that you will purchase the house today and receive the first (beginning of month) rental payment today. What is the most that you should pay for the property today? (Round to the nearest dollar.)arrow_forwardJan wants to plan for her daughter's education. Her daughter, Rachel was born today and will go to college at age 18 for five years. Tuition is currently $15,000 per year, in today's dollars. Jan anticipates tuition inflation of 6% and believes she can earn an 11% return on her investment. How much must Jan save at the end of each year, if she wants to make her last payment at the beginning of her daughter's first year of college? $4,680.37 $7,334.72 $3,882.03 $2,547.54arrow_forward

- You are saving for the university education of your two children. They are two years apart in age; one will begin university 15 years from today and the other will begin 17 years from today. You estimate your children's university expenses to be $45,000 per year per child, payable at the beginning of each school year. The annual interest rate is 7.5 percent. Your deposits begin one year from today. You will make your last deposit when your older child enters university. Assume four years of university. How much money must you deposit in an account each year to fund your children's education? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Annual savings $arrow_forwardYour daughter wants to the University of Cincinnati. She is already planning to start in 10 years (which is when her first tuition payment is due). Her tuition will be $19,886 per year for four years. The relevant discount rate is 8.01 percent per year. You plan to save for her education by setting aside the same amount of money per year for 9 years. What is the amount you need to save per year if you start saving at the end of this year? O $32,914.10 O $5,271.07 $3,657.12 $30,473.20 O $7,316.70arrow_forwardIf the average college tuition cost is $40,000/year currently to go to college, what will it cost for your children in 2045 for a 4-year degree if the inflation rate is 4% per year until thenarrow_forward

- Assume the total cost of a college education will be $350,000 when your child enters college in 15 years. You presently have $67,000 to invest.What annual rate of interest must you earn on your investment to cover the cost of your child’s college education?arrow_forwardYou and your sister are planning a large anniversary party 3 years from today for your parents' 50th wedding anniversary. You have estimated that you will need $6,500 for this party. You can earn 2.6 percent compounded annually on your savings. How much would you and your sister have to deposit today in one lump sum to pay for the entire party? Can the excel and calculator solution be provided?arrow_forwardYou plan to buy property in Florida 8 years from today. To do this, you estimate that you will need $ 45000 at that time for the purchase. You would like to accumulate these funds by making equal annual deposits into your savings account, which pays 9% annually. If you make your first deposit at the end ofthis year, and you would like your accountto reach$ 45000 when the final deposit is made, what amount do you need to deposit annually?arrow_forward

- Suppose that your parents are willing to lend you $20,000 for part of the cost of your college education and living expenses. They want you to repay them the $20,000, without any interest, in a lump sum 15 years after you graduate, when they plan to retire and move. Meanwhile, you will be busy repaying federally guaranteed loans for the first 10 years after graduation. But you realize that you won’t be able to repay the lump sum without saving up. So you decide that you will put aside money in an interest-bearing account every month for the five years before the payment is due. You feel comfortable with putting aside $275 a month (the amount of the payment on your college loans, which will be paid off after 10 years). How high an annual nominal interest rate on savings do you need to accumulate the $20,000 in 60 months, if interest is compounded monthly? Enter into a spreadsheet the values d 5 275, r 5 0.05 (annual rate), and n 5 60, and the savings formula with r replaced by r/12 (the…arrow_forwardJan wants to plan for her daughter's education. Her daughter, Rachel was born today and will go to college at age 18 for five years. Tuition is currently $15,000 per year, in today's dollars. Jan anticipates tuition inflation of 6% and believes she can earn an 11% return on her investment. How much must Jan save at the end of each year, if she wants to make her last payment at the beginning of her daughter's first year of college? $4,680.37 $7,334.72 $3,882.03 $2,547.54arrow_forwardYou are planning for your retirement. You expect to earn a monthly salary of $7,000 starting on the 1st month after you retire, which will be able to provide comfortably for your daily expenses through your retirement years. You are currently 33 and plan on retiring when you become 64, and you expect to live 20 years after retirement. In addition to providing a salary for your retirement you would like to buy a house by the time you reach 55. The house you dream of would cost you $1,650,000. Now you have a down payment of $50,000 (ignore closing costs). In addition you would like to offer yourself a retirement gift, a Mercedes that you would buy brand new to serve you through your retirement years. The car is expected to cost you $76,000. It will be purchased when you reach 64 years of age. Assume you can earn 12% compounded monthly from now until you retire, and the rate will change to 6% monthly compounding after that. And how much do you need to save in TOTAL per month after you buy…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education