ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

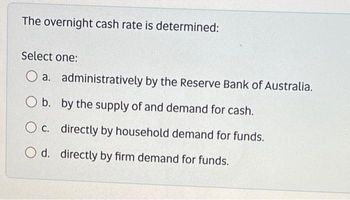

Transcribed Image Text:The overnight cash rate is determined:

Select one:

a.

O b.

b.

administratively by the Reserve Bank of Australia.

by the supply of and demand for cash.

O c.

c. directly by household demand for funds.

O d.

d. directly by firm demand for funds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the Fed sells U.S. government securities to banks, the federal funds rate and banks' reserves O a. rises; increase O b. rises; decrease O c. falls; decrease O d. falls; increase O e. rises; do not changearrow_forward2. Suppose that the money market can be depicted in the graph below. Interest rate (M/P)² (M³/P)⁰ (M³/P)1 H A K O B C O E L3 L1 L2 Quantity of Money LI is the original demand for money by the public and (M/P) is the real money supply. Assume tha the price level does not change. The original equilibrium is at point O. Suppose that the government lowered income taxes so that consumers had more disposable income. Briefly describe how you reached that conclusion. Identify the new equilibrium point and what happens to interest ratesarrow_forwardSuppose you read in the Wall Street Journal that the Fed was "increasing its target interest rate." It follows that the rate in question is the and one way in which Fed could achieve its new, higher target rate is by Select one: O a. Federal Funds Rate; conducting an open market sale O b. Federal Funds Rate; conducting an open market purchase O c. Prime Rate; conducting an open market sale d. Prime Rate; conducting an open market purchasearrow_forward

- If a bank gets $90 in new reserves from the Fed and the required-reserve ratio is 0.1, then the maximum amount by which total deposits in the economy can increase is O $900 O $90 O $9 O $80arrow_forwardSuppose that the reserve requirement is 12.5% and that commercial banks are NOT holding excess reserves. If the Federal Reserve wishes to reduce the money supply by $200 billion, it should conduct an open-market purchase of $16 billion O open-market purchase of $25 billion open-market sale of $16 billion O None of these answers is correct. O open-market sale of $25 billionarrow_forward29arrow_forward

- 23arrow_forwardThe interest rate commonly used by banks to borrow from each other outside the US, which is also used for revolving loans inside the US, is the O REPO O IEURO O LOREN O LIBORarrow_forwardBanks create money by O a. buying U.S. government securities with cash. O b. printing money up to their required reserve limit. O c. creating deposits without limit. O d. making loans and creating deposits, a process that is limited by the size of banks' excess reserves. O e. printing dollar bills without limit.arrow_forward

- If the Fed is pursuing a fixed interest rate target, an increase in the money supply will be required when Select one: O a. money demand increases. O b. GDP decreases. c. M2 increases relative to M1, because the transaction cost of transferring money from savings accounts to checking accounts declines. O d. money demand decreases.arrow_forwardAssume that a bank receives a deposit of $1,000 in cash, puts aside $200 as required reserves, and makes a loan of $800, these transactions imply that: O the money supply by the whole banking system can increase by $1,000. O the money supply by the whole banking system can increase by $4,000. the money supply by the whole banking system can increase by $8,000. O the money supply by the whole banking system can increase by $5,000.arrow_forwardTyped plzzz And Asap Thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education