FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

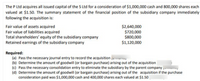

Transcribed Image Text:The P Ltd acquires all issued capital of the S Ltd for a consideration of $1,000,000 cash and 800,000 shares each

valued at $1.50. The summary statement of the financial position of the subsidiary company immediately

following the acquisition is:

Fair value of assets acquired

Fair value of liabilities acquired

Total shareholders' equity of the subsidiary company

Retained earnings of the subsidiary company

$2,640,000

$720,000

$800,000

$1,120,000

Required:

(a) Pass the necessary journal entry to record the acquisition ..

(b) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition

(c) Pass the necessary consolidation entry to eliminate the subsidiary by the parent company,

(d) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition if the purchase

consideration paid was $1,000,000 cash and 400,000 shares each valued at $1.50 .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Visnoarrow_forwardOn January 1, 20x8, Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. During the year, Parent sold goods to Subsidiary for P150,000 at a 25% mark-up and in turn purchased P200,000 of Subsidiary’s goods which Subsidiary sold at a 20% mark-up. From the goods purchased, P50,000 remain in Parent’s books at the end of the year, while P20,000 remain in Subsidiary’s books at the end of the year. 30% of the undervalued inventory of Subsidiary still remain unsold by the end of 20x8. The following are…arrow_forwardWhat is the amount of pre-acquisition earnings on the acquisition date consolidated income statement if the parent acquires 90 percent of the subsidiary’s stock and the following income statement accounts exist at the acquisition date? Parent Subsidiary Sales P250,000 P60,000 Cost of Goods Sold 120,000 12,000 Depreciation Expense 10,000 5,000 Operating Expenses 40,000 8,000 Income Tax Expense 32,000 14,000 2. Using the same information in No. 1, what is the imputed value of a subsidiary if the parent pays P56,000 for 80 percent of the subsidiary’s stock? Use the following information for question 3 and 4: Marksman acquired 100 percent of Tribal Transit for P275,000. At the date of acquisition, Fast Transit…arrow_forward

- Unity Ltd acquired 100% of the issued shares of Vista Ltd for cash consideration of $250 000. At the date of acquisition, Vista Ltd Had had share capital of $100 000, retained earnings of $60 000 and liabilities of $80 000. There are no fair value adjustments required at the acquisition date. What is the amount of goodwill recognised on consolidation? O a $10,000 O b. $90,000 O $110,000 O d. $150,000 Next pagearrow_forwardPushdown Accounting Assume a parent company acquires its subsidiary by paying $1,700,000 for all of the outstanding voting shares of the investee. On the acquisition date, subsidiary's assets and liabilities have individual fair values that equal their book values, except for property equipment with a fair value greater than book value by $150,000 and license with a fair value greater than book value by $250,000. The parent and subsidiary have the following balance sheets immediately after the acquisition, but before any pushdown adjustments by the subsidiary: Parent Parent Subsidiary Assets: Cash & receivables $ 800,000 $ 350,000 Inventory 600,000 200,000 Property & equipment, net 2,300,000 1,025,000 Equity investment 1,700,000 Licenses - 275,000 $ 5,400,000 $ 1,850,000 Liabilities and stockholders' equity: Current liabilities $ 400,000 $ 400,000 Other liabilities 300,000 - Note payable - 600,000 Common stock 1,670,000…arrow_forwardOn January 1, 20x8,Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. The following are taken from the books of Parent and Subsidiary for 20x8. 1) From the given data, determine the total assets as of December 31, 20x1. 2) From the given data, assuming the retained earning of Subsidiary on December 31, 20x11 is P350,000, determine the non-controlling interest to be reported in the consolidated financial statements on December 31, 20x11 assuming no changes to Subsidiary company’s ordinary…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education