Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

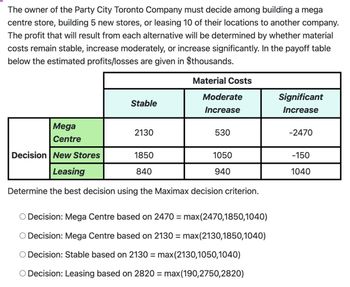

Transcribed Image Text:The owner of the Party City Toronto Company must decide among building a mega

centre store, building 5 new stores, or leasing 10 of their locations to another company.

The profit that will result from each alternative will be determined by whether material

costs remain stable, increase moderately, or increase significantly. In the payoff table

below the estimated profits/losses are given in $thousands.

Material Costs

Stable

Mega

Centre

Decision New Stores

Leasing

Determine the best decision using the Maximax decision criterion.

2130

Moderate

Increase

1850

840

530

1050

940

O Decision: Mega Centre based on 2470 = max(2470,1850,1040)

O Decision: Mega Centre based on 2130 = max(2130,1850,1040)

Decision: Stable based on 2130 = max(2130,1050,1040)

O Decision: Leasing based on 2820 = max(190,2750,2820)

Significant

Increase

-2470

-150

1040

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Today’s Electronics specializes in manufacturing modern electronic components. It also builds the equipment that produces the components. Phyllis Weinberger, who is responsible for advising the president of Today’s Electronics on electronic manufacturing equipment, has developed the following table concerning a proposed facility: Payoffs Outcomes Large facility 550,000 -310,000 Medium-sized facility 300,000 -100,000 Small facility 200,000 -32,000 No facility 0 0 Develop an opportunity loss table. What is the minimax regret decision? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardThe Zhao family of Atlanta, Georgia, is planning its annual summer vacation. Three vacation locations along with criteria weights and location ratings follow. What is the recommended vacation location? Criteria Travel distance Vacation Entertainment available Outdoor activities Unique experience Family fun O Myrtle Beach, South Carolina OSmoky Mountains Branson, Missouri Weight 2 5 3 2 4 5 Myrtle Beach, South Carolina 5 5 7 9 5 8 Ratings Smoky Mountains 9 6 4 6 9 9 Branson, Missouri 3 8 4 5 9 8arrow_forwardDecision Tree Analysisarrow_forward

- A builder has located a piece of property that she would like to buy and eventually build on. The land is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on approval of zoning requests and your analysis of this problem to advise her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities: Cost of land: $3 million. Probability of rezoning: 0.50. If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million. If the land is rezoned, the contractor must decide whether to build a shopping center or 1,400 apartments that the tentative plan shows would be possible. If she builds a shopping center, there is a 50 percent chance that she can sell the shopping center to a large department store chain for $6 million over her construction cost, which excludes the land; and there is a 50 percent chance that she can sell it…arrow_forwardGrocers Inc. is considering offering a purified water service through a contract company that would locate a machine on the inside of the market store. There are two contract companies Grocers Inc. is considering, ClearWater and PureVida. ClearWater would charge an annual lease fee of $800 for set-up of the machine and for this machine, there is a utility cost of $0.10 for every gallon of water dispensed and ClearWater charges $0.05 for maintenance. For PureVida, the annual lease fee is $700, the utility cost is $0.12 for every gallon and PureVida charges $0.06 for maintenance. Grocers Inc. customers would purchase refilled gallons of water for $0.97.a. What is the annual break-even point for each option?b. At what volume in number of gallons would the two options have the same cost?c. At what forecasted volume should Grocers Inc. select ClearWater and what volume should they select PureVida and why?arrow_forwardJohn and Jane Darling are newlyweds trying to decide amongseveral available rentals. Alternatives were scored on a scaleof 1 to 5 (5 = best) against weighted performance criteria,as shown in Table 13.7. The criteria included rent, proximity to work and recreational opportunities, security, and otherneighborhood characteristics associated with the couple’svalues and lifestyle. Alternative A is an apartment, B is abungalow, C is a condo, and D is a downstairs apartment inJane’s parents’ home.Which location is indicated by the preference matrix? Whatqualitative factors might cause this preference to change?arrow_forward

- Based on the following payoff table, answer the following: Alternative High Medium Low A 20 20 5 B 25 30 11 C 30 12 13 D 10 12 12 E 50 40 −28 Prior Probability 0.3 0.2 0.5 The Bayes’ decision rule strategy is: Multiple Choice: E. B. C. D. A.arrow_forwardHillary’s Flight Operations offers maintenance and repair services for business jets located in Atlanta. They are considering whether they should expand their operations. Hillary has decided that they have a number of options—four to be precise. They can keep their current facilities; they can modify their facilities to make them more efficient; they can expand their current facility; or they can rent additional space. The decision as to which option they should select is predicated upon the estimation of the direction of the economy for the next four years. Hillary’s Flight Operations developed the following decision matrix. What option should Hillary’s Flight Operations make based on Maximax criterion? Future Air Traffic Alternatives Down Same Up Keep As Is ($40,000) $70,000 $100,000 Remodel ($60,000) $65,000 $200,000 Expansion ($150,000) $50,000 $400,000 Rent ($50,000) $60,000 $80,000 Group of answer choicesarrow_forwardThe following payoff table shows profit for a decision analysis problem with two decision alternatives and three states of nature. Decision Alternative If S1 d₁ d₂ States of Nature then ? $1 240 90 90 15 The probabilities for the states of nature are P(S₁) = 0.65, P(s₂) = 0.15, and P(s3) = 0.20. (a) What is the optimal decision strategy if perfect information were available? ; If S₂ then ? 90 65 ; If S3 then ? (b) What is the expected value for the decision strategy developed in part (a)? î (c) Using the expected value approach, what is the recommended decision without perfect information? What is its expected value? The recommended decision without perfect information is ? EV = (d) What is the expected value of perfect information? EVPI = îarrow_forward

- Two vaccination schemes are recently adopted in Lebanon, Pfizer and Astrazenica The profit for each one of these is dependent on the site (clinic or hospital) performing the vaccination process. This is shown in the following payoff table. Ministry of health considering the maximum profit to be able to cover the cost of staff where vaccination process can either be in a small clinics, or medium size hospitals or in main hospitals Alternative capacity for new store Pfizer Astrazenica Clinics 10 Small Hospitals Main Hospitals 7 6. 3 (a) Assume the payoffs represent profits. Determine the alternative that would be chosen under each of these decision criteria: Maximin, Maximax, Laplace, In your own opinion, which alternative likely to be excluded and why? (b) The ministry of health would like to check the possible loss. Find out the minimax regret table and identify the recommended alternative. (c) Assuming the probability of getting Pfizer is 0.6 and getting Astrazenica is 40%, determine…arrow_forwarddepends on interest rate movement in the next 5 years. The various development projects and 8. Place-Plus, a real estate development firm, is considering several alternative development a projects. These include building and leasing building an office park, purchasing a parcel of land and an office building to rent, buying anmd leasing a warchouse, building a strip shopping ter, and building and selling condominiums. The financial success of these projects meir 5 year financial return (MU millions) given that interest rates will decline, remain stable or increase are shown in the following payoff table: Interest Rates Projects Office Park OfficeBuilding We Shopping Center Condominiums Decline Stable Increase 0.5 1.7 4.5 1.5 1.9 2.4 1.7 1.4 0.7 2.4 3.6 3.2 1.5 0.6 Determine the best investment using the following decision criteria: a. Maximax b. Maximin c. Minimax regret d. Equally Likely e. Hurwicz (a 0.3)arrow_forward( Use an excel sheet to show formulas used )arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.